Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

CONCEPT – DRAFT POLICY ON ECOMMERCE 2018

Read more on - Polity | Economy | Schemes | S&T | Environment

- INDIAN ONLINE RETAIL MARKET: THE NUMBERS

- The Indian e-commerce industry is growing fast, and may surpass the US to become the second largest e-commerce market by 2034.

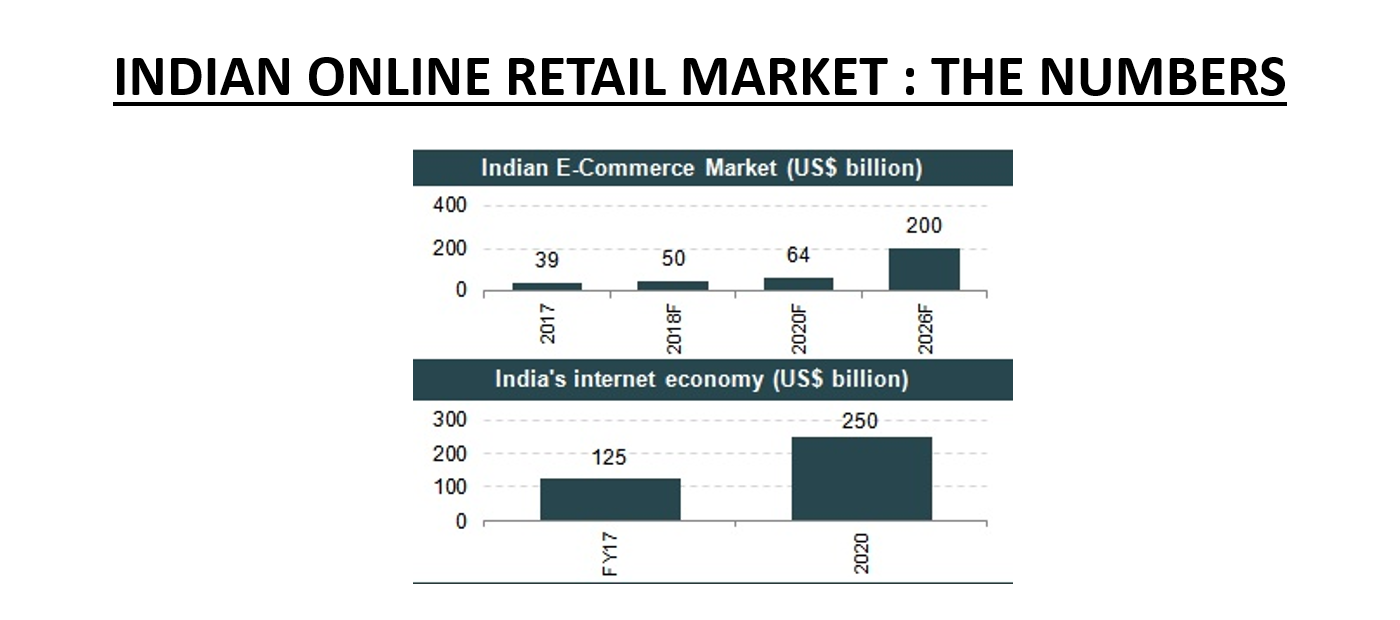

- The e-commerce market may reach US$ 64 billion by 2020 and $200 b by 2026 from US$ 38.5 billion as of 2017.

- With growing internet penetration, internet users in India are expected to increase from 48.1 cr (December 2017) to 82.9 cr by 2021.

- India’s internet economy is expected to double from US$125 billion as of April 2017 to US$ 250 billion by 2020, majorly backed by ecommerce.

- INTERNET DRIVING THE GROWTH

- Internet penetration in India grew from just 4 % in 2007 to 35% in 2017.

- As of December 2017, internet penetration in India stood at 64.84 % in urban areas and 20.26 % in the rural areas.

- Urban India had 29.5 cr internet users (Dec 2017) while Rural India had 18.6 cr internet users (Dec 2017).

- The younger generation is the most prolific user of internet.

- Rising internet penetration is expected to drive ecommerce growth in India.

- Biggest concerns of today

- Domination of foreign investors and brands

- Edging out of local brands and sellers

- Grave risks posed to brick-and-mortar retail

- Brand India vanishing, only “Market India” left

- Biggest risks in trying to allay the concerns

- Any policy that harms competition, is not good

- Any policy that creates favouritism is not good

- Competition should be increased, not reduced

- Consumers should not be harmed in any way

- Two models in E Commerce in India

- Online Marketplace model

- They will follow all rules for zero inventory. Examples : eBay, Naaptol, Shopclues etc. The marketplace is the digital platform for consumers and sellers, and the marketplace owner doesn’t participate. They can surely offer payment help, shipment and delivery help, etc.100% FDI in automatic route is allowed in such models.

- Inventory-led model

- The marketplace owner owns the products also, and handles the complete end-to-end sales process. Example : Jabong The controversy is around companies like Flipkart that are marketplaces but also running their own sales through subsidiaries or other companies.

- The Ministry of Commerce has proposed a new policy to govern the entire E-Commerce sector of India. It has six broad aspects.

- FIRST – ‘India First’ measures

- SECOND – Data localisation measures

- THIRD – Measures to help MSMEs

- FOURTH – Payments monitoring

- FIFTH – Sector’s regulation

- SIXTH – Measures on Press Note 3

- FIRST – ‘INDIA FIRST’ MEASURES

- A limited model will be allowed in inventory-based B2C format, for locally made goods if

- ‘Made in India’ goods are sold on the platform

- The founder / promoter is a resident Indian

- Foreign shareholding is not > 49% and Indian control exists

- Domestic businesses to be promoted. How? Preferential treatment for digital products made in India

- Govt. will incentivise local capital raising and investments by large Indian firms in Indian ecommerce

- Special shareholding rights for Indian entrepreneurs to enable their control over the ecomm companies

- SECOND – DATA LOCALISATION MEASURES

- All large companies (Google, Flipkart, Amazon etc.) that generate user data online in India through search engines, ecommerce platforms and social media have to save data locally in India only

- Subject to privacy and consent rules (as per a new data law coming up in 2019), the government will have access to this data

- Various measures to be taken to incentivise creation of data storage infrastructure in India

- THIRD – MEASURES TO HELP MSMEs

- To help MSME vendors and suppliers remain viable and find customers, a dedicated platform to be built for them in PPP mode

- Small industry clusters will be aided to start online sales platforms (Example – Meerut, Aurangabad, Ludhiana etc.)

- The tax collection at source (TCS) provisions in the GST law that create liquidity and operational hurdles for MSMEs to be relooked at

- Retail logistics market too is growing.

- FOURTH – PAYMENTS MONITORING

- A “Social Credit Database” to be set up through PPP to facilitate digital lending

- One central agency for KYC data to be formed to reduce the cost incurred by individual operators and operational burden on consumers

- Payments can be stipulated by Rupay cards

- FIFTH – REGULATION OF THE SECTOR

- A single law will be made to capture all aspects of the industry

- To regulate issues like FDI implementation and consumer grievances etc., a single regulator is proposed (for ecommerce)

- More scrutiny of “market distorting practices” will be done and CCI will lead that process (to check entry barriers for newcomers)

- Deals like Walmart-Flipkart are candidates for examination

- SIXTH – MEASURES ON PRESS NOTE 3

- A separate wing in Directorate of Enforcement to handle grievances related to Press Note 3

- Large firms will not be allowed to influence prices through subsidiaries etc.

- Sunset clause for differential pricing strategies to be introduced (so deep discounts will get phased out)

- WHAT IS THIS PRESS NOTE 3 ON FDI?

- FDI upto 100% under automatic route is permitted in Business to Business (B2B) e-commerce. No FDI is permitted in Business to Consumer (B2C) e-commerce. However, FDI in B2C e-commerce is permitted in the following circumstances.

- A manufacturer is permitted to sell its product manufactured in India through e-commerce retail.

- An Indian manufacture is permitted to sell its own single brand products through e-commerce retail. Indian manufacturer would be the investee company, which is the owner of the Indian brand and which manufactures in India, in terms of value, at least 70% of its product in house, and sources, at most 30% from Indian manufacturers.

- An e-commerce entity will not permit more than 25% of the sales affected through its marketplace from one vendor or their group companies.

- E-commerce marketplace may provide support services to sellers in respect of warehousing, logistics, order fulfillment, call centre, payment collection and other services.

- Marketplace e-commerce entity will be permitted to enter into transactions with sellers registered on its platform on B2B basis.

- WALMART – FLIPKART DEAL AND SMALLER PLAYERS

- In May 2018, American giant Walmart agreed to acquire a 77% interest in Flipkart Group, from Softbank Vision Fund LP, Japan, and Naspers Ltd, for an estimated $16.0 billion (INR 1.074 trillion).

- This deal alone is considered currently the largest-ever M&A transaction involving India, and the biggest Asia Pacific Retail M&A deal on record.

- However, traders believe it violates the FDI policy of e-commerce sector.

- It is clear that Amazon and Flipkart have been accused on various occasion by sellers and many other stakeholders for misusing the norms in Press Note 3, which disallows one seller from selling more than 25% of the total sales on the marketplace.

- Estimates are that smaller players like Snapdeal and ShopClues had a market share of just 2.5% and 2.1% in 2017, respectively. Giants like Flipkart and Amazon enjoyed market share of 39.5% and 31.1% in the same year respectively.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.