Excellent study material for all civil services aspirants - being learning - Kar ke dikhayenge!

Indian economy - measures of national income

1.0 INTRODUCTION

India is a mixed economy. In such an economy, the public sector (government-owned) business enterprises exist alongside the private sector to achieve a socialistic pattern of society, in a welfare state model. Ever since gaining independence, India’s economic development has been guided by the twin objectives of developing:

- to rapidly develop the economy, ensuring it becomes technologically progressive and achieve this through democratic means; and

- a social order based on justice, offering equal opportunity to every citizen of the country.

India is a federal economy. It has strong powers vested in the Centre with financial independence and adequacy, thus creating a federal finance system. Money, currency, banking, and sources of revenue which are exclusive and high yielding are under central jurisdiction. Concurrent taxation is avoided and efficient financial powers vest with both the Centre and the State Governments.

The Indian economy, even today, displays the characteristic features of a typical underdeveloped economy.

These are: more than one-third of the population below poverty line, very low per capita income, low life expectancy, agriculture as the chief occupation of the economy, swift population growth, high dietary deficiencies and mortality rates, and so on.

2.0 Traditional Definitions of National Income

Over the years, many economists have tried to define national income, its various dimensions and uses and suggested ways to estimate it. The two basic methods that have evolved are the Income Method and the Expenditure method. Some important definitions are:

Marshall: "The labour and capital of a country acting on its natural resources produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the true net annual income or revenue of the country or national dividend."

Pigou: "National income is that part of objective income of the community, including of course income derived from abroad, which can be measured in money."

Fisher: "The national dividend or income consists solely of services as received by ultimate consumers, whether from their material or from their human environments. Thus, a piano, or an over-coat made for me this year is not a part of this year's income, but an addition to the capital. Only the services rendered to me during this year by these things are income."

2.1 Keynesian Approach to National Income

The Keynesian model assumes that the aggregate supply curve is perfectly elastic up to the full employment level of output after which it becomes perfectly inelastic. Hence price level, until the full employment level, will be determined solely by the height of the supply curve. Hence, the price variable gets less attention while entire focus is on the determination of equilibrium level of income, which is determined solely by the aggregate demand.

Aggregate Demand in a Two Sector Economy

The postulates are

- The prices are constant or invariable

- Given the price level, the firms are willing to sell any amount of the output at that price level

- The short run aggregate supply curve is perfectly elastic or flat

- Investment is assumed to be autonomous and thus independent of the income level

- There exist only two sectors in the economy, the households and the firms

Aggregate demand is the total amount of goods demanded in an economy. The aggregate demand function can be expressed as:

AD = C + I where, C = aggregate demand for consumers goods, and I = aggregate demand for investment goods

Determination of equilibrium income or output in a Two Sector Economy

In the most basic terms, an economy can be said to be in equilibrium when the production plans of the firms and the expenditure plans of the households are realized.

Below are the assumptions of the analysis:

- There exist only two sectors of the economy. There is no government sector and foreign sector.

- All the factors of production are owned by the households who sell the factor services to earn an income. With a part of this income, they purchase goods and services and save the rest.

- As there is no government in the economy there are no taxes and subsidies and no government expenditure.

- As there are no foreign sectors in the economy, there are no exports and imports and external inflows and outflows.

- As far as the firms are concerned there are no undistributed profits.

- All the prices are constant and do not change.

- The technology and the supply of capital are given.

2.2 Keynes suggested three approaches to national income

Income - expenditure approach: According to this approach, national income is equal to total expenditure on consumption and investment goods.

Factor income approach: According to this approach, national income is measured as the aggregate of incomes received by all the factors of production.

Sales proceeds minus cost approach: According to this approach, national income is defined as the aggregate sales proceeds minus cost.

2.2 Modern Approach to National Income

Modern economists consider three aspects of national income and emphasise the fundamental identity between these three aspects. These three aspects are:

- product aspect

- income aspect, and

- expenditure aspect

In one of the publications of the United Nations, national income has been defined in three ways:

- 'Net National Product' as the aggregate of the net value added is all branches of economic activity during a specified period, together with the net income from abroad.

- 'Sum of the distributive shares' as the aggregate of national income accrued to the factors of production (in the form of wages, profits, interest, rent, etc) in a specified period.

- 'Net National Expenditure' as the sum of expenditure on final consumption of goods and services, plus domestic and foreign investments.

Modern economists consider national income as a flow of output, income and expenditure. When goods are produced by the firms, the factors of production are paid incomes in the form of wages, profits, interest, rent, etc. These income receipts are spent by the household sector on consumption goods and their savings are mobilised by the producers for investment spending.

Thus, there is a circular flow of production, income and expenditure, Obviously, income, output and expenditure flows are always equal per unit of time. Thus, there is a tripple identity: Output = Income = Expenditure.

2.3 The three methods of measuring National Income

The three commonly used techniques of measuring National Income are (i) Product method, (ii) Income method and (iii) Expenditure method.

- Product Method: Under this method National Income is measured at the production stage. The monetary value of total output produced in the economy during the year is calculated. Only the market value of only final goods and services is taken into account in calculating national income through product method. The value of intermediate goods is not considered. Inclusion of the value of intermediate goods results in double counting which leads to overestimation of national income. The price of bread (final goods) already includes the costs of wheat, flour and sugar (intermediate goods) because these costs have been paid during the production process.

- Income Method: Under the income method, incomes earned by the factors of production - land, labour, capital and organization - are totalled up. Factor incomes are considered in measuring national income. This method is also known as distributive share method or factor payment method. In this method, total income generated in the production of goods and services is taken into account. In other words, rent plus wages plus interest plus profit will be equal to national income. Transfer payments however are excluded.

- Expenditure Method: The expenditure method takes into account the aggregate of all the final expenditure on gross domestic product in an economy during a year. This method is based on the assumption that in an economy Total Income = Total Expenditure. In other words, the expenditure method measures the disposal of gross domestic product. This method is also known as 'consumption and investment method' or 'income disposal method'. Final expenditure is the expenditure on final product. The total income generated in the economy is used for purchasing either consumption goods or investment goods. As such, total final expenditure or national expenditure (Y) equal to the sum total of final expenditure incurred on consumption goods (C) and investment goods (I).

Symbolically, Y = C + I.

Final consumption expenditure includes - (a) personal consumption expenditure, and (b) government final consumption expenditure (government's purchase of goods and services).

Final investment expenditure includes - (a) gross domestic private investment, and (b) net foreign investment or net export of goods and services.

2.4 Various measures used

Gross Domestic Product at Market Price (GDP at MP): Gross Domestic Product at Market Price is the money value of the final goods and services produced within the domestic territory of a country during a year. Gross Domestic Product is obtained by multiplying all goods and services produced with their prices.

Symbolically, GDP = P x Q

Where, GDP at MP is Gross Domestic Product at Market Price, P is market price and Q is final goods and services.

Gross Domestic Product includes three types of final goods and services:

- Consumer goods and services to satisfy immediate wants of the people

- Capital goods consisting of fixed capital formation, residential construction, and inventories of finished and unfinished goods, and

- Goods and services produced by the government.

Gross National Product at Market Price (GNP at MP): Gross National Product at Market Price is the money value of all final goods and services produced annually in a country plus net factor income from abroad. GNP is a broader concept than GDP. GNP is GDP plus net factor income from abroad.

Symbolically,

GNP at MP = GDP at MP + Net Factor Income from abroad.

Net factor income from abroad is the difference between the factor income earned by our residents from foreign countries and the factor income earned by the foreigners in our country.

Net National Product at Market Price (NNP at MP): Net National Product at Market Price is Gross National Product at Market Price less depreciations of fixed capital or consumption of fixed capital. By deducting the value of depreciation of fixed capital from the value of Gross National Product in a year, we get the value of Net National Product.

Symbolically, NNP at MP = GNP at MP – Depreciation

Net Domestic Product at Market Price (NDP at MP): Net Domestic Product at Market Price is the difference between Net National Product at Market Price and net factor income from abroad.

Symbolically, NDP at MP = NNP at MP – Net Factor Income from Abroad

Net Domestic Product at Factor Cost (NDP at FC): Net Domestic Product at Factor cost or Domestic Income is the income earned by the factors of production in the form of wages, profits, rent, interest, etc within the territorial limits of the country.

Net Domestic Product at Factor Cost (NNP at FC) or Domestic Income = Rent, including imputed rent + Compensation of Employees or Wages and Salaries + Interest + Dividend + Reserve Fund of the Firms or Corporate Saving + Corporate or Other Direct Taxes + Mixed Income of the Self Employed + Profits of Government Enterprises + Property Income of the Government + Savings of Non-Departmental Undertakings.

Gross Domestic Product at Factor Cost (GDP at FC): Gross Domestic Product at Factor Cost is obtained by adding depreciation or consumption of fixed capital to the Net Domestic Product at Factor Cost.

Symbolically, GDP at FC = NDP at FC + Depreciation

Gross National Product at Factor Cost (GNP at FC): Gross National Product at Factor cost is obtained by adding net factor income from abroad to the Gross Domestic product at Factor Cost.

Symbolically, GNP at FC - GDP at FC + Net Factor Income From Abroad

Net National Product at Factor Cost or National Income (NNP at FC, or NI): Net National Product at Factor Cost or National Income is the total earnings of all factors of production in the form of wages, profits, rent, interest, etc. plus net factor income from abroad. In other words, if net factor income from abroad is added to the Net Domestic Product at Factor Cost, we get Net National Product at Factor Cost.

Symbolically,

NNP at FC or NI = NDP at FC + Net Income from Abroad.

(Net National Product at Factor Cost or National Income can also be calculated by deducting depreciation from Gross National Product at Factor Cost.

Symbolically, NNP at FC or NI = GNP at FC - Depreciation

Per Capita Income: Per capita income means income per head. Per capita income refers to the average income of the normal residents of a country during any particular year. It is equal to national income divided by total population.

Personal Income: The income earned by the personal sector, i.e., households and unincorporated business is personal income. Personal income includes transfer payments like welfare payments, pensions, unemployment etc.

Disposable Personal Income: That part of the personal income which the households can spend the way they like is called disposable personal income. It refers to the purchasing power of the households.

Disposable Income = Personal Income - Direct Taxes

The entire amount of disposable income is not spent on consumption. A part of it is saved. Thus,

Disposable Income = Consumption Expenditure + Saving

3.0 BASE YEAR

Base Year: In order to enable a proper comparison between economic fundamentals in different years, it is important to fix a year as a reference year. A base year is a reference year with respect to which GDP numbers for the following as well as preceding years are computed. This is mainly due to the changes in the pattern of consumption and production in a particular economy. Reference to a base year is usually made when the GDP figures for any particular year are discussed.

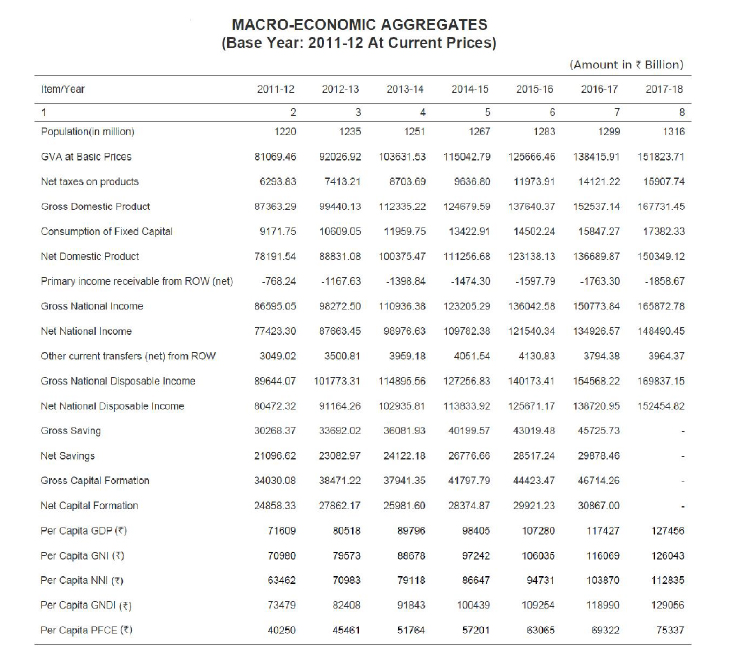

Why a change in the Base Year was needed: The reason for periodically changing the base year of the national accounts is to take into account the structural changes which have taken place in the economy and to depict a true picture of the economy through macro aggregates like GDP, consumption expenditure, capital formation etc. For examining the performance of the economy in real terms through the macro-economic aggregates like Gross Domestic Product (GDP), national income, consumption expenditure, capital formation etc., estimates of these aggregates are prepared at the prices of selected year known as base year. The estimates at the prevailing prices of the current year are termed as "at current prices", while those prepared at base year prices are termed "at constant prices". The comparison of the estimates at constant prices, which means "in real terms", over the years gives the measure of real growth.

The first national income estimates published in 1956 took FY 1949 as the base year. Since then there have been seven changes. The base years of the National Accounts Statistics series have been shifted from 1948-49 to 1960-61 in August 1967; from 1960-61 to 1970-71 in January 1978; from 1970-71 to 1980-81 in February 1988; and from 1980-81 to 1993-94 in February 1999. Thereafter it was changed to 2004-05 in 2006. The last time it was changed was in the year 2015 in which the base year of national accounts was changed from 2004-05 to 2011-12.

In 2015, many sectors such as IT, e-commerce, mobile telephony contribute majorly to our economy. In 2004-05 they did not occupy such a significant part. Thus, if the base year was not changes, India would have ended up showing wrong GDP figures, since majority of economic activities driving sectors were not represented in the year 2004-05. Therefore, the Indian Government decided to change the base year to 2011-12. The revised base year will lead to all such sectors coming into play, and the GDP number will increase as the total output from these sectors will be added, which was not the case earlier.

The Central Statistics Office (CSO) of the Ministry of Statistics and Programme Implementation on 29 January 2016 released the first revised estimates of national income, consumption expenditure, saving and capital formation for 2014-15.

Besides, the CSO also released second revised estimates of the years 2011-12 to 2013-14 (with base year 2011-12).

4.0 Nominal and Real GDP

The most fundamental difference between these two approaches is that effect of inflation is not considered in the computation of Nominal GDP whereas Real GDP is computed after adjustments on account of inflation. In other words, Nominal GDP is the aggregate output measured at current prices whereas Real GDP is the aggregate output measured at the prices of the base year.

Nominal GDP = å ptqt

where p refers to price, q is quantity, and t indicates the year in question (usually the current year).

However, it can be misleading to do a direct comparison of a GDP of say $0.5 trillion in 2008 with a GDP of $100 billion in 1990. This is because of inflation. The value of one dollar in 1990 was far greater than the value of a dollar in 2008. In other words, prices in 1990 were different from prices in 2008. Therefore, for comparing the economic output over such a long period, GDP is to be calculated by using prices for a particular base year.

Nominal GDP adjusted for price changes (inflation or deflation), is known as the Real GDP. It can be calculated using the following formula:

Real GDP = å pbqt where b denotes the base year.

To effectively compare the real GDP of two years, one can construct an index using a base year.

The nominal GDP figures are used to determine the total value of the products and services manufactured in a country during a particular year. However, when one wants to compare GDP in one year with past years to study trends in economic growth, real GDP is used.

By definition (since real GDP is calculated using prices of a given "base year"), real GDP has no meaning by itself unless it is compared to GDP of a different year.

If a set of real GDPs from various years are calculated, each calculation uses the quantities from its own year, but all use the prices from the same base year. The differences in those real GDPs will, therefore, reflect merely differences in volume.

An index called the GDP deflator can be obtained by dividing, for each year, the nominal GDP by the real GDP. It gives an indication of the overall level of inflation or deflation in the economy.

GDP deflator for year t = GDPt / Real GDPt

4.1 GDP Deflator

The concept of GDP deflator has been developed by economists to facilitate comparison between Real GDP and Nominal GDP. The GDP deflator is simply nominal GDP in a given year divided by real GDP in that given year and then multiplied by 100.

The GDP deflator is also called implicit price deflator and is a measure of inflation. Simply put, it is the ratio of the value of goods and services an economy produces in a particular year at current prices to that at prices prevailing during any other reference (base) year. This ratio basically shows to what extent an increase in GDP or gross value added (GVA) in an economy has happened on account of higher prices, rather than increased output. Since the deflator covers the entire range of goods and services produced in the economy as against the limited commodity baskets for the wholesale or consumer price indices, it is seen as a more comprehensive measure of inflation.

GDP Deflator in India increased to 117.80 Index Points in 2015 from 114.40 Index Points in 2014. GDP Deflator in India averaged 127.69 Index Points from 2005 until 2015, reaching an all time high of 171.30 Index Points in 2013 and a record low of 100 Index Points in 2005. GDP Deflator in India is reported by the Ministry of Statistics and Programme Implementation (MOSPI).

5.0 MEASUREMENT OF NATIONAL INCOME IN INDIA

Historical Background: The development of official estimates of national income and related aggregates to meet the requirements of planning and policy purposes began after Independence. Recognizing the need for providing estimates of national income on a regular basis, Government of India set up a High Powered Expert Committee in 1949 known as 'National Income Committee under the Chairmanship of Prof. P.C. Mahalanobis. It was for the first time that this Committee provided the estimates of national income for the entire Indian Union.

The estimates of national income and details of methodology adopted by the Committee were published in the First and Final reports of the National Income Committee brought out in April 1951 and February 1954 respectively. Following the methodology recommended by the National Income Committee, the Central Statistical Office (CSO) prepared the first official estimates of national income with base year 1948-49 at constant prices.

The CSO published these estimates at constant (1948-49) prices alongwith the corresponding estimates at current prices and the accounts of the Public Authorities in the publication, "Estimates of National Income" in 1956. With the gradual improvement in the availability of basic data over the years, a comprehensive review of methodology for national accounts statistics has constantly been undertaken by the CSO with a view to updating the data base and shifting the base year to a more recent year. As a result, base years of the National Accounts Statistics series were shifted from 1948-49 to 1960-61 in August 1967, from 1960-61 to 1970-71 in January 1978, from 1970-71 to 1980-81 in February 1988, from 1980-81 to 1993-94 in February 1999, from 1993-94 to 1999-2000 in January 2006 and from 1999-2000 to 2004-05 on 29th January 2010. Alongwith the shifting of base years of national accounts series, the CSO also had been making improvements in the compilation of national accounts series, in terms of coverage of activities, incorporation of latest datasets and latest international guidelines.

6.0 CIRCULAR FLOW OF INCOME

The circular flow of income is a theory that describes the movement of expenditure and income throughout the economy. Major exchanges are represented as flows of money, goods and services, etc. between economic agents (households and businesses). The flows of money and goods exchanges in a closed circuit and correspond in value, but run in the opposite direction. This theory forms the basis for measurement of National Income and macroeconomics. Each transaction in an economy involves a buyer and a seller. Households spend money for buying goods and services produced.

Thus, from the buyers' side comes the flow of money demand. In other words, we have expenditure- side transaction. On the sellers' side, money payments go to factor owners in the form of rent, wages, etc. Firms spend money for buying input services. Thus, we have income-side transaction from the seller's side. These two are obverse and reverse of the same coin. This is called circular flow of income and expenditure.

Goods and services flow from firms to households via the product market in return for the money payment for these goods and services by firms. Households supply factor inputs to firms via the factor markets. In return, households receive money from firms in the form of rent, wages, etc. These income payments to households on hiring input services must be identical to the firms' income. This is the essence of the circular flow of income in a two-sector economy where there is no governmental activity and the economy is a closed one. Adding these, we have

Y = C + I

where Y stands for national income, C for private consumption spending, and I for private investment spending.

In a three-sector (closed) economy, the government intervenes. This intervention benefits of the general people and firms by higher spending but also imposes taxes on them to finance its spending. If we add government activities (levying of taxes, T and incurring expenditures, G), we have

Y = C + I + G

Households receive money income from firms and government by selling input services. Part of this income is used to pay taxes to the government. Government receives taxes from both households and firms. Government spends by utilising its tax revenues. Households save in the financial market. These two, saving and taxes, constitute leakages in the circular flow. Thus circular flow of money income depends upon consumption spending of households, investment spending of business firm and government's plans to tax and spend.

A four-sector economy is called an open economy in the sense that the country gets money by sending its goods outside i.e., exports (X), and spends money by buying foreign-made goods and services i.e., imports (M). In other words, in an open economy, there occurs a trading relationship between nations. Adding (X-M) in the above equation, we get

Y = C + I + G + (X – M)

7.0 THE GLOBAL ECONOMY

After strong growth in 2017 and early 2018, global economic activity slowed notably in the second half of 2019, reflecting a confluence of factors affecting major economies. China’s growth declined following a combination of needed regulatory tightening to rein in shadow banking and an increase in trade tensions with the United States. The euro area economy lost more momentum than expected as consumer and business confidence weakened and car production in Germany was disrupted by the introduction of new emission standards; investment dropped in Italy as sovereign spreads widened; and external demand, especially from emerging Asia, softened. Elsewhere, natural disasters hurt activity in Japan. Trade tensions increasingly took a toll on business confidence and, so, financial market sentiment worsened, with financial conditions tightening for vulnerable emerging markets in the spring of 2018 and then in advanced economies later in the year, weighing on global demand. Conditions have eased in 2019 as the US Federal Reserve signaled a more accommodative monetary policy stance and markets became more optimistic about a US–China trade deal, but they remain slightly more restrictive than in the fall.

7.1 Global growth is set to moderate in the near term, then pick up modestly

As a result of these developments, global growth is now projected to slow from 3.6 percent in 2018 to 3.3 percent in 2019, before returning to 3.6 percent in 2020. Growth for 2018 was revised down by 0.1 percentage point relative to the October 2018 World Economic Outlook (WEO), reflecting weakness in the second half of the year, and the forecasts for 2019 and 2020 were marked down by 0.4 percentage point and 0.1 percentage point, respectively. The current forecast envisages that global growth will level off in the first half of 2019 and firm up after that. The projected pickup in the second half of 2019 is predicated on an ongoing buildup of policy stimulus in China, recent improvements in global financial market sentiment, the waning of some temporary drags on growth in the euro area, and a gradual stabilization of conditions in stressed emerging market economies, including Argentina and Turkey. Improved momentum for emerging market and developing economies is projected to continue into 2020, primarily reflecting developments in economies currently experiencing macroeconomic distress—a forecast subject to notable uncertainty. By contrast, activity in advanced economies is projected to continue to slow gradually as the impact of US fiscal stimulus fades and growth tends toward the modest potential for the group.

7.2 Risks are tilted to the downside

While global growth could surprise favourably if trade differences are resolved quickly so that business confidence rebounds and investor sentiment strengthens further, the balance of risks to the outlook remains on the downside. A further escalation of trade tensions and the associated increases in policy uncertainty could further weaken growth. The potential remains for sharp deterioration in market sentiment, which would imply portfolio reallocations away from risk assets, wider spreads over safe haven securities, and generally tighter financial conditions, especially for vulnerable economies. Possible triggers for such an episode include a no-deal Brexit withdrawal of the United Kingdom from the European Union; persistently weak economic data pointing to a protracted global growth slowdown; and prolonged fiscal uncertainty and elevated yields in Italy—particularly if coupled with a deeper recession—with possible adverse spillovers for other euro area economies.