An analysis of how cash and digital are evolving in India, with reference to the 2016 demonetisation exercise.

Demonetisation 2016, and Cash with Public 2021 - An analysis

- The story: On 8th of November, 2016, the Prime Minister of India Narendra Modi made the shocking announcement that more than 85% of the currency was being "demonetised" from 12 midnight that very evening. The various goals announced included ending black money, crushing terrorism and Naxalism, and more. Later, cashless economy too was added as a goal.

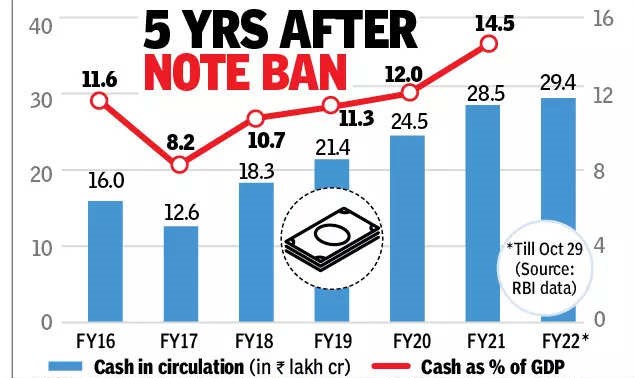

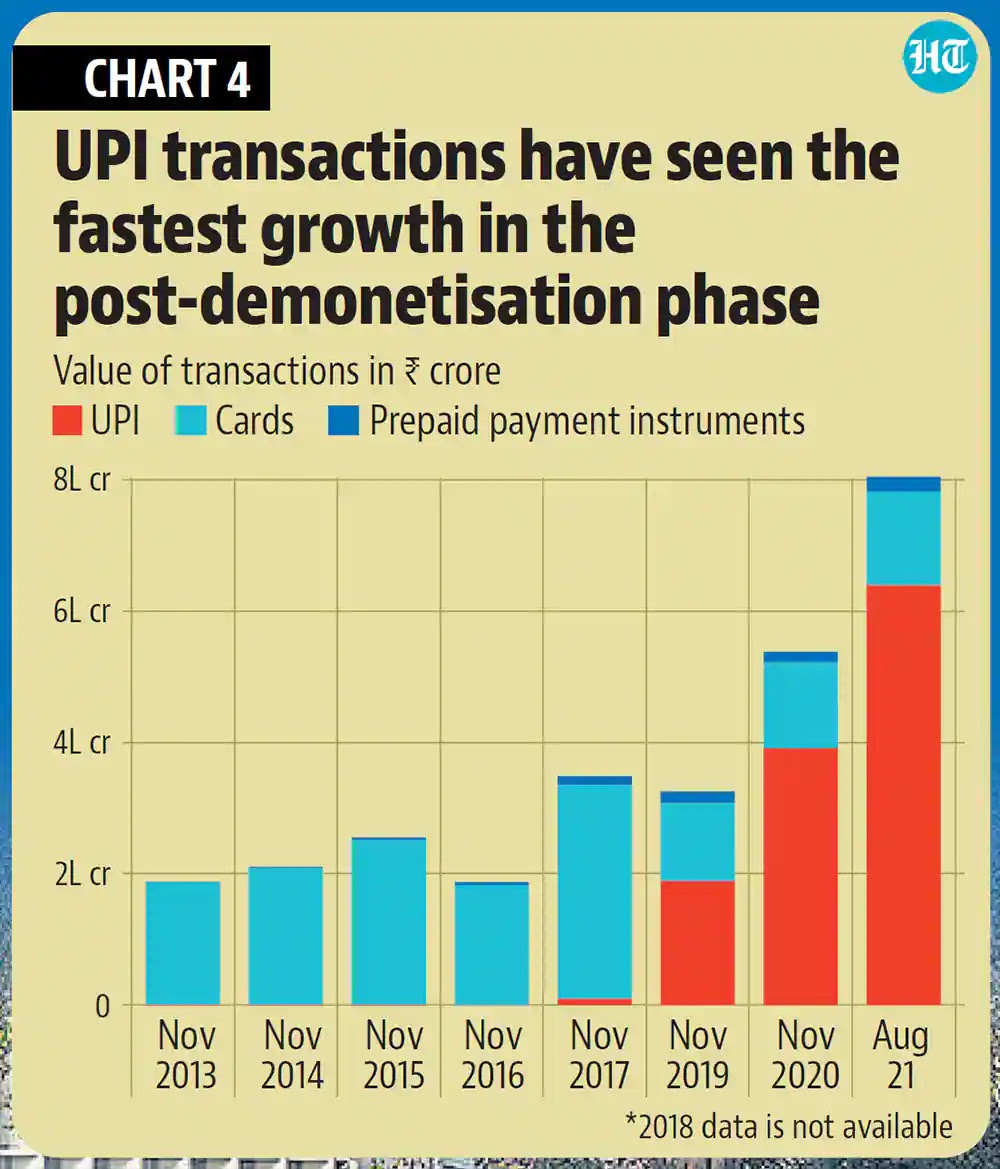

- Digital economy: There is absolutely no doubt that digital retail payments have taken off in a very big way now, especially after the pandemic struck in 2020. The success of NPCI's UPI platform is proof of that. But what about currency with public? Data suggests that during the same time currency in circulation to GDP ratio has increased in consonance with the overall economic growth.

- Facts, figures, data: The Reserve Bank of India (RBI) data shows currency with public has continued to rise even five years after the government announced demonetisation on November 8, 2016. In fact, cash with public has shot up 211 per cent from Rs 9.11 lakh crore, recorded on November 25, 2016.

- For the fortnight ended October 23, 2020, data shows the currency with public rose by Rs 15,582 crore ahead of the Diwali festival. It rose by 8.5 per cent, or Rs 2.21 lakh crore, on a year-on-year basis.

- With cash remaining the preferred mode of payment, currency with public for the fortnight ended October 8, 2021 stood at a record high of Rs 28.30 lakh crore — up 57.48 per cent, or Rs 10.33 lakh crore, from a level of Rs 17.97 lakh crore on November 4, 2016.

- Initial days: After the Rs 500 and Rs 1,000 notes were withdrawn in November 2016, currency with the public, which stood at Rs 17.97 lakh crore on November 4, 2016, declined to Rs 7.8 lakh crore in January 2017. But after that, cash in the system has been steadily rising, even though the government and the RBI pushed for a “less cash society”, digitisation of payments and imposed restrictions on the use of cash in various transactions.

- Why the rise: The jump was driven by a rush for cash by the public in 2020 as the government announced stringent lockdown to tackle the spread of the Covid pandemic. As nations around the world announced lockdowns in February '20 and the Indian government also prepared to announce lockdown, people began accumulating cash to meet their grocery and other essential needs that was being mainly catered by neighbourhood grocery stores.

- How calculated: As per the RBI’s definition, currency with public is arrived at after deducting cash with banks from total currency in circulation (CIC). CIC refers to cash or currency within a country that is physically used to conduct transactions between consumers and businesses.

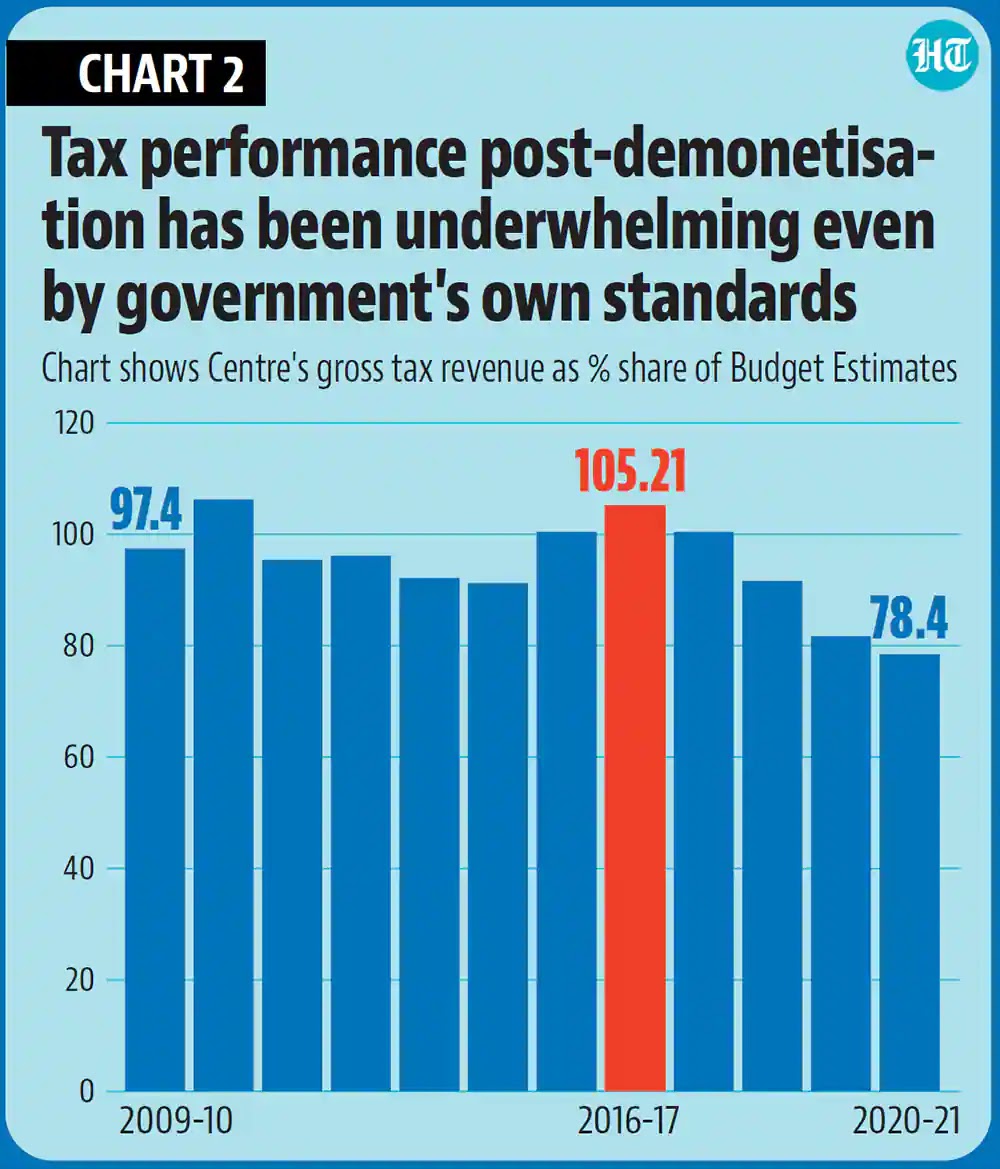

- The sudden withdrawal of notes in November 2016 had roiled the economy, with demand falling, businesses facing a crisis and gross domestic product (GDP) growth declining nearly 1.5 per cent. Many small units were hit hard and shut shutters after the note ban. It also created a liquidity shortage.

- The rise in currency in circulation in absolute numbers is not the reflection of reality. What needs to be taken into account is the currency to GDP ratio, which had come down after demonetisation.

- The cash in circulation to GDP ratio has been 10-12 per cent till about FY20. However, post the covid-19 pandemic and due to the growth of cash in the ecosystem, CIC to GDP is expected to inch up to 14 per cent by FY25. The RBI’s own view of CIC suggests that there is little or no correlation between CIC and digital payment penetrations and that CIC will grow in line with nominal GDP.

- Cash is gold: Experts say that cash in India continues to be the dominant medium of transactions, across regions and income groups. During the festival season, the cash demand remains high as a large number of merchants still depend on cash payments for end-to-end transactions. Cash remains a major mode of transaction with about 15 crore people not having a bank account. Moreover, 90 per cent of e-commerce transactions use cash as a mode of payment in tier four cities compared to 50 per cent in tier one cities.

- EXAM QUESTIONS: (1) Explain the conflict between digital payments and cash payments, in Indian society. Which one is being preferred, and why? (2) What is the problem with a high Cash in Circulation in Indian economy? Explain. (3) What goals did demonetisation achieve? Make a list and compare with original goals declared on 8th Nov., 2016.

#RBI #Cashless #Digital #CIC #Cashinsystem

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.

COMMENTS