Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

NATIONAL MONETISATION PIPELINE (NMP)

Read more on - Polity | Economy | Schemes | S&T | Environment

- The story: In August 2021, the Union government unveiled a four-year National Monetisation Pipeline (NMP) worth an estimated Rs 6 lakh crore. This was mentioned in the Union Budget 2021-22 also.

- Details: The goal of NMP is to "unlock value" in "brownfield projects" by engaging the private sector, transferring to them revenue rights (not ownership) in the projects, and using the revenue so generated later for infrastructure building across India (by government). So the flow is - (i) Government has public assets, (ii) Govt grants lease on them to private parties, (iii) Private parties pay lumpsum amounts to govt. and take charge, (iv) Goverment uses that money elsewhere, (v) Private parties earn from that asset for themselves (for lease period), (vi) Asset handed back to government.

- List of assets: The government has announced a huge list of assets, for potential investors, and all are brownfield assets, so they are ready assets with zero execution risks. NMP will now focus on structuring the monetisation deals, and effective execution. It won't be easy.

- Brownfield versus Greenfield: The greenfield investments are where a company is needed to build its own, brand new facilities from the ground up. Brownfield investment happens when a company purchases or leases an existing facility.

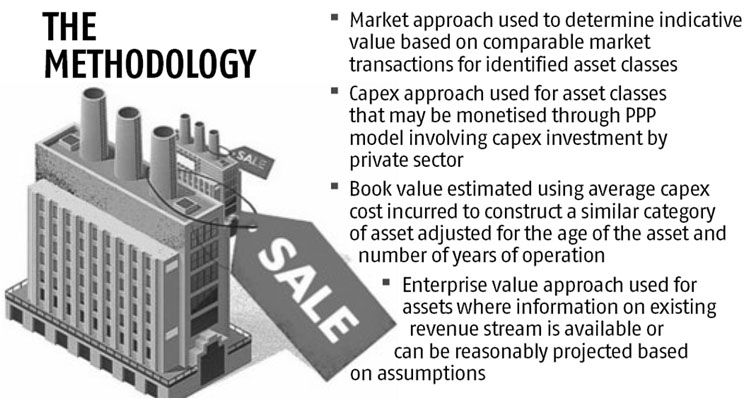

- Monetisation: In a monetisation transaction, the government transfers revenue rights to private parties, for a specified transaction period, in return for upfront money, or a revenue share, and commitment of investments in the assets.

- Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), for instance, are the key structures used to monetise assets in the roads and power sectors. (India already has these in Power Grid Corporation, etc.)

- These are listed on stock exchanges, providing investors liquidity through secondary markets.

- Monetisation models on PPP (Public Private Partnership) basis include - (i) Operate Maintain Transfer (OMT), (ii) Toll Operate Transfer (TOT), and (iii) Operations, Maintenance & Development (OMD). The OMT and TOT have been used in highways sector while OMD is being deployed in case of airports.

- Why monetise at all: The government feels that there are completed assets which are languishing or are not fully monetised or are under-utilised. By bringing in private participation in this better earnings and further investment in infrastructure building will be made possible.

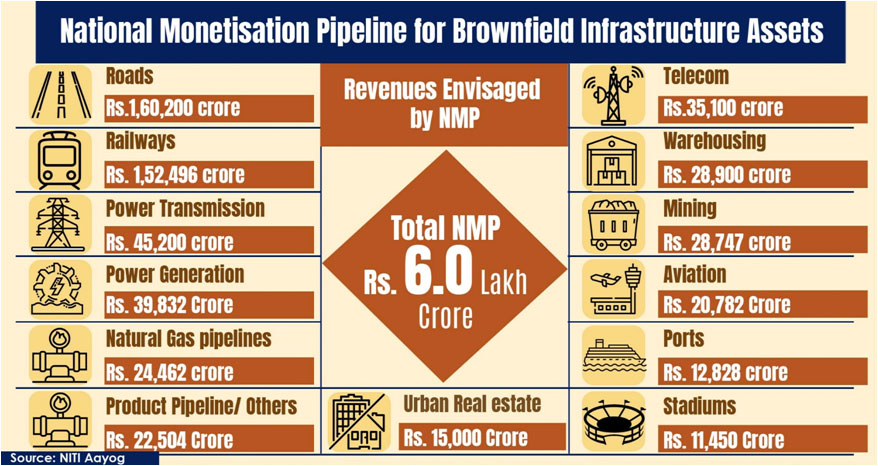

- The exact plan: Roads, railways and power sector assets will comprise 66% of the total estimated value of the assets to be monetised. Rest will include telecom, mining, aviation, ports, natural gas and petroleum product pipelines, warehouses and stadiums.

- In FY 2021-22, 15% of assets with an indicative value of Rs 0.88 lakh crore will rollout

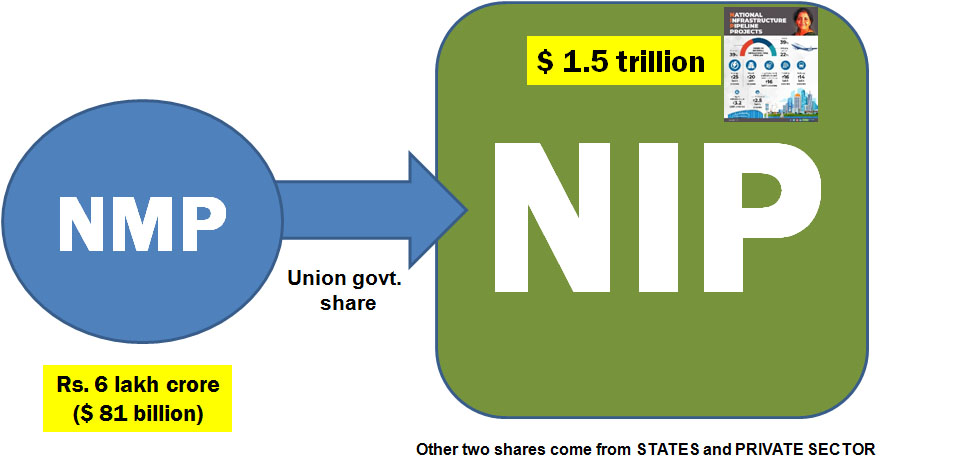

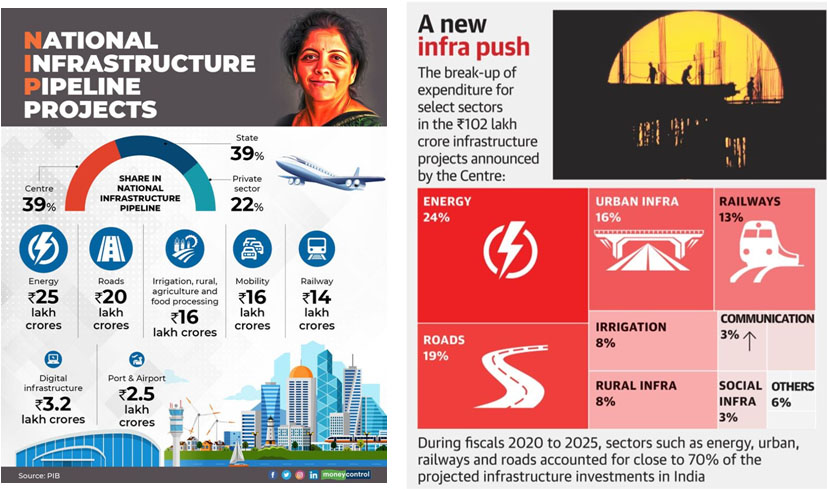

- The NMP will run co-terminus with the National Infrastructure Pipeline (NIP) of Rs 100 lakh crore announced in December 2019

- The estimated amount raised through monetisation is around 14% of the proposed outlay for the Centre of Rs 43 lakh crore under NIP.

- Assets list: It includes 26,700 km of roads, railway stations, train operations and tracks, 2,8608 Ckt km (circuit kilometre) worth of power transmission lines, 6 GW of hydroelectric and solar power assets, 2.86 lakh km of fibre assets and 14,917 towers in the telecom sector, 8,154 km of natural gas pipelines and 3,930 km of petroleum product pipelines. In the roads sector, the government has already monetised 1,400 km of national highways worth Rs 17,000 crore. Another five assets have been monetised through a PowerGrid InvIT raising Rs 7,700 crore. Also, 15 railway stations, 25 airports and the stake of central government in existing airports and 160 coal mining projects, 31 projects in 9 major ports, 210 lakh MT of warehousing assets, 2 national stadia and 2 regional centres, will be up for monetisation. Redevelopment of various government colonies and hospitality assets including ITDC hotels is expected to generate Rs 15,000 crore.

- Challenges: There are many - (i) lack of identifiable revenues streams in various assets, (ii) level of capacity utilisation in gas and petroleum pipeline networks, (ii) dispute resolution mechanism, (iv) regulated tariffs in power sector assets, and (v) low interest among investors in national highways below four lanes (total length of four-lane NH stretches and above is about 23% of the total NH network). The slow pace of privatisation in government companies including Air India and BPCL, and less-than-encouraging bids in the recently launched PPP initiative in trains, show attracting private investors interest is not that easy. Then there are asset-specific challenges like presence of an identifiable revenue stream, in railway sector, which has seen limited PPP success as a mode of project delivery. Konkan Railway has multiple stakeholders, including state governments, and creating an effective monetisation transaction structure could be a bit challenging.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.