Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

Indian Budget - Important terms and concepts

1.0 INTRODUCTION

The term budget is derived from the French word "Budgette" which means a "leather bag" or a "wallet". It is a statement of the financial plan of the government. It shows the income & expenditure of the Indian government during a financial year, which runs generally from 1st April to 31st March.

Budget is most important information document of the government. One part of the government's budget is similar to company's annual report. This part presents the overall picture of the financial performance of the government. The second part of the budget presents government's financial plans for the period up to its next budget.

So, every citizen of a nation from the common man to the politician is eager to know about the budget as they would like to get an idea of the

- Financial performance of the government over the past one year

- Financial programmes & policies of the government for the next one year

- Factors which will affect their standard of living in the next one year

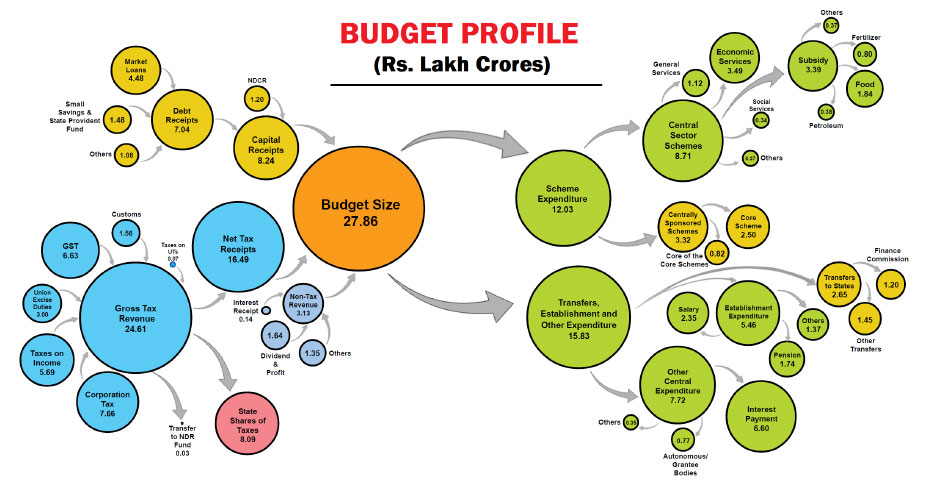

2.0 RECEIPTS OF THE GOVERNMENT

2.1 Revenue receipts

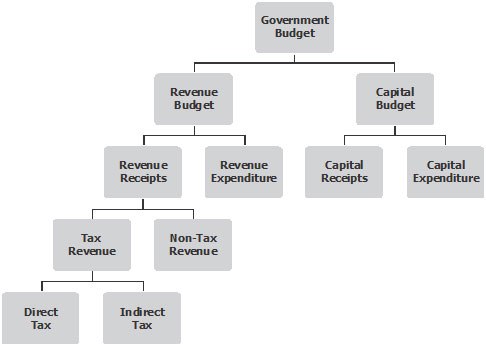

The Revenue receipts of the Government comprise Tax and Non-Tax Revenues.

2.1.1 Gross Tax Revenue

The share received by the Central Government after paying the States' share as mandated by the relevant Finance Commission is known as Gross Tax Revenue.

There are two types of taxes - Direct Taxes and Indirect Taxes.

A.Direct taxes

Direct taxes are those taxes which have to be paid by the person on whom they are levied. Its burden can not be shifted to some one else. E.g. Income tax, property tax, corporation tax, estate duty, etc. are direct taxes. There is no direct benefit to the tax payer.

B.Indirect taxes

Indirect taxes are those taxes which are levied on commodities and services and affect the income of a person through their consumption expenditure. Here the burden can be shifted to some other person. E.g. Custom duties, sales tax, services tax, excise duties, etc. are indirect taxes.

2.1.2 Non-tax revenue

The main receipts under this head are interest on loans given by the government, and dividends and profits received from PSUs. The government also earns from various services, including public services it provides. Of this, only the Railways is a separate department, though all its receipts and expenditure are routed through the Consolidated Fund of India.

- Fees: The government provides variety of services for which fees have to be paid. E.g. fees paid for registration of property, births, deaths, etc.

- Fines and penalties: Fines and penalties are imposed by the government for not following (violating) the rules and regulations.

- Profits from public sector enterprises: Many enterprises are owned and managed by the government. The profits receives from them is an important source of non-tax revenue. For example in India, the Indian Railways, Oil and Natural Gas Commission, Air India, Indian Airlines, etc. are owned by the Government of India. The profit generated by them is a source of revenue to the government.

- Gifts and grants: Gifts and grants are received by the government when there are natural calamities like earthquake, floods, famines, etc. Citizens of the country, foreign governments and international organisations like the UNICEF, UNESCO, etc. donate during times of natural calamities.

- Special assessment duty: It is a type of levy imposed by the government on the people for getting some special benefit. For example, in a particular locality, if roads are improved, property prices will rise. The Property owners in that locality will benefit due to the appreciation in the value of property. Therefore the government imposes a levy on them which is known as special assessment duty.

Receipts which create a liability or result in a reduction in assets are called capital receipts. They are obtained by the government by raising funds through borrowings, recovery of loans and disposing of assets. The main items of Capital receipts (income) are

- Loans raised by the government from the public through the sale of bonds and securities. They are called market loans.

- Borrowings by government from RBI and other financial institutions through the sale of Treasury bills.

- Loans and aids received from foreign countries and other international organisations like International Monetary Fund (IMF), World Bank, etc.

- Receipts from small saving schemes like the National saving scheme, Provident fund, etc.

- Recoveries of loans granted to state and union territory governments and other parties. These include recoveries of loans and advances.

Miscellaneous capital receipts: These are primarily receipts from PSU disinvestment.

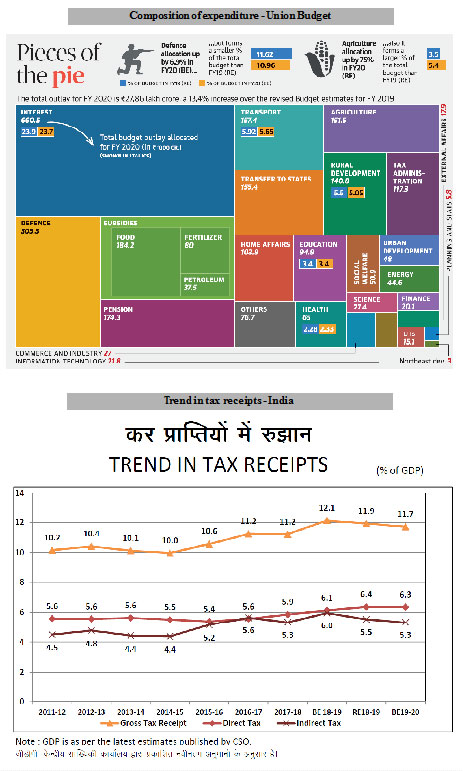

3.0 EXPENDITURE OF THE GOVERNMENT

According to Article 112 of the Indian Constitution, the Government in its Annual Financial Statement has to classify expenditure as expenditure on revenue account and other expenditure. Another mandatory classification is the separation of expenditure between expenditure charged on the CFI - Consolidated Fund of India (Non-votable expenditure) and other expenditure made in the form of demand for grants (Votable expenditure.)

Before we understand government spending, it is important to know the concept of plan and non-plan spending and the Central Plan.

Gross budgetary support: The Five-Year Plans are split into five annual plans. The funding of the Plan is split almost evenly between government support (from the budget) and internal and extra-budgetary resources of state-owned enterprises. The government's support to the Plan, which includes state plans, is called Gross Budgetary Support.

Plan expenditure: This is essentially the budget support to the annual plans. This is typically considered developmental spending (on health, education, infrastructure and social goals). Like all budget heads, it is also split into revenue and capital components.

Non-plan expenditure: This is in the nature of consumption expenditure, broadly corresponding to revenue expenditure: interest payments, subsidies, salaries, defence & pensions. Its 'capital' component is small, the largest chunk being defence.

3.1 Revenue Expenditure

Revenue expenditure is the expenditure incurred for the routine, usual and normal day to day running of government departments and provision of various services to citizens. It includes both development and non-development expenditure of the Central government. Usually expenditures that do not result in the creations of assets are considered revenue expenditure.

The following expenses are included in Revenue Expenditure

- Expenditure by the government on consumption of goods and services

- Expenditure on agricultural and industrial development, scientific research, education, health and social services

- Expenditure on defence and civil administration

- Expenditure on exports and external affairs

- Grants given to State governments even if some of them may be used for creation of assets

- Payment of interest on loans taken in the previous year

- Expenditure on subsidies

3.2 Capital Expenditure

Any projected expenditure which is incurred for creating assets with a long life is a capital expenditure. Thus, expenditure on land, machines, equipment, irrigation projects, oil exploration and expenditure by way of investment in long term physical or financial assets are capital expenditure.

When government's expenditure exceeds its receipts, it has to borrow to meet the shortfall. This deficit has material implication for the economy as bridging it increases public debt and eats up revenues through higher interest payments.

4.0 DEFICITS AND DEBTS

4.1 Public debt

The money borrowed by the government is eventually a burden on the people of India, and is, therefore, called public debt. It is split into two heads: internal debt (money borrowed within the country) and external debt (funds borrowed from non-Indian sources).

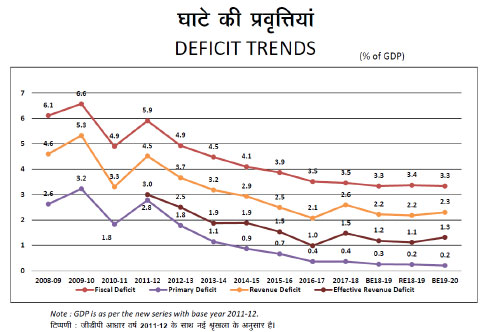

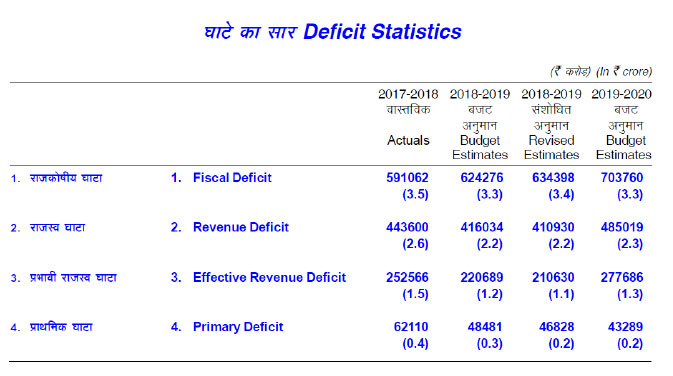

4.2 Fiscal deficit

Usually the government spends more than what it earns through various sources. The difference between total revenue and total expenditure of the government is termed as fiscal deficit. It is an indication of the total borrowings needed by the government. While calculating the total revenue, borrowings are not included.

Generally fiscal deficit takes place due to either revenue deficit or a major hike in capital expenditure. Capital expenditure is incurred to create long-term assets such as factories, buildings and other development. A deficit is usually financed through borrowing from either the central bank of the country or raising money from capital markets by issuing different instruments like treasury bills and bonds. This shortfall, which is met with borrowed funds, is called fiscal deficit. Technically, it is the excess of government expenditure over 'non-borrowed' receipts (revenue receipts plus loan repayments received by the government plus miscellaneous capital receipts.)

4.3 Primary deficit

Primary deficit is one of the parts of fiscal deficit. While fiscal deficit is the difference between total revenue and expenditure, primary deficit can be arrived by deducting interest payment from fiscal deficit. Interest payment is the payment that a government makes on its borrowings to the creditors.

Economists differ widely on their views on fiscal deficit. According to John Maynard Keynes, a deficit prevents an economy from falling into recession, while another school of thought is that a country should not have fiscal deficit.

Many economists think that if the deficit is financed by raising debt from the central bank it may lead to an inflationary scenario. Higher fiscal deficit is one of the reasons for the Indian economy to have relatively higher inflation.

4.4 Revenue deficitA mismatch in the expected revenue and expenditure can result in revenue falling below expectations. This arises when the government's actual net receipts is lower than the projected receipts. On the contrary, if the actual receipts are higher than expected one, it is a good situation. A ‘Revenue Deficit’ is defined as Revenue Receipts less Revenue Expenditure.

4.5 Deficit and GDP

Apart from the numbers in rupees, the budget document also mentions deficit as a percentage of GDP. This is because in absolute terms, the fiscal deficit may be large, but if it is small compared to the size of the economy, then it's not such a bad thing, especially if it is being used to create production capacities.

5.0 FISCAL RESPONSIBILITY AND BUDGET MANAGEMENT ACT (FRBM Act)

The FRBM Act was enacted by Parliament in 2003 to bring in fiscal discipline. It received the President's assent in August the same year. The United Progressive Alliance (UPA) government had notified the FRBM Rules in July 2004. As Parliament is the supreme legislative body, these will bind the finance ministers and governments.

The FRBM Rules impose limits on fiscal and revenue deficit. Hence, it will be the duty of the Union government to stick to the deficit targets.

As per the target, revenue deficit, which is revenue expenditure minus revenue receipts, have to be reduced to nil in five years beginning 2004-05. Each year, the government is required to reduce the revenue deficit by 0.5% of the GDP.

6.0 IMPORTANT UNION BUDGET DOCUMENTSThe Budget of the Central Government is not merely a statement of receipts and expenditure but has also become a significant statement of government policy. Various essential documents make up the entire budget exercise. Here is an explanation for the same.

- Annual Financial Statement (AFS) : The Annual Financial Statement (AFS) is provided under Article 112, and shows estimated receipts and expenditure of the Government of India for next financial year (say, 2021-22) in relation to estimates for the previous financial year (ie 2020-21) as also expenditure for the year before last financial year (ie. 2019-20). The receipts and disbursements are shown under the three parts, in which Government Accounts are kept viz.,(i) Consolidated Fund, (ii) Contingency Fund and (iii) Public Account. The estimates of receipts and expenditure included in the Annual Financial Statement are for the expenditure net of refunds and recoveries, as will be reflected in the accounts. Annual Financial Statement has the following heads. Statement I – Consolidated Fund of India [Receipts and Expenditure: Revenue Account; Receipts and Expenditure: Capital Account] Statement IA – Expenditure charged on the Consolidated Fund of India Statement 2 – Contingency Fund of India Statement 3 – Public Accounts of India [Receipts and Expenditure] Receipts & Expenditure of Union Territories without Legislature. Demand For Grants

- Demand for Grants (DG) : The Article 113 of the Constitution mandates that the estimates of expenditure from the Consolidated Fund of India included in the Annual Financial Statement and required to be voted by the Lok Sabha are submitted in the form of Demands for Grants. The Demands for Grants are presented to the Lok Sabha along with the Annual Financial Statement. Generally, one Demand for Grant is presented in respect of each Ministry or Department. However, more than one Demand may be presented for a Ministry or Department depending on the nature of expenditure. In regard to Union Territories without Legislature, a separate Demand is presented for each of the Union Territories. Each Demand first gives the totals of ‘voted’ and ‘charged’ expenditure as also the ‘revenue’ and ‘capital’ expenditure included in the Demand separately, and also the grand total of the amount of expenditure for which the Demand is presented. This is followed by the estimates of expenditure under different major heads of account. The breakup of the expenditure under each major head between ‘Plan’ and ‘Non-Plan’ also used to begiven earlier, but then the distinction between Plan and Non-Plan was gradually removed. The amounts of recoveries taken in reduction of expenditure in the accounts are also shown. A summary of Demands for Grants is given at the beginning of this document, while details of ‘New Service’ or ‘New Instrument of Service’ such as formation of a new company, undertaking or a new scheme, etc., if any, are indicated at the end of the document.

- Appropriation Bill : Under Article 114(3) of the Constitution, no amount can be withdrawn from the Consolidated Fund without the enactment of such a law by Parliament. After the Demands for Grants are voted by the Lok Sabha, Parliament’s approval to the withdrawal from the Consolidated Fund of the amounts so voted and of the amount required to meet the expenditure charged on the Consolidated Fund is sought through the Appropriation Bill. The process beginning with the presentation of the Budget and ending with discussions and voting on the Demands for Grants requires sufficiently long time. The Lok Sabha is, therefore, empowered by the Constitution to make any grant in advance in respect of the estimated expenditure for a part of the financial year pending completion of procedure for the voting of the Demands. The purpose of the ‘Vote on Account’ is to keep Government functioning, pending voting of ‘final supply’. The Vote on Account is obtained from Parliament through an Appropriation (Vote on Account) Bill.

- Finance Bill : At the time of presentation of the Annual Financial Statement before Parliament, a Finance Bill is also presented in fulfillment of the requirement of Article 110 (1)(a) of the Constitution, detailing the imposition, abolition, remission, alteration or regulation of taxes proposed in the Budget. A Finance Bill is a Money Bill as defined in Article 110 of the Constitution. It is accompanied by a Memorandum explaining the provisions included in it.

- Memorandum Explaining the Provisions in the Finance Bill : To facilitate understanding of the taxation proposals contained in the Finance Bill, the provisions and their implications are explained in the document titled Memorandum Explaining the Provisions of the Finance Bill. Documents as per the requirements of FRBM act:

- Macroeconomic Framework Statement : The Macroeconomic Framework Statement presented to Parliament under Section 3(5) of the Fiscal Responsibility and Budget Management Act, 2003 (FRBM) and the rules made thereunder contains an assessment of the growth prospects of the economy with specific underlying assumptions. It contains assessment regarding the GDP growth rate, fiscal balance of the Central Government and the external sector balance of the economy.

- Fiscal Policy Strategy Statement : The Fiscal Policy Strategy Statement, presented to Parliament under Section 3(4) of the Fiscal Responsibility and Budget Management Act, 2003, outlines the strategic priorities of Government in the fiscal area for the ensuing financial year relating to taxation, expenditure, lending, and investments, administered pricing, borrowings and guarantees. The Statement explains how the current policies are in conformity with sound fiscal management principles and give the rationale for any major deviation in key fiscal measures.

- Medium-term Fiscal Policy Statement : The Medium-term Fiscal Policy Statement presented to Parliament under Section 3(2) of the Fiscal Responsibility and Budget Management Act, 2003, sets out three-year rolling targets for four specific fiscal indicators in relation to GDP at market prices namely (i) Revenue Deficit, (ii) Fiscal Deficit, (iii) Tax to GDP ratio and (iv) Total outstanding Debt at the end of the year. The Statement includes the underlying assumptions, an assessment of sustainability relating to balance between revenue receipts and revenue expenditure and the use of capital receipts including market borrowings for generation of productive assets.

- Medium-term Expenditure Framework Statement : The Medium-term Expenditure Framework Statement presented to Parliament under Section 3 of the Fiscal Responsibility and Budget Management Act, 2003 sets forth a three-year rolling target for the expenditure indicators with a specification of underlying assumptions and risks involved. The objective of the MTEF is to provide a closer integration between budget and the FRBM Statements. This Statement is presented separately in the session next to the session in which Budget is presented, i.e. normally in the Monsoon Session.Explanatory Documents :

- Expenditure Budget Volume-1 : This document deals with revenue and capital disbursements of various Ministries/Departments and gives the estimates in respect of each under ‘Plan’ and ‘Non-Plan’. It also gives analysis of various types of expenditure and broad reasons for the variations in estimates.

- Expenditure Budget Volume-2 : The provisions made for a scheme or a programme may spread over a number of Major Heads in the Revenue and Capital sections in a Demand for Grants. In the Expenditure Budget Vol. 2, the estimates made for a scheme/programme are brought together and shown on a net basis at one place, by Major Heads. To understand the objectives underlying the expenditure proposed for various schemes and programmes in the Demands for Grants, suitable explanatory notes are included in this volume in which, wherever necessary, brief reasons for variations between the Budget estimates and Revised estimates for the current year and requirements for the ensuing Budget year are also given.

- Receipts Budget : Estimates of receipts included in the Annual Financial Statement are further analysed in the document “Receipts Budget”. The document provides details of tax and non-tax revenue receipts and capital receipts and explains the estimates. The document also provides the arrears of tax revenues and non-tax revenues, as mandated under the Fiscal Responsibility and Budget Management Rules, 2004. The trend of receipts and expenditure along with deficit indicators, statement pertaining to National Small Savings Fund (NSSF), statement of revenues foregone, statement of liabilities, statement of guarantees given by the government, statements of assets and details of external assistance are also included in Receipts Budget.

- Budget at a Glance : This document shows in brief, receipts, and disbursements along with broad details of tax revenues and other receipts. This document also exhibits broad break-up of expenditure – Plan and Non-Plan (now defunct), allocation of Plan outlays by sectors as well as by Ministries/Departments and details of resources transferred by the Central Government to State and Union Territory Governments. This document also shows the revenue deficit, the gross primary deficit and the gross fiscal deficit of the Central Government. The excess of Government’s revenue expenditure over revenue receipts constitutes revenue deficit of Government. The difference between the total expenditure of Government by way of revenue, capital and loans net of repayments on the one hand and revenue receipts of Government and capital receipts which are not in the nature of borrowing but which finally accrue to Government on the other, constitutes gross fiscal deficit. Gross primary deficit is measured by gross fiscal deficit reduced by gross interest payments. In the Budget documents ‘gross fiscal deficit’ and ‘gross primary deficit’ have been referred to in abbreviated form ‘fiscal deficit’ and ‘primary deficit’, respectively. This document also shows liabilities of the Government on account of securities (bonds) issued in lieu of oil and fertilizer subsidies.

- Highlights of Budget : This document explains the key features of the Budget, inter alia, indicating the prominent achievements in various sectors of the economy. It also explains, in brief, the budget proposals for allocation of funds to be made in important areas. The summary of tax proposals is also reflected in the document. Other Documents Along with Budget Statements :

- Detailed Demands for Grants : The Detailed Demands for Grants are laid on the table of the Lok Sabha sometime after the presentation of the Budget, but before the discussion on Demands for Grants commences. Detailed Demands for Grants further elaborate the provisions included in the Demands for Grants as also actual expenditure during the previous year. A break-up of the estimates relating to each programme/organisation, wherever the amount involved is not less than 10 lakhs, is given under a number of object heads which indicate the categories and nature of expenditure incurred on that programme, like salaries, wages, travel expenses, machinery and equipment, grants-in-aid, etc. At the end of these Detailed Demands are shown the details of recoveries taken in reduction of expenditure in the accounts.

- Outcome Budget : With effect from Financial Year 2007-08, the Performance Budget and the Outcome Budget hitherto presented to Parliament separately by Ministries/Departments, are merged and presented as a single document titled “Outcome Budget” by each Ministry/Department in respect of all Demands/ Appropriations controlled by them, except those exempted from this requirement. Outcome Budget broadly indicates physical dimensions of the financial budget of a Ministry/Department, indicating actual physical performance in the preceding year, performance in the first nine months (up to December) of the current year and the targeted performance during the ensuing year.

- Annual Reports : A descriptive account of the activities of each Ministry/Department during the year 2016-2017 is given in the document Annual Report which is brought out separately by each Ministry/Department and circulated to Members of Parliament at the time of discussion on the Demands for Grants.

- Economic Survey : The Economic Survey brings out the economic trends in the country which facilitates a better appreciation of the mobilisation of resources and their allocation in the Budget. The Survey analyses the trends in agricultural and industrial production, infrastructure, employment, money supply, prices, imports, exports, foreign exchange reserves and other relevant economic factors which have a bearing on the Budget, and is presented to the Parliament ahead of the Budget for the ensuing year.

7.0 STATE OF INDIAN ECONOMY 2020

The Indian economy started showing serious growth slowdown from 2019 onwards. Here is a comprehensive update on ten aspects of it, with detailed charts.

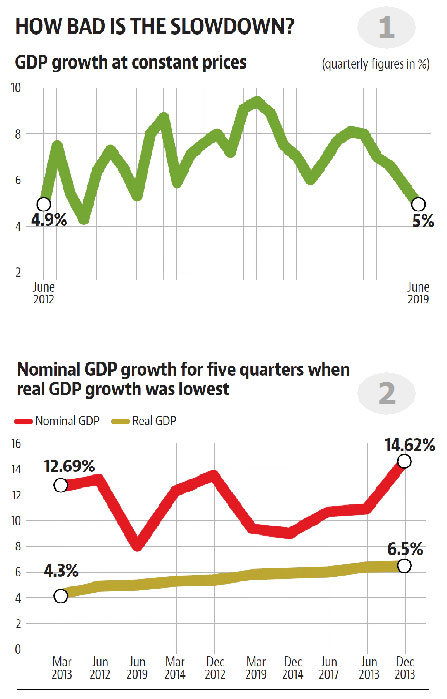

- Nature of slowdown : India’s gross domestic product (GDP) growth slowed to 5% in the quarter ended June, 2019, in the first big signal of a slowdown. This was the slowest pace or growth since March 2013, when GDP had expanded 4.7%. GDP growth had been declining for five consecutive quarters before Q1, 2019-20. This was only the first time since 1997 that India had five consecutive quarters of declining GDP growth. The trend continued. The GDP grew by just 4.5% in Q2, Fy 2019-20.

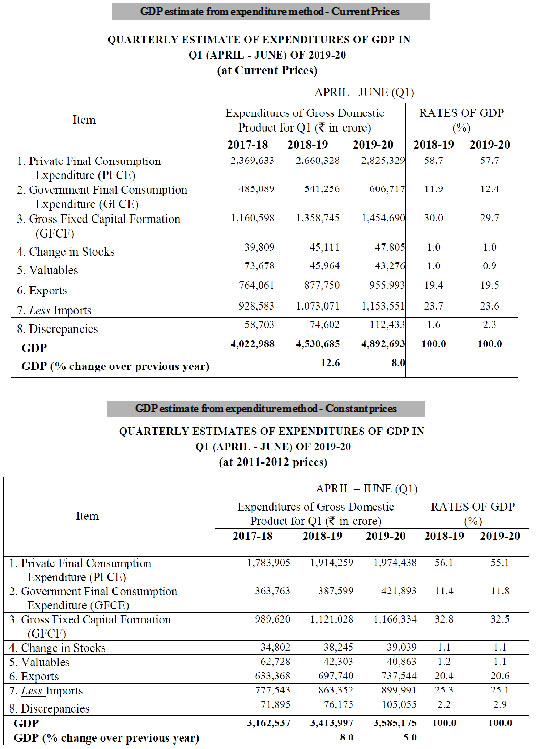

- Poor tax collections due to low nominal GDP growth : The slowdown posed an additional challenge, especially for the government. The collapse in nominal GDP growth, which was just 8% in the June 2019 quarter mattered a lot for tax collections. Tax projections made in the budget are based on projected nominal GDP growth for the year. Budget 2019-20 (July) had projected nominal GDP growth of 12%. An 8% growth rate can lead to a serious shortfall in taxes. (Nominal GDP figures are not adjusted for inflation, and once adjusted, they give the Real GDP number)

- Slowing private consumption figures : Private consumption was the driving force behind India’s economic growth for a long time (as exports growth as well as private investments had stalled). But in 2019, even private consumption began stalling. The Private Final Consumption Expenditure (PFCE) growth was just 3% in the June 2019 quarter. Between March 2018 and June 2019, GDP growth came down by 3.1 percentage points, and the PFCE growth fell by 5.6 per cent. Many reasons were responsible - (a) the flow of credit slowed due to higher interest rates, as NBFCs found their own funds getting costlier, (b) the lack of confidence in households due to low real income growth, (c) rural and farm distress, and (d) poor distribution of wealth in economy.

- Rural stress : Since 2015, a strong low inflation regime, driven by falling food prices, put the squeeze on farm incomes. This, in turn, has led to a squeeze on rural wages. This adversely affected rural demand, which created headwinds for private consumption. While there has been some revival in food inflation in 2019, it continues to be very low in rural areas. At the same time, the govt. remained non-committal to MGNREGA (due to political legacy reasons) and did not allot more funds as rural stress demanded. Everything added up pretty fast

- Urban regions : It is not only about the farms and villages. Various consumer confidence surveys indicate the stress in cities also. Even in urban centres, consumer sentiment had been worsening for a long time. The Reserve Bank of India’s Consumer Confidence Surveys (CCS) showed a weakening of perception about the general economic situation as well as spending on non-essential items. Everytime that happens, and consumers indicate they'd be spending less of their discretionary incomes going forward, it actually translates to less spends on ground. Mass layoffs across industries is also impacting sentiment.

- Interest rate reducations not working out : Since 2018, repeated attempts to boost investment by interest rate reductions by the RBI have not worked. The central bank has been downgrading its growth forecasts with every rate cut. Clearly, monetary policy driven boost has run it course (bad news). A slowdown in consumption demand, accompanied by growing uncertainty about export prospects due to trade wars, has made investors jittery.

- Bring in a fiscal stimulus, then : As the monetary policy did not help revive animal spirits in the economy, demand for a fiscal stimulus was increasing. For the government, it was an uneviable situation because the nominal growth rate was significantly short of the projected rate of 12%, and that meant only one thing - a significant shortfall in taxes. In 2018-19, the government had a shortfall of Rs 1 lakh crore in Goods and Services Tax (GST) collections. Overall direct tax collections too have been impacted. So a big fiscal stimulus was ruled out.

- Twin shocks of DeMo and GST : Many things went wrong with Indian economy. The twin shocks of demonetisation (Nov. 2016) and GST (July 2017) had a hugely disruptive impact on the economy. The 2017-18 Periodic Labour Force Survey (PLFS) showed unemployment to be at a four-decade high. Indian economy has a big informal sector, that contributes to both output growth and employment. These forced formalisation policies (DeMo and GST) badly impacted both. But as forma sector recovered, the informal sector jobs did not. If jobs are lost in large number, so is purchasing power. The formal sector started feeling the loss of consumption (of its products and services) after an year as low consumption demand struck hard.

- Global factors : President Trump of the US started a vicious trade war against China, that ruined market sentiment for a long time. Disruption was high, and for investors to make up their mind regarding investments was tough.The worries of global growth slowing down have been compounded by a reversal of the yield curve in the US, with long-term bond yields falling below short-term yields. Although bond yields are a financial market phenomenon, long-term yields falling behind short-term values is seen as a precursor to a slowdown.

- An existential challenge for Indian economy : India tried hard ater the 2008 global crisis, but has not been on a sustained high-growth path after that. Global growth is slowing down in a big way. If India too slows down, it will impact the per capita income growth of India badly. With a less than $2000 per capita income in 2018, India needs 12-13 years of consistent 8 - 9% growth per annum to pull the per capita income to $5000 per person levels. That is the only way to pull India into the middle income country status. If growth falters, and does not recover for a long time, we will end up losing our demographic dividend as well.

The Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Prime Minister on April 8, 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. These loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions mentioned above or can apply online. Under the aegis of PMMY, MUDRA has created three products namely 'Shishu', 'Kishore' and 'Tarun' to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth. The government introduced the Pradhan Mantri Mudra Yojana scheme with an aim towards turning youth into entrepreneurs. The plan was to create a business environment across the country and keep a check on unemployment.

8.1 The numbers

The yearwise sanctioned number of loans and amounts is given below :

2015-2016 - Total loans 34880924 - Total funds sanctioned Rs. 132954.73 cr

2016-2017 - Total loans 39701047 - Total funds sanctioned Rs. 175312.13 cr

2017-2018 - Total loans 48130593 - Total funds sanctioned Rs. 246437.40 cr

2018-2019 - Total loans 59870318 - Total funds sanctioned Rs. 311811.38 cr

2019-2020 - Total loans 16411989 (till Sept.) - Total funds sanctioned Rs. 311811.38 cr

8.2 Status in 2019

Media reports on one of the flagship schemes raised serious concerns. It is now being said that the move not only burdened the banks with lakhs of loans to manage and recover but also has failed to generate a significant number of jobs, which was a prime objective.

8.3 What is the Mudra Yojana exactly

- Through Mudra Yojana MSMEs, small farmers, and non-corporates can take a loan up to Rs 10 lakh.

- Around 13 crore Mudra loans were distributed in three categories, Shishu, Kishor, and Tarun depending on the amount.

- The Shishu category extends up to Rs 50000, while the Kishore category extends up to Rs 5 lakh and Rs 10 lakh respectively.

- About 45 per cent of the Mudra loans was from Shishu category as of March 2019. These loans come with low collateral and the total amount borrowed under it stood at 1.4 lakh crore.

- The Kishore loans contributed 32 per cent of the Mudra Loans and stood at Rs 99,868 crore, while 23 per cent loans were disbursed under Tarun category loans which amounted to Rs 72000 crore.

The government in Parliament had said that the total NPAs under Mudra loans summed up to Rs 17654 crores as of March 2019, which is a 10,000 crore increase from March 2018 when the NPAs stood at Rs 7277.32 crore.

The NPAs for Shishu category which has the most amount of loans are consistently declining from 4.14 per cent in 2016 to 1.93 per cent in 2017-18 and 1.29 per cent in 2018-19. This indicates that most of the NPAs are under the Kishore and Tarun category.

The Reserve bank of India had warned the government on Mudra loans becoming NPAs even though the figures are not worrying yet.

8.5 Failure In Job Generation

According to the Labour Bureau’s Draft report on Pradhan Mantri Mudra Yojana Survey conducted recently, 1.12 crore additional jobs were created during the first 33 months following the rollout of the scheme. Of this, 51.06 lakhs were self-employed while 60.94 lakh were employees or hired workers.

Now, if we compare the number of jobs created to the loans disbursed, only 10 per cent of the jobs were created. Total Mudra loans given were more than 13 crores.

Most of the jobs were created under the Shishu category, which has the least number of NPAs. As per the data, Shishu loans accounted for 66 per cent of the new jobs created while Kishor and Tarun accounted for 18.85 per cent and 15.51 per cent new jobs each.

As per an Indian Express report, the survey is said to be the government’s attempt to counter the National Sample Survey Office (NSSO) report on unemployment which estimated the unemployment rate to be 6.1 per cent in 2017-18. The NSSO report was ready in December 2018 but was released after Lok Sabha elections on May 31, 2019.