Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

Taxation system in India

1.0 INTRODUCTION

India has a well-developed tax structure with clearly demarcated authority between Central and State Governments and local bodies. Central Government levies taxes on income (except tax on agricultural income, which the State Governments can levy), customs duties, central excise and service tax. Value Added Tax (VAT), stamp duty, state excise, land revenue and profession tax are levied by the State Governments. Local bodies are empowered to levy tax on properties, octroi and for utilities like water supply, drainage etc.

Indian taxation system has undergone tremendous reforms during the last decade. The tax rates have been rationalized and tax laws have been simplified resulting in better compliance, ease of tax payment and better enforcement. The process of rationalization of tax administration is ongoing in India.

2.0 Direct Taxes

Taxes in which the point of payment and the point of incidence are the same are known as direct taxes. Direct taxes form a substantial chunk of the government's receipts.

2.1 Income tax

The law regarding income tax is laid down by the Income Tax Act 1961. Previously income tax in India was governed under the Indian Income Tax Act, 1922. According to the Income Tax Act, 1961, every person, who is an assessee and whose total income exceeds the maximum exemption limit, shall be chargeable to the income tax at the rate or rates prescribed in the Finance Act. Such income tax shall be paid on the total income of the previous year in the relevant assessment year.

Any person by whom (any tax) or any other sum of money is payable under the Income Tax Act, is an assessee.

Accordingly there are eight types of persons:

- Individual

- Hindu Undivided Family (HUF)

- Association of persons (AOP)

- Body of individuals (BOI)

- Company

- Firm

- A local authority, and

- Every artificial judicial person not falling within any of the preceding categories.

Income tax is an annual tax imposed separately for each assessment year (also called the tax year). Assessment year commences from 1st April and ends on the next 31st March.

2.1 Residential status and its impact on taxation

The total income of an individual is determined on the basis of his residential status in India. For tax purposes, an individual may be resident, nonresident or not ordinarily resident. The kinds of income which are liable to tax in India are based on residential status as the following table illustrates

2.1.1 Personal Income Tax

Personal income tax is levied by Central Government and is administered by Central Board of Direct taxes under Ministry of Finance in accordance with the provisions of the Income Tax Act.

2.1.2 Corporate tax

A corporate has been defined as an artificial juridical person having an independent and separate legal entity from its shareholders. Income of the company is computed and assessed separately in the hands of the company. However the income of the company, which is distributed to its shareholders as dividend, is assessed in their individual hands. Such distribution of income is not treated as expenditure in the hands of company; the income so distributed is an appropriation of the profits of the company.

Residence of a company

- A company is said to be a resident in India during the relevant previous year if:

- It is an Indian company

- If it is not an Indian company but, the control and the management of its affairs is situated wholly in India

- A company is said to be non-resident in India if it is not an Indian company and some part of the control and management of its affairs is situated outside India.

Corporate sector tax: The taxability of a company's income depends on its domicile. Indian companies are taxable in India on their worldwide income. Foreign companies are taxable on income that arises out of their Indian operations, or, in certain cases, income that is deemed to arise in India. Royalty, interest, gains from sale of capital assets located in India (including gains from sale of shares in an Indian company), dividends from Indian companies and fees for technical services are all treated as income arising in India. The current rate of corporate tax in India is 25%, for all firms with turnover upto Rs. 400 crore annually.

2.1.3 Minimum Alternative Tax (MAT)

Normally, a company is liable to pay tax on the income computed in accordance with the provisions of the Income Tax Act, but the profit and loss account of the company is prepared as per provisions of the Companies Act. There were large number of companies who had book profits as per their profit and loss account but were not paying any tax because income computed as per provisions of the income tax act was either nil or negative or insignificant. In such case, although the companies were showing book profits and declaring dividends to the shareholders, they were not paying any income tax. These companies are popularly known as Zero Tax companies. In order to bring such companies under the Income Tax Act net, section 115JA was introduced w.e.f assessment year 1997-98.

A new tax credit scheme has been introduced by which MAT paid can be carried forward for set-off against regular tax payable during the subsequent five year period subject to certain conditions, as under:-

- When a company pays tax under MAT, the tax credit earned by it shall be an amount, which is the difference between the amount payable under MAT and the regular tax. Regular tax in this case means the tax payable on the basis of normal computation of total income of the company.

- MAT credit will be allowed carry forward facility for a period of five assessment years immediately succeeding the assessment year in which MAT is paid. Unabsorbed MAT credit will be allowed to be accumulated subject to the five-year carry forward limit.

- In the assessment year when regular tax becomes payable, the difference between the regular tax and the tax computed under MAT for that year will be set off against the MAT credit available. The credit allowed will not bear any interest.

2.1.4 Fringe Benefit Tax (FBT)

The Finance Act, 2005 introduced a new levy, namely Fringe Benefit Tax (FBT) contained in Chapter XIIH (Sections 115W to 115WL) of the Income Tax Act, 1961. The origin of FBT stems from the corporate trend wherein the amount of salary paid to an employe is less but the perquisites (perks) are more.

Fringe Benefit Tax (FBT) was an additional income tax payable by the employers on value of fringe benefits provided or deemed to have been provided to the employees. The FBT is payable by an employer who is a company; a firm; an association of persons excluding trusts/a body of individuals; a local authority; a sole trader, or an artificial juridical person.

This tax was payable even where employer does not otherwise have taxable income. Fringe Benefits are defined as any privilege, service, facility or amenity directly or indirectly provided by an employer to his employees (including former employees) by reason of their employment and includes expenses or payments on certain specified heads.

This tax was abolished from A.Y. 2010-11.

2.1.5 Wealth Tax

Wealth tax, in India, is levied under Wealth-tax Act, 1957. Wealth tax is a tax on the benefits derived from property ownership. The tax is to be paid year after year on the same property on its market value, whether or not such property yields any income.

Under the Act, the tax is charged in respect of the wealth held during the assessment year by the following persons:

- Individual

- Hindu Undivided Family (HUF)

- Company

Chargeability to tax also depended upon the residential status of the assessee, same as the residential status for the purpose of the Income Tax Act.

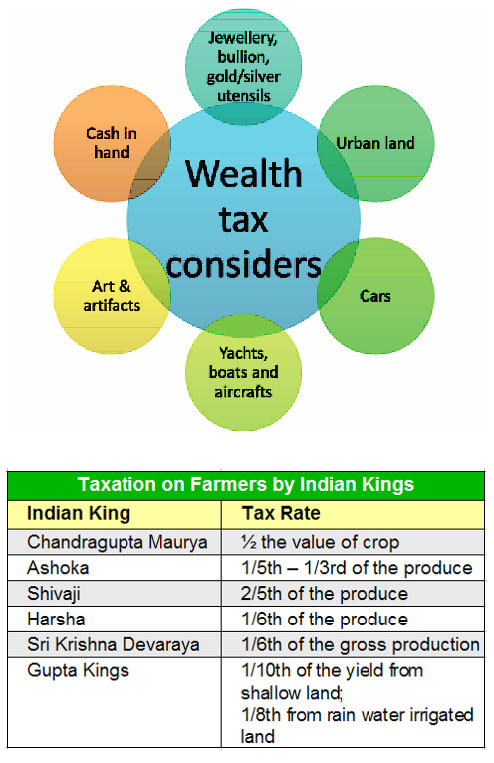

Wealth tax was not levied on productive assets, hence investments in shares, debentures, UTI, mutual funds, etc are exempt from it. The assets chargeable to wealth tax are Guest house, residential house, commercial building, Motor car, Jewellery, bullion, utensils of gold, silver, Yachts, boats and aircrafts, Urban land and Cash in hand (in excess of Rs 50,000 for Individual & HUF only).

The following will not be included in Assets:

- Assets held as Stock in trade.

- A house held for business or profession.

- Any property in nature of commercial complex.

- A house let out for more than 300 days in a year.

- Gold deposit bond.

- A residential house allotted by a Company to an employee, or an Officer, or a whole time director (Gross salary i.e. excluding perquisites and before Standard Deduction of such Employee, Officer, Director should be less than Rs. 5,00,000).

The assets exempt from Wealth tax are "Property held under a trust", Interest of the assessee in the coparcenary property of a HUF of which he is a member, "Residential building of a former ruler", "Assets belonging to Indian repatriates", one house or a part of house or a plot of land not exceeding 500 sq. m. (for individual & HUF assessee).

Wealth Tax was abolished in India in 2015 & not brought back.

2.1.6 Dividend Distribution Tax (DDT)

Under Section 115-O of the Income Tax Act, any amount declared, distributed or paid by a domestic company by way of dividend shall be chargeable to dividend tax. Only a domestic company (not a foreign company) is liable for the tax. Tax on distributed profit is in addition to income tax chargeable in respect of total income. It is applicable whether the dividend is interim or otherwise. Also, it is applicable whether such dividend is paid out of current profits or accumulated profits.

The tax shall be deposited within 14 days from the date of declaration, distribution or payment of dividend, whichever is earliest. Failing to this deposition will require payment of stipulated interest for every month of delay under Section115-P of the Act. Rate of dividend distribution tax is to be raised from 12.5 per cent to 15 per cent on dividends distributed by companies; and to 25 per cent on dividends paid by money market mutual funds and liquid mutual funds to all investors.

2.1.7 Securities Transaction Tax (STT)

Securities Transaction Tax or turnover tax, as is generally known, is a tax that is leviable on taxable securities transaction. STT is leviable on the taxable securities transactions with effect from 1st October, 2004 as per the notification issued by the Central Government. The surcharge is not leviable on the STT.

2.1.8 Tax Rebates for Corporate Tax

The classical system of corporate taxation is followed in India. Corporates and individuals are given a lot of freedom to invest and save tax. These rules are influenced by various macro economic conditions that may exist at that time.

- Domestic companies are permitted to deduct dividends received from other domestic companies in certain cases.

- Inter Company transactions are honoured if negotiated at arm's length.

- Special provisions apply to venture funds and venture capital companies.

- Long-term capital gains have lower tax incidence.

- There is no concept of thin capitalization.

- Liberal deductions are allowed for exports and the setting up on new industrial undertakings under certain circumstances.

- There are liberal deductions for setting up enterprises engaged in developing, maintaining and operating new infrastructure facilities and power-generating units.

- Business losses can be carried forward for eight years, and unabsorbed depreciation can be carried indefinitely. No carry back is allowed.

- Dividends, interest and long-term capital gain income earned by an infrastructure fund or company from investments in shares or long-term finance in enterprises carrying on the business of developing, monitoring and operating specified infrastructure facilities or in units of mutual funds involved with the infrastructure of power sector is proposed to be tax exempt.

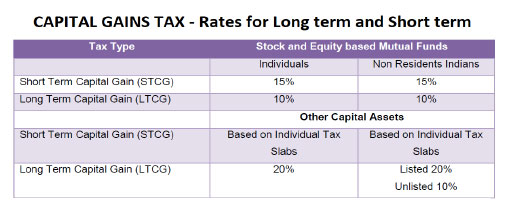

2.2 Capital Gains Tax

A capital gain is income derived from the sale of an investment. A capital investment can be a home, a farm, a ranch, a family business, work of art etc. In most years slightly less than half of taxable capital gains are realized on the sale of corporate stock. The capital gain is the difference between the money received from selling the asset and the price paid for it.

Capital gain also includes gain that arises on "transfer" (includes sale, exchange) of a capital asset and is categorized into short-term gains and long-term gains.

The capital gains tax is different from almost all other forms of taxation in that it is a voluntary tax. Since the tax is paid only when an asset is sold, taxpayers can legally avoid payment by holding on to their assets – a phenomenon known as the "lock-in effect."

The scope of capital asset is being widened by including certain items held as personal effects such as archaeological collections, drawings, paintings, sculptures or any work of art. Presently no capital gain tax is payable in respect of transfer of personal effects as it does not fall in the definition of the capital asset. To restrict the misuse of this provision, the definition of capital asset is being widened to include those personal effects such as archaeological collections, drawings, paintings, sculptures or any work of art.

Transfer of above items shall now attract capital gain tax the way jewellery attracts despite being personal effect as on date.

2.2.1 Short Term and Long Term capital Gains

Gains arising on transfer of a capital asset held for not more than 36 months (12 months in the case of a share held in a company or other security listed on recognised stock exchange in India or a unit of a mutual fund) prior to its transfer are "short-term". Capital gains arising on transfer of capital asset held for a period exceeding the aforesaid period are "long-term".

Section 112 of the Income-Tax Act, provides for the tax on long-term capital gains, at 20 per cent of the gain computed with the benefit of indexation and 10 per cent of the gain computed (in case of listed securities or units) without the benefit of indexation.

2.3 Double Taxation Relief

Taxation of the same income of the person more than once is known as Double Taxation. This may happen when a person is liable to pay tax in more than one nation. Due to countries following different rules for income taxation.

As per the source of income rule, the income may be subject to tax in the country where the source of such income exists (i.e. where the business establishment is situated or where the asset / property is located) whether the income earner is a resident in that country or not.

According to the residence rule, the income earner may be taxed on the basis of the residential status in that country. For example, if a person is resident of a country, he may have to pay tax on any income earned outside that country as well.

Therefore a problem of double taxation arises if a person is taxed in respect of any income on the basis of source of income rule in one country and on the basis of residence in another country or on the basis of mixture of above two rules.

Relief against such hardship can be provided mainly in two ways:

- Bilateral relief

- Unilateral relief

Bilateral Relief: The Governments of two countries can enter into Double Taxation Avoidance Agreement (DTAA) to provide relief against such Double Taxation, worked out on the basis of mutual agreement between the two concerned sovereign states. This may be called a scheme of 'bilateral relief' as both concerned powers agree as to the basis of the relief to be granted by either of them.

Unilateral relief: The above procedure for granting relief will not be sufficient to meet all cases. No country will be in a position to arrive at such agreement with all the countries of the world for all time. The hardship of the taxpayer however is a crippling one in all such cases. Some relief can be provided even in such cases by home country irrespective of whether the other country concerned has any agreement with India or has otherwise provided for any relief at all in respect of such double taxation. This relief is known as unilateral relief.

Double Taxation Avoidance Agreement (DTAA): List of double taxation avoidance agreements in India are as follows:

- DTAA Comprehensive Agreements - (With respect to taxes on income)

- DTAA Limited Agreements - With respect to income of airlines/ merchant shipping

- Limited Multilateral Agreement

- DTAA Other Agreements/Double Taxation Relief Rules

- Specified Associations Agreement

- Tax Information Exchange Agreement (TIEA)

3.1 Central Sales Tax (CST)

Central Sales tax is generally payable on the sale of all goods by a dealer in the course of inter-state trade or commerce or, outside a state or, in the course of import into or, export from India.

The CST was subsumed in GST from 01 July 2017.

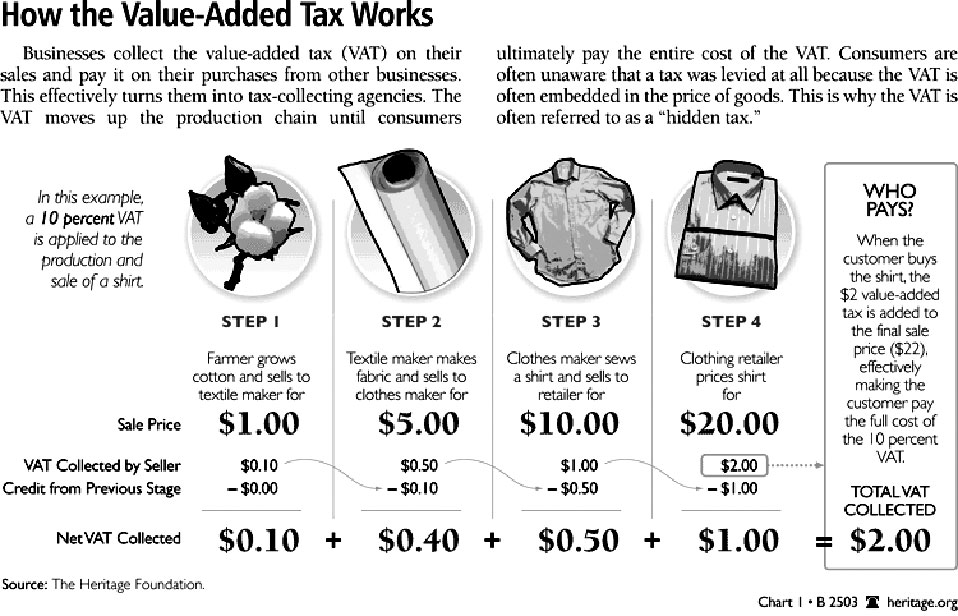

3.2 Value Added Tax (VAT)

VAT was a multi-stage tax on goods levied across various stages of production and supply with credit given for tax paid at each stage of Value addition. Introduction of state level VAT was the most significant tax reform measure at state level. The state level VAT replaced the existing State Sales Tax. The decision to implement State level VAT was taken in the meeting of the Empowered Committee (EC) of State Finance Ministers held on June 18, 2004, where a broad consensus was arrived at to introduce VAT from April 1, 2005. Accordingly, all states/UTs have implemented VAT.

The Empowered Committee, through its deliberations over the years, finalized a design of VAT to be adopted by the States, which seeks to retain the essential features of VAT, while at the same time, providing a measure of flexibility to the States, to enable them to meet their local requirements. Some salient features of the VAT design finalized by the Empowered Committee are given below. VAT was subsumed in GST from 01 July 2017.

3.2.1 Basic features of the VAT system

- The rates of VAT on various commodities shall be uniform for all the States/UTs. There are 2 basic rates of 4 per cent and 12.5 per cent, besides an exempt category and a special rate of 1 per cent for a few selected items. The items of basic necessities have been put in the zero rate bracket or the exempted schedule. Gold, silver and precious stones have been put in the 1 per cent schedule. There is also a category with 20 per cent floor rate of tax, but the commodities listed in this schedule are not eligible for input tax rebate/set off. This category covers items like motor spirit (petrol), diesel, aviation turbine fuel, and liquor.

- There is provision for eliminating the multiplicity of taxes. In fact, all the State taxes on purchase or sale of goods (excluding Entry Tax in lieu of Octroi) are required to be subsumed in VAT or made VATable.

- Provision has been made for allowing "Input Tax Credit (ITC)", which is the basic feature of VAT. However, since the VAT being implemented is intra-State VAT only and does not cover inter-State sale transactions, ITC will not be available on inter-State purchases.

- Exports will be zero-rated, with credit given for all taxes on inputs/ purchases related to such exports.

- To make the provisions business friendly there is a facility for self-assessment by the dealers. Similarly, there is provision of a threshold limit for registration of dealers in terms of annual turnover of Rs 5 lakh. Dealers with turnover lower than this threshold limit are not required to obtain registration under VAT and are exempt from payment of VAT. There is also provision for composition of tax liability up to annual turnover limit of Rs. 50 lakh.

Regarding the industrial incentives, the States have been allowed to continue with the existing incentives, without breaking the VAT chain. However, no fresh sales tax/VAT based incentives are permitted.

3.3 Excise Duty

Central Excise duty is an indirect tax levied on goods manufactured in India. Excisable goods have been defined as those, which have been specified in the Central Excise Tariff Act as being subjected to the duty of excise.

There are three types of Central Excise duties collected in India namely

3.3.1 Basic Excise Duty

This is the duty charged under section 3 of the Central Excises and Salt Act, 1944 on all excisable goods other than salt, which are produced or manufactured in India at the rates set forth in the schedule to the Central Excise tariff Act,1985.

3.3.2 Additional Duty of Excise

Section 3 of the Additional duties of Excise (goods of special importance) Act, 1957 authorizes the levy and collection in respect of the goods described in the Schedule to this Act. This is levied in lieu of Sales Tax and shared between Central and State Governments. These are levied under different enactments like medicinal and toilet preparations, sugar etc. and other industries development etc.

3.3.3 Special Excise Duty

As per the Section 37 of the Finance Act, 1978 Special Excise Duty was attracted on all excisable goods on which there is a levy of Basic Excise Duty under the Central Excises and Salt Act, 1944. Since then each year the relevant provisions of the Finance Act specifies that the Special Excise Duty shall be or shall not be levied and collected during the relevant financial year.

3.4 Customs Duty

Custom or import duties are levied by the Central Government of India on the goods imported into India. The rate at which customs duty is leviable on the goods depends on the classification of the goods determined under the Customs Tariff. The Customs Tariff is generally aligned with the Harmonised System of Nomenclature (HSL).

In line with aligning the customs duty and bringing it at par with the ASEAN level, government has reduced the peak customs duty from 12.5 per cent to 10 per cent for all goods other than agriculture products. However, the Central Government has the power to generally exempt goods of any specified description from the whole or any part of duties of customs leviable thereon. In addition, preferential/concessional rates of duty are also available under the various Trade Agreements.

3.5 Service Tax

Service tax was introduced in India way back in 1994 and started with mere 3 basic services viz. general insurance, stock broking and telephony. Today the counter services subject to tax have reached over 100. There has been a steady increase in the rate of service tax. From a mere 5 per cent, service tax was levied on specified taxable services at the rate of 12 per cent of the gross value of taxable services. In 2017, Service Tax (an indirect tax) was subsumed in the GST.

Laffer CURVE ON TAXATION

- In economics, the Laffer curve is a theoretical relationship between rates of taxation levied by a government, and the resulting revenue.

- It shows the concept of taxable income elasticity. Taxable income changes in response to changes in the rate of taxation.

- Assumption is that governments will not levy extreme tax rates of 0% and 100%, and that there is a rate between 0% and 100% that maximizes government taxation revenue.

- The Laffer curve is typically represented as a graph that starts at 0% tax with zero revenue, rises to a maximum rate of revenue at an intermediate rate of taxation, and then falls again to zero revenue at a 100% tax rate. There are debates on the type of curve that will result.

- One lesson is that reducing or increasing tax rates beyond a certain point is a bad idea for raising further tax revenue.

- Laffer does not claim to have invented the concept; he notes that there are antecedents, including in the Muqaddimah by 14th-century Tunisian scholar Ibn Khaldun, and in the writings of John Maynard Keynes.

4.0 understanding g.s.t.

To earn revenues to keep working, i.e. to finance their own expenditure. A lot of taxes are used to ultimately run public services that benefit citizens. Every king, warlord, feudal landlord, and government ever in the history of mankind has taxed its subjects. Unfortunately, in modern India, the system has become extremely complex and perverse over time. The GST regime will hopefully recoup the simplicity and smooth flow in Indian taxation systems.

4.1 Taxes in India, listed

Tax - A tax is a fee charged by the government on a product, income or activity. It becomes a direct tax if it is levied directly on the income of a person or a company. However, if the tax is levied on the price of a service or a good, it becomes an indirect tax.

Sales Tax - A tax levied on every sale made. Thus, a dealer A selling to another dealer B collects local sales tax from B, normally included in the price itself. B again does the same to C. Thus, tax gets repeatedly levied as sales price of B included his purchase price from A (which included sales tax) + his profits.

Value Added Tax (VAT) - A tax levied on every step of the inventory process. Tax is levied at each step of the process - from manufacturer to distributor to wholesaler to retailer to customer. VAT is uniform.

Service Tax (ST) - A tax levied on Services, and there are tonnes of them in any modern society today!

Excise and VAT - Taxes levied on Goods, and there is a bewildering range of these in any consumer society today

Goods and Services Tax (GST) - It is a VAT to be levied on both goods and services. A comprehensive tax that promises to subsume (take over) all other taxes. Even VAT in India was not able to eliminate the cascading effect of taxes, hence the struggle to bring a GST regime. GST is a destination tax, similar to a consumption tax. It is applied on the goods and services when a consumer buys them. More than 160 developed nations have this tax in place. GST destination principle means imports would be subject to GST, while exports would be zero-rated. In the case of inter-State transactions within India, the State tax would apply in the State of destination as opposed to that of origin.

So what exactly is this "Cascading Effect of Taxes"?

4.2 Problems with the Indian VAT system

The VAT system was introduced in which at every next stage, a dealer would get credit of the tax paid at earlier stage, against his tax liability.

Benefits? Reduced overall liability of traders, reduced inflationary impact on prices. The Central Excise Duty had a similar concept earlier - the CENVAT credit scheme (earlier known as MODVAT). It this, credit of excise duty paid at the input stages was allowed to be set-off against the liability of excise on removal of goods. In 2004, this system was extended to Service Tax also. Cross-utilisation of credit between excise duty and service tax was also permitted. The problem of cascading effect of taxes is resolved by these measures. But, even till 2016, problems existed with the system that remained unsolved.

The official press release by Government of India (August 2016) defined GST as:

"GST is one indirect tax for the whole nation, which will make India one unified common market. GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages."

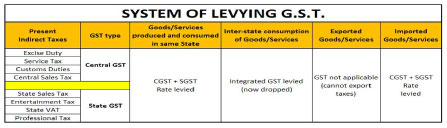

What the GST will not subsume : The GST in India shall subsume all the above taxes, except the Basic Customs Duty that will continue to be charged even after the introduction of GST. Other indirect taxes, such as stamp duties etc shall also continue. India shall adopt a Dual GST model, meaning that the GST would be administered both by the Central and the State Governments.

4.3 Earlier structure of Indirect Taxes in India

Central Taxes - Central Excise Duty, Service Tax, Additional Customs Duty (CVD), Special Additional Duty of Customs (SAD), Central Sales Tax (levied by Centre, collected by States), Central surcharges and cesses (relating to supply of goods and services)

State Taxes - Value Added Tax (VAT), Octroi and Entry Tax, Purchase Tax, Luxury Tax, Taxes on lottery-betting-gambling, State cesses and surcharges, Entertainment Tax (other than local bodies'), Central Sales Tax (levied by Centre, collected by States)

4.4 Structure and components of Indian GST

Components of GST - India built a dual GST system. It has a Central GST (CGST) and a State GST (SGST). A third component also exists - the IGST or Integrated GST for inter-state transactions of goods.

CGST - The CGST subsumed many taxes levied earlier like (a) Central excise duty, (b) Additional excise duty, (c) Service Tax, (d) Additional Customs Duty commonly known as Countervailing duty (CVD), (e) Special Additional Duty of customs (ADC), (f) Surcharges and Cess

SGST - The SGST subsumed many taxes levied earlier like (a) State VAT and Sales tax, (b) Octroi and Entry Tax, (c) Purchase tax, (d) Entertainment Tax, (e) Luxury Tax, (CVD), (f) Lottery Tax, (g) State Surcharges and Cess

Modus Operandi - Both Centre and States simultaneously levy GST across the value chain. Tax is levied on every supply of goods and services. Centre levies and collects the Central Goods and Services Tax (CGST), and States levy and collect the State Goods and Services Tax (SGST) on all transactions within a State. The input tax credit of CGST is available for discharging the CGST liability on the output at each stage. Similarly, the credit of SGST paid on inputs is allowed for paying the SGST on output. No cross utilization of credit is permitted.

4.4.1 Four Tier Structure of GST

A four-tier GST tax structure of 5%, 12%, 18% and 28% was finalised by the GST Council.

The 0% slab - Essential food items - 0% - With a view to keeping inflation under check, essential items including food, which presently constitute roughly half of the consumer inflation basket, are taxed at zero rate.

The 5% slab - Common Use Items - 5% - The lowest rate of 5% are for common use items.

The 12% to 18% slab - Two standard rates of 12% and 18% finalised under the GST regime.

The 28% slab - Luxury items - 28% - The highest tax slab applicable to items which are currently taxed at 30-31% (excise duty plus VAT). Luxury cars, tobacco and aerated drinks also be levied with an additional cess on top of the highest tax rate. The collection from this cess as well as that of the clean energy cess creates a revenue pool which would be used for compensating states for any loss of revenue during the first five years of implementation of GST. The cess would be lapsable after five years.

Other Nations - In other nations, it is as follows - Canada 5%, UK 20%, Australia 10%, France 19%, New Zealand 15% and China 17%.

Compensation to States - As per the Finance Ministry, Rs.50,000 crore would be needed to compensate states for loss of revenue from rollout of GST, which is to subsume a host of central and state taxes like excise duty, service tax and VAT, in the first year.

GST and Savings - India expects to save Rs.80,000 crores annually by introducing GST. Employment boost is expected to be anywhere from 40 lacs to 50 lacs. Average price decrease of manufactured products can be up to 2.5%.

4.5 System of levying the GST

The Central GST and the State GST are levied simultaneously on every transaction of supply of goods and services except on exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both are levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

4.5.1 Dual GST within a State

A diagrammatic representation of the working of the Dual GST model within a State is shown below. In this, the cross utilization of credit of CGST between goods and services is allowed. Similarly, the facility of cross utilization of credit is available in case of SGST. However, the cross utilization of CGST and SGST is not allowed except in the case of inter-State supply of goods and services under the IGST model which is explained now.

4.5.2 GST for inter-state transaction of Goods and Services

How will be Inter-State Transactions of Goods and Services be taxed under GST in terms of IGST method? In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods and services under Article 269A (1) of the Constitution. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in that order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State.

A diagrammatic representation of the working of the IGST model for inter-State transactions is shown below.

4.6 Positive and transformational impact of GST

It will impact the pricing of services and goods, it will lead to optimization of supply chains, deployment of I.T. tools and ERPs, accounting norms etc. Companies will need to adopt best practices, gear up for changes in processes, train their teams and develop IT systems for being GST compliant. The Goods and Services Tax intends to convert all states into a single market through a new indirect tax regime, subsuming levies such as excise, sales tax and service tax. It will reduce the need for reconciliation at state borders and could help the country break down the web of check-posts around the country, thereby speeding up the movement of goods. GST is a destination tax, similar to a consumption tax. It is applied on the goods and services when a consumer buys them. More than 160 developed nations have this tax in place. So, the GST will replace the confusing array of indirect taxes levied by various governments in the federal structure with a single nationwide tax.

Indian Prime Minister Narendra Modi made it a point to reach out to all political parties in an attempt to get a consensus and end this long journey. While we got political freedom in 1947 and became one political entity - One State - we will now finally become One Market instead of a collection of multiple fragmented markets. In essence, we are signing a Free Trade Agreement with ourselves!

In the 24 months that followed the July 2017 launch, there were many bitter lessons learnt, with must related to poor portal performance and failure to issue refunds in time.

4.7 Key features of the Indian GST system

- The power to make laws in respect of supplies in the course of inter-State trade or commerce will be vested only in the Union government. States will have the right to levy GST on intra-State transactions including on services.

- Centre will levy IGST on inter-State supply of goods and services. Import of goods will be subject to basic customs duty and IGST.

- GST is being defined as any tax on supply of goods and services other than on alcohol for human consumption.

- Central taxes like, Central Excise duty, Additional Excise duty, Service tax, Additional Custom duty and Special Additional duty and State level taxes like, VAT or sales tax, Central Sales tax, Entertainment tax, Entry tax, Purchase tax, Luxury tax and Octroi will be subsumed in GST. That is, they will cease to exist separately.

- Petroleum and petroleum products i.e. crude, high speed diesel, motor spirit, aviation turbine fuel and natural gas shall be subject to the GST on a date to be notified by the GST Council.

- 1% origin based additional tax to be levied on inter-State supply of goods will be non-creditable in GST chain. The revenue from this tax is to be assigned to the Origin State. This tax is proposed to be levied for initial two years or such period as recommended by the GST Council.

- Provision for removing imposition of entry tax / Octroi across India.

- Entertainment tax, imposed by States on movie, theatre, etc will be subsumed in GST, but taxes on entertainment at panchayat, municipality or district level to continue.

- GST may be levied on the sale of newspapers and advertisements and this would give the government's access to substantial incremental revenues.

- Stamp duties, typically imposed on legal agreements by the state, will continue to be levied by the States.

- Administration of GST will be the responsibility of the GST Council, which will be the apex policy making body for GST. Members of GST Council comprised of the Central and State ministers in charge of the finance portfolio.

4.8 A simple explanation for GST mechanism

Let us assume a supply chain - Weaver - Tailor - Retailer - Customer

Assume GST rate of 8% throughout.

Weaver sources raw material and weaves the fabric. He sells to Tailor at Rs.100, but has to pay GST, so applies it on Rs.100. Weaver's sale price to Tailor become Rs.108, of which Rs.8 is the GST.

The Tailor gets the fabric at Rs.108, tailors it into a readymade shirt. He sells the shirt to a Retailer for Rs.250. But he has to apply GST, which is 8% of Rs.250 = Rs 20. So sales price of Tailor = Rs.270, of which Rs.20 is the GST. Tailor had already paid Rs.8 as GST, so he will get a credit for Rs.12 (20 - 8) in his books. Weaver got credit for Rs.8 in his own books.

The Retailer sells that shirt to a Customer for Rs.500. But he has to apply GST on it @ 8% rate. So sale price becomes Rs.500 + Rs.40 = Rs.540. Of this, the Tailor and Weaver have claimed credit for Rs.12 + Rs.8 already, so the Retailer claims tax credit for Rs.40 - Rs.20 = Rs.20.

Customer bought the shirt for Rs. 540. That is the destination point. He is not selling to anyone but consuming the shirt. Hence, no tax credit. He pays full Rs.40 of GST.

So, in the whole cycle, total tax credit claimed was

- Rs.8 by Weaver + Rs.12 by Tailor + Rs.20 by Retailer = Rs.40

- Customer paid that entire amount = Rs.40

Now the realistic rate of GST may be around 15%, so the calculations will look like

And the supply chain will look like

4.9 Overall benefits of GST

- Avoidance of tax cascading leading to minimum inflation stoking

- One tax subsuming all other indirect taxes leading to simple administration

- Harmonization of center and State tax administrations, which would reduce duplication and compliance costs. Tax controversies and litigations reduce.

- India becomes a single market rather than a fragmented one, leading to free movement

- Less developed states get a boost as the 2% inter-state levy means production is kept within a state. Under the GST national market, it can be dispersed.

- "Make in India" becomes possible due to higher competitiveness of companies

- Wider tax base, necessary for lowering the tax rates and eliminating classification disputes

- Faster turnaround times due to minimum entry formalities across state borders

- Destination principle and zero rating, leading to GST collection by consuming states (DP) and exports benefit due to ZR as taxes cannot be exported!

- GDP gets a boost due to elimination of tax cascading etc.

5.0 DIRECT VERSUS INDIRECT TAXES & TAX TO GDP RATIO

The big debate over which type of tax is better rages on. Here is a comprehensive analysis of the Indian situation, pointwise, with relevant historical data.

Nature of taxes : Direct taxes are taxes on income, wealth, property and capital gains. Indirect taxes are taxes on goods, services and excise taxes. Indirect taxes are usually considered regressive because the marginal impact on the economically weaker sections of society is far greater. India’s direct to indirect tax ratio is roughly 35:65, and has stayed so for a long time.

India and OECD : If a 50 year analysis is done, then data for Organization for Economic Cooperation and Development (OECD) and India (from 1965 to 2013 across 35 countries) shows that India is an outlier. India’s tax-to-GDP ratio increased from 10.4% in 1965 to 17.2% in 2013. This includes both central and state tax revenues. The corresponding tax-to-GDP ratio for OECD countries (weighted by GDP) increased from 21% in 1965 to 33% in 2013. Purely in terms of a tax-to-GDP ratio, India has always been substantially lower than the average of OECD economies, over a 50-year period.

Proper comparison : Compared to a subset of OECD nations with lower GDP (Korea, Turkey, Mexico, Chile, Portugal, Greece, Slovenia, Indonesia and Poland), India’s tax-to-GDP is still lower at 17% versus an average of 24% for these nations.

Thomas Piketty's observation : Famous French economist Thomas Piketty has said that 1) inequality in India is widening, 2) India’s tax-to-gross domestic product (GDP) ratio is abysmally low and 3) the Indian state spends too little on health and education. It is indeed true that India taxes its citizens much lower in proportion to its GDP vis-à-vis other economies and a large portion of such taxes are collected through largely regressive and distorting indirect rather than direct means.

What is a good tax to GDP ratio : India’s overall tax revenues are indeed very low for the size of its economy. Conventional macroeconomics says that it is not optimal for the tax rate to exhibit erratic jumps up or down. At the same time, there is a maximum feasible tax-to-GDP ratio, which corresponds to the peak of the “Laffer curve". Perhaps, the optimum tax-to-GDP ratio is simply the lowest tax-to-GDP ratio which pays the government’s bills and keeps its books balanced, without running perpetual budget deficits or surpluses.

Movement in the ratio over the decades : In the 25-year period from 1965 to 1990, India’s tax-to-GDP increased steadily from 10% to 16% while GDP increased 2.8-fold. In the subsequent 25-year period from 1991 to 2014, India’s tax-to-GDP stayed roughly constant between 16% and 17% while GDP increased 4.5-fold. One sees that India’s rate of tax revenues did not grow commensurate with its GDP growth post the 1991 reforms. It is a mystery!

Direct and Indirect : India behaves differently than other major world economies on the split between direct and indirect taxes. India’s direct to indirect tax ratio is roughly 35:65. This is in contrast to most OECD economies where the ratio is the exact opposite, 67:33 in favour of direct taxes. From 1965 to 2015, India’s direct-to-indirect tax ratio has swung from a low of 13:87 to its current high of 35:65. For the OECD nations, throughout this 50-year period, the direct-to-indirect tax ratio has remained roughly constant in the range of 65:35.

Which is better : According to the modern view, direct taxes — such as income or wealth taxes — function better both in terms of efficiency and equity, while indirect taxes are inferior. Left politics may like those for reasons of progressivity, while the right for reasons of minimizing inefficiency. If indirect taxes must be used anyhow (due to whatever constraints), they should be minimally distorting. An example of a “good" indirect tax is a single rate goods and services tax (GST) with no exemptions. Such a tax distorts individuals’ labour supply and savings choices, like direct income and wealth taxes, but does not distort the economy’s structure of production or consumption, as most indirect taxes, such as trade tariffs, do. The “worst" taxes are sector-specific excise taxes with high tax rates — such as taxes on petroleum, alcohol and tobacco — which are maximally distorting to the economy and maximally regressive. Unfortunately, they are also among the most popular for governments the world over, because they are good ways to grab a lot of revenue!

The best solution : As per Joseph Stiglitz, the desirable features of an optimal tax system would be “progressive income taxes, complemented by indirect taxation, bequest taxes and capital taxes that enhance the progressivity that can be achieved by the tax system while limiting the level of distortion (deadweight loss)". So India must do two things - (1) raise its tax to GDP ratio, and (2) raise more taxes directly and not indirectly.

6.0 TAX BASE IN INDIA - ESTIMATES

Expansion of tax base : During the last several years, India’s tax base has expanded and the number of taxpayers has also increased over the last five years — across income groups. According to Central Board of Direct Taxes (CBDT) data, the number of tax returns filed surged to 6.85 crore in 2018-19, an 80% growth from 2014-15.

Estimating a number : Of the estimated population of 136 crore, the working population is estimated at about 40% (~ 54 crore). If half of the workforce is assumed to be engaged in agriculture, that’s a potential tax base of 27 crore individuals. With individual income tax payers already topping 6.85 crore, it is clear that a fourth of those who owe income tax are already paying tax.

What is tax base : The official definition of ‘tax base’ includes all assessees who have filed their IT returns in the last three years, and adds in those who paid TDS. A new income tax filer is defined as a person who is not included in the tax filing base at the beginning of the year but subsequently files his/her income tax return during the fiscal. On the other hand, the base consists of those who have filed ITRs in any of the previous three financial years. According to the CBDT, about 1.10 crore new tax filers were added to the tax base during the 2018-19, up from about 1.06 crore in FY18. The number of Indians reporting income greater than Rs 1crore has increased by 60% between 2014-15 and 2017-18. Yet, the actual collection of direct taxes has fallen short of the target.

Low number of income tax payers : India’s limitation lies in its small tax base. Only around 7.4% of adults (aged 15 years and above) in India file or pay income tax. This is lower than developing countries with similar per capita income, such as the Philippines (26%) and Vietnam (58%). The fact that India still collects as much taxes (as a percentage of GDP) as those economies suggests that India’s tax structure is heavily skewed. Despite a very low percentage of tax filers falling in the highest tax liability brackets, the lion’s share of direct tax revenues comes from a small pool of rich taxpayers. For instance, those with incomes between ?2 crore and ?5 crore and hence in the tax liability brackets of ?69 lakh to ?1.8 crore accounted for about 0.1% of the effective personal income tax base (excluding those paying zero taxes). But this small group contributed 13% to the overall personal income tax collection in 2017-18.

Under-reporting : National Sample Survey Office (NSSO) data suggest that the number of crorepatis is under-reported. The problem seems to be acute among professionals such as lawyers, doctors, accountants and those running private educational institutes. The tax base has not deepened among these groups. Consequently, the share of reported non-salary income in the gross income of individuals has declined over the years to 43% in 2017-18 from 48% in 2012-13.

Poor collection from newbies : CBDT data does show that newbie return filers have mostly joined the bottom of the pyramid where tax rates are nominal or nil. Hopefully, as India’s income levels improve over the next few years and it transitions into a middle-income economy, these new return filers will graduate into the higher tax slabs and cough up their due share of taxes.

Myth of 3% only : Income tax payers in India have always felt a sense of victimhood because they make up such a small sliver of the population, with this ‘unfortunate’ 3% ruing over their fate! But that number is now outdated.

Historically : In FY14, a total of 3.79 crore IT returns were filed by taxpaying entities (including individuals, small businesses and companies). Over the next two years to FY16, this number crept up to 4.36 crore. That’s a 15% addition over two years. The number of filings zoomed to 6.84 crore by the end of FY18. That was a 57% increase (2.48 crore new filings).

CAP of CBDT : The Central Action Plan (CAP) for 2019-20 drafted by the Central Board of Direct Taxes (CBDT) continues to focus on widening the tax base. The latest action plan targets 1.30 crore new tax filers. The CAP refers to the increased economic activity in the country, in the organised as well as the unorganised sectors, to justify widening the tax net. It also pointed out that new opportunities for identification of potential tax payers have opened up due to data mining and data analytics conducted by the systems directorate, investigation wing and TDS/TCS units.

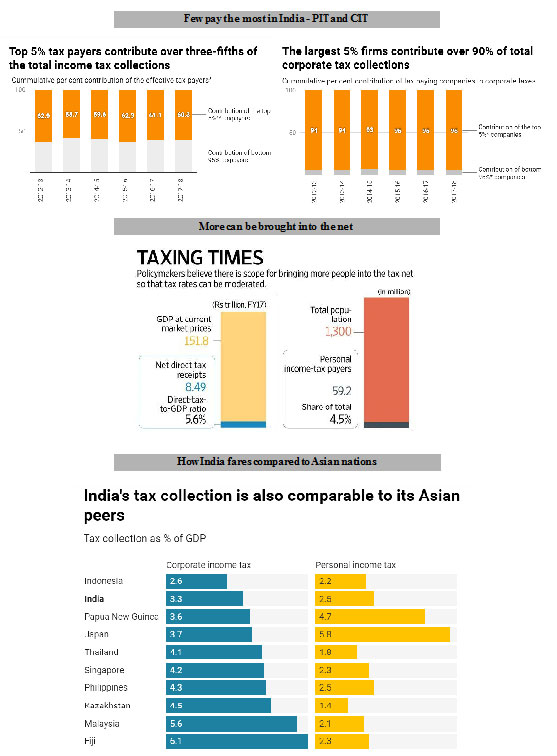

The smallest numbers paying the most : The top 5% of effective tax-payers in the country, equal to 0.1% of the country’s population, contribute nearly three-fifths of India’s income tax collections. And the top 1% of effective tax-payers, equivalent to 0.03% of the country’s population, contribute roughly a third of India’s income-tax collections! Similarly, for firms, just the top 5% of tax-paying firms (based on taxes paid) contribute about 95% of the total corporate tax collections! Despite a small and narrow tax base, India’s tax collections appear respectable when compared to economies with similar levels of per-capita income.

As a per cent of GDP : India’s personal income tax collection as a share of its GDP, at 2.5%, is higher than that of countries such as Vietnam, Bangladesh and Egypt and comparable to that of the Philippines. India also does not fare badly when compared to its Asian peers. In terms of corporate tax collections, India’s collections (3.3% of GDP) is slightly smaller compared to comparable economies such as Vietnam (3.8%), Bhutan (6.4%), and the Philippines (4.3%). This is despite the fact that India’s statutory corporate tax rate is among the highest in the world.

7.0 WAS DEMONETISATION USEFUL

- Changing goalposts : When announced in November 2016, demonetisation was promised as a solution to India’s black money and counterfeit currency problems. Later it was projected as a move to encourage digital payments. On all of these fronts, it is unclear if it has worked.

- Most notes returned : According to the RBI's annual report for 2017-18, 99.3% of the demonetised Rs. 500 and Rs. 1000 notes were returned to the central bank. One of the primary aims of demonetisation was extinguishing ill-gotten currency notes. That was not met clearly.

- Cash to GDP ratio : The amount of cash in India has reached pre-demonetisation levels. India’s currency circulation is growing at a similar trajectory to the months before November 2016. On counterfeit money, there has been no significant change in the number of fake notes detected. In 2017-18, the number of counterfeit notes detected was in line with pre-demonetisation levels and, more importantly, minimal in the grand scheme of India’s currency circulation. The 522,783 fake notes detected accounted for a mere 0.0005% of total currency circulation.

- Digital payments : Even on digital payments, demonetisation does not seem to have provided a significant and sustained push. Mobile payments and card payments through PoS have increased significantly since November 2016 but they were also increasing in the months preceding demonetisation. The demonetisation-induced cash crunch did increase digital payments but the years since, as cash returned, have seen more modest growth in digital payments.

- Tax compliance : Demonetisation’s impact on boosting tax compliance was tough to assess. The 2018 Economic Survey suggested that demonetisation helped increase India’s tax base, in terms of taxpayers, and this may have played some role in the increase in the tax-to-GDP ratio over the last two years. In 2019, the ratio dipped again, in a clear sign of economic slowdown.

- Rural areas hit hard : Demonetisation’s impact was biggest in rural districts with lower banking access and more informal workers. These districts grew at a significantly slower rate in the quarter after demonetisation.

- Economic slowdown : Experts say that in the initial phase, the formal sector did not feel any crunch, but the informal sector witnessed large-scale job losses. Many enterprises (dealing in cash) shut down. Those may never have re-started. The loss of purchasing power for crores came to bite the formal sector by 2018 and 2019, and consumption demand fell in many sectors. The 2017 GST roll-out was the second shock for the informal economy.

- Summary : Taken together, the costs of demonetisation (in terms of loss of purchasing power and jobs in informal sector) seem to outweigh the benefits (in terms of increased tax base and higher tax buoyancy).

TAX TERRORISM

- What is tax terrorism : 'Tax terrorism' is a term that came to light in 2019, yet again, with the suicide by Cafe Coffee Day (CCD) founder VG Siddhartha in 2019. It made many people vocal about tax harassment that they too have faced. It refers to the high-handed behaviour by direct tax officials while dealing with assessees.

- What industry feels : A leading entrepreneur said that business fraternity all over India has faced the tax department's excesses. Late VG Siddhartha had alleged harassment from lenders and tax authorities in a letter purportedly written by him. It has also shown up serious faultlines in the government-business interface.

- Claims by the late Founder : Siddhartha had claimed that Income Tax Department attached "our shares on two separate occasions to block our Mindtree deal and then taking position of our Coffee Day shares, although revised returns have been filed by us". Many claim that when they go to the I-T department, they are told that they better pay up. The officers say they have a target to achieve.

- Problem is with CBDT : Officers claim that the controlling body of direct taxes - the Central Board of Direct Taxes (CBDT) - continuously puts pressure on them and threaten to transfer them on failing to meet the set target.

- Targeted and troubled : In his July 27 letter, Siddhartha has quite unambiguously spelt out harassment by income-tax authorities and pressure from private equity (PE) investors, who wanted him to buy back their stake, as factors that pushed him to the brink. The I-T department has contended that it has followed due process, but that is less than convincing. There is a growing sense that businesses are being targeted if not ‘terrorised’ by tax authorities, with a political element often thrown in.

- Economic slowdown : Post demonetisation and GST, reports have surfaced of small and medium scale entrepreneurs being driven to distress, debt and suicide. It is clear that by 2019, the economy was in serious trouble, owing to both supply and demand factors. Credit to business had evaporated with banks being risk-averse and NBFCs running out of liquidity after the IL&FS crisis. On the demand side, investment has stagnated and jobs are evidently in free fall, having a knock-on effect on revenues of businesses.

- Ease of doing business : India’s efforts to be investor-friendly would appear inconsequential if the overall climate is one where fear of authority prevails over a sense of freedom.

GAAR - GENERAL ANTI AVOIDANCE RULE

- Making laws that make tax avoidance tough is the role of the government.

- The General anti-avoidance rule (GAAR) is an anti-tax avoidance law under Chapter X-A of the Income Tax Act, 1961 of India, framed by the Department of Revenue under the Ministry of Finance. GAAR was originally proposed in the Direct Tax Code 2009 and was targeted at arrangements or transactions made specifically to avoid taxes. GAAR provisions were also present in the Direct Tax Code 2010 and Direct Tax Code 2013. However, the Direct Tax Code did not see the light of the day and was not implemented in India.

- GAAR was finally introduced in India by then Finance Minister, Pranab Mukherjee, on 16 March 2012 during the Budget session. It was considered controversial because it had provisions to seek taxes from past overseas deals involving local assets retrospectively. (The Vodafone case) The provision was adopted originally in the Finance Act, 2012 with effect from 1 April 2014. Those rules were replaced in the Finance Act, 2013 with new Chapter X-A which was inserted with effect from 1 April 2016. The revised provisions were deferred for two years and made applicable to income in financial year 2017-18 (assessment year 2018-19 and subsequent years) in the Finance Act 2015. In July 2018 the CBDT amended the existing Tax Audit Reports Form 3CD with effect from 20 August 2018 and deferred the implementation of the GAAR reporting requirements until 31 March 2019.

- During the 2015 Budget presentation, Finance Minister Arun Jaitley announced that its implementation will be delayed.

- Issues with GAAR : It provides discretion to the tax administration which can be misused. The Standing Committee responded to GAAR in their report on the Direct Taxes Code Bill in March, 2012. They suggested that the provisions should ensure that taxpayers entering genuinely valid arrangements are not harassed. They recommended that the onus should be on tax authorities, not the taxpayer, to prove tax avoidance. In addition, the committee suggested an independent body to act as the approving panel to ensure impartiality.

- India’s GAAR is in addition to, or in lieu of, any other basis for determination of tax liability of a specified person. The GAAR seeks to align tax liability with the real intention of the parties and the real effect of transactions.

RETROSPECTIVE TAXATION - THE VODAFONE CASE

- Canon of Certainty : Taxes are levied as per set rules. Adam Smith even made the 'Canon of Certainty' a core principle in a rational taxation system. But if the government decides to raise tax demands with a retrospective effect, it can have a deadly effect on business sentiment.

- Vodafone versus Income Tax department : The tax dispute between Vodafone and the tax department of India is a case of 'retrospective taxation'. The case originated after the revenue’s (tax department) notice to Vodafone that the company has to pay a capital gains tax of nearly Rs.11000 crores from its purchase of Hutchison Essar Telecom Company from Hutch (in 2007).

- Details and timeline of the case :

- 2007 deal : The dispute centered on the question that whether an indirect transfer of property located in India can be taxed under the relevant section 9(1)(i) of the Income-tax Act. The section instructs imposition of capital gains tax when the capital assets are transferred directly from one company to another. Indirect transfer means when the shares of a company is transferred, the underlying asset is also transferred to the buyer.

- Tax demands and Supreme Court verdict : Tax authorities had in September 2007 served notice to Vodafone International Holdings BV for its alleged failure to deduct withholding tax from consideration paid to the Hutchison Telecommunications International Ltd. {The company was in January 2013 served a tax notice of Rs.14,200 crore after including interest on the principal amount. A year later, Vodafone challenged the tax demand under the Dutch BIT. The official said the company in April 2014 served the notice of arbitration after out-of-the-court dispute resolution talks failed. The tax department in February 2016 served a demand notice of Rs22,100 crore, including interest accruing since the date of the original demand.}

- 2012 Supreme Court verdict : At the final stage of the dispute, the Supreme Court verdict arrived that tax department doesn’t have the right to tax the deal! This was so because the relevant income tax Act (Section 9 (i) (i)) doesn’t instruct tax authorities when capital asset (machinery building etc.) lying in India is transferred indirectly by transferring the shares by foreign companies abroad. Both Vodafone and Hutch were foreign companies and they made a deal in another foreign company which held 67% of shares of Hutchison Essar India Limited. Hence Vodafone need not pay tax for the said deal.

- 2012 retrospective taxation under the Income Tax Act : After the setback in the Vodafone case, the government amended Section 9 (i) (i)). The new amendment clarified that when a share transaction takes place between two nonresident entities that results indirect transfer of assets lying in India, such an income will be taxed in India. The 2012 amendment forces Vodafone to pay tax and penalty on its 2007 acquisition of a 67% stake in Hutch-Essar in India. The government basically came up with the General Anti-Avoidance Rule (GAAR). GAAR faced a lot of opposition, and its implementation was continuously postponed year after year.

- Effective 1962 : The striking thing about the 2012 amendment of the income tax act was that it was amended with effect from 1962. This means the amendment has 'retrospective effect'. By this logic, any law can be amended to mean something else. A retrospective tax law is one that takes effect from a date before it is passed. Here, the law imposing tax on indirect transfer of assets in India was enacted in 2012, but the tax will be applicable to all transaction that took place from 1962 onwards (Income tax rule was passed in 1962). A company’s business decisions are based upon the tax situation that exists today. It is very difficult to organize its activities today based on a future law that will be made applicable from today. An ideal tax system should be predictable certain and stable. Hence retrospective implemetation is a bad move.

- P Shome Committee : Later, the government asked Parthasarathi Shome to make recommendations about the retrospective implementation. Recommendations of the Shome Committee arrived, and it said that any taxation involving indirect transfer of assets located in India should be prospective and not retrospective. The Committee concluded that retrospective application of tax law should occur in exceptional or rarest of rare cases, and with particular objectives. Moreover, retrospective application of a tax law should occur only after exhaustive and transparent consultations with stakeholders who would be affected.

- Going for international arbitration : Vodafone had contested the govt. move, approaching an international tribunal. It said the arbitration clause was invoked for breach of its expectations of ‘fair and equitable’ treatment from the Centre under the two bilateral investment treaties, namely, India-UK bilateral investment protection agreement (BIPA) and India-Netherlands BIPA. “You may breach the treaty without breaching the Constitution.. No State can take defense of national law to avoid international obligations under public international law". Vodafone further argued that issues of breach of a bi-lateral investment treaty (BIT) have to be determined and judged on the principles of international law by an international court.

- 2012 and 2014 : Vodafone invoked the first arbitration under the India-Netherlands BIPA through a notice of dispute of 17 April, 2012 and notice of arbitration of 17 April, 2014, after the introduction of the retrospective amendment to the Income Tax Act which imposed a Rs.11,000 crore tax liability on Vodafone in relation to its $11 billion deal acquisition of the entire 67% holding of CK Hutchison Holdings Ltd in Hutchison Essar Ltd in 2012.

- 2017 : The second arbitration under the India-UK BIPA was invoked on 24 January, 2017. This second arbitration was stayed by the Delhi high court in August 2017 on the grounds that both arbitral proceedings were on the same issue. The Supreme Court on 15 December, 2017, had allowed Vodafone to appoint an arbitrator in the second arbitration but added that the proceedings would not start until completion of hearings in the case before the Delhi high court.

- 2019 : An international arbitration tribunal, headed by Sir Franklin Berman, then started hearing the government’s objection to tax matters being covered under the Netherlands-India Bilateral Investment Treaty, which was used by Vodafone to trigger an arbitration over the tax demand. India challenged the tribunal’s jurisdiction to decide on such matters. Vodafone has maintained that there is no liability and that it will “continue to defend vigorously any allegation that VIHBV or Vodafone India Ltd is liable to pay tax in connection with the transaction with Hutchison and will continue to exercise all rights to seek redress".