Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

RISKS IN NATIONAL MONETISATION PIPELINE (NMP)

Read more on - Polity | Economy | Schemes | S&T | Environment

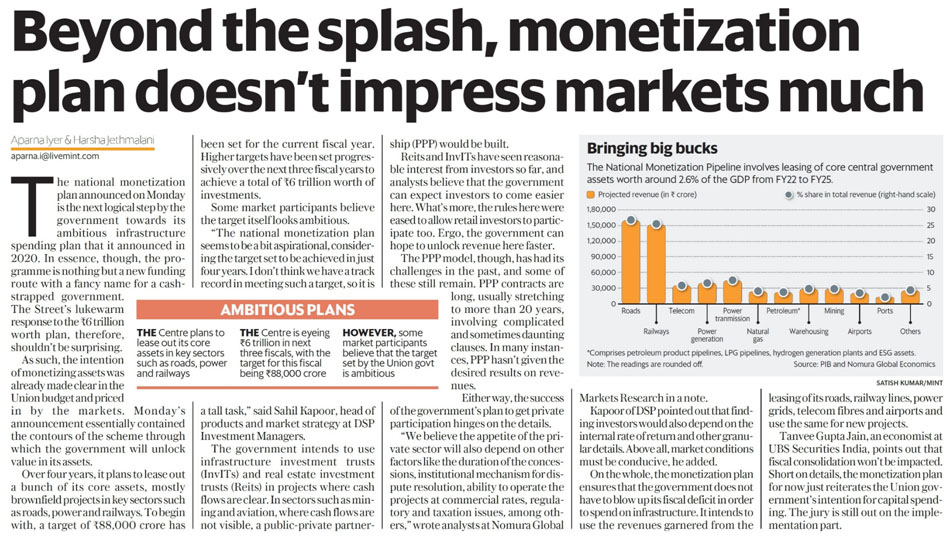

- The story: India has announced a massive NMP - National Monetisation Pipeline - to raise funds from public assets. But global experience serves as a warning - Privatize to increase the efficiency of the economy, or don’t privatize at all. Why? Because otherwise it only creates monopolies.

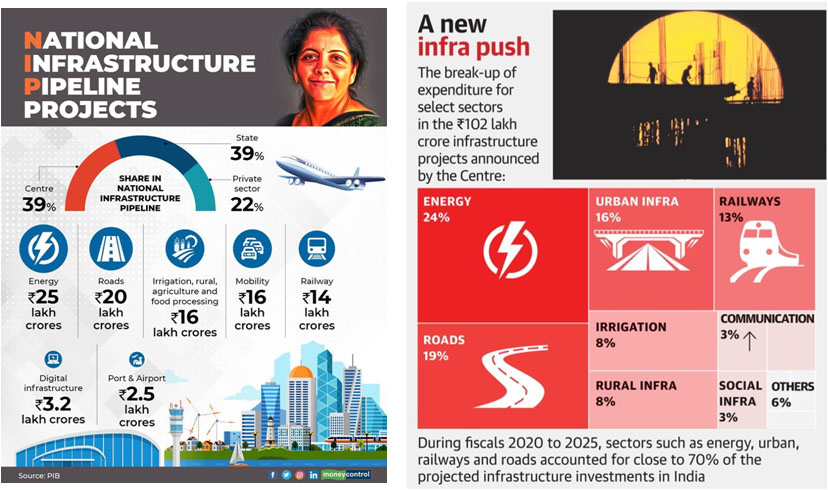

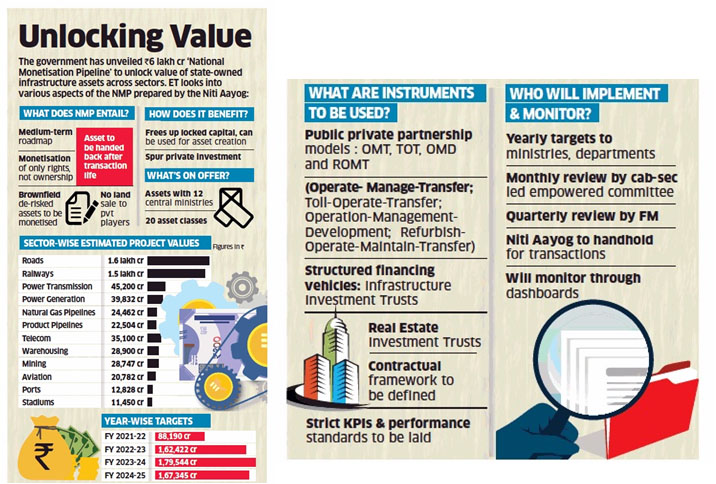

- Why NMP: The cash-strapped Indian government has identified Rs.6 lakh crore ($81 billion) in existing revenue-generating assets, which it will monetize over four years to fund (its share of) an ambitious $1.5 trillion pipeline of new infrastructure (NIP).

- Australian experience: It also had a phase of enthusiasm in asset recycling, with the 2013 leasing of Port Kembla and Port Botany near Sydney. There is concern that handing over control of public utilities to a small private sector will hurt the consumer.

- India wants to give away revenue-earning operating concessions in exchange for upfront payments or investments. The deals will be structured as “contractual partnerships” with the state retaining long-term public ownership.

- What will private firms do? To maximize their profit over a limited time frame, they would want to raise prices, limit competition or cut back on upkeep.

- Singapore was forced to nationalize its suburban trains and signaling systems because the main private operator underinvested in maintenance, leading to frequent breakdowns and stranded, angry passengers.

- It will be important to prevent today’s lump-sum gains to the government from becoming a cost tomorrow. In New South Wales, where electricity prices doubled in five years after poles and wires were privatized, the government had to step in with an Energy Affordability Package to lower the burden on consumers.

- Without expertise: If there is not enough bureaucratic capability and regulatory acumen, then the NMP could become a transfer of taxpayer-funded assets to a handful of business groups. Rising concentration of economic power in everything from transport to telecom is India's reality. Airports and seaports are the stranglehold of billionaire Gautam Adani who is now going for acquire Container Corporation of India Ltd., a state-owned logistics firm. The mobile telecom industry has turned into a duopoly, led by Mukesh Ambani, India’s richest man.

- Control lost for decades: Once control over utilities is out of the government’s hands for years, even decades, the broader public will worry about higher user charges slapped by operators of roads, railways, airports, power grids and gas pipelines.

- For an emerging market, India already has fairly well-established investment trusts and toll-operate-transfer structures. But does it have the legal and regulatory mechanisms to truly de-risk politically sensitive infrastructure before asking the private sector to put a price on it?

- Even where environmental clearances, land acquisition and construction are all cleared, and there’s certainty over future traffic, weak regulators can introduce their own hard-to-price risks.

- Random regulations: In aviation, after a year-and-a-half of Covid-19, India is enforcing capacity caps and pricing floors and ceilings on flights, denying passenger footfall to airports to save some inefficient airlines. Such arbitrariness results from political economy considerations. While many global firms may like to bid for the assets, they will not have the political influence of the Indian home-grown biggies.

- Even when stocks were high: The state’s execution capability was seen in long delays in selling government-run banks, the biggest life insurer, a large oil refinery and Air India Ltd., the national carrier. Rising equity markets, resulting from a massive global and local liquidity glut, had presented a golden opportunity to extract great value for assets, excluding Air India. It could not be done. Who took the money? Startups with no current earnings!

- The virus and the taper: The U.S. Federal Reserve could already be tapering its bloated balance sheet. Emerging-market assets may get hit first. And if the coronavirus keeps coming back in waves to countries slow to reach universal vaccination, or unable to afford repeated boosters, it'd be a double-whammy.

- Summary: Finding the right balance between public and private interests is key to a patient asset recycling program. Other nations have learnt that lesson. Will India use that?

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.