Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

CONCEPT – INSOLVENCY RESOLUTION PROCESS IN INDIA, NCLT, IBBI

Read more on - Polity | Economy | Schemes | S&T | Environment

- How have banks dealt with stress commercially in the past? There were various ways to do it.

- Joint Lenders Forum (JLF)/Corporate Debt Restructuring (CDR) - Traditionally, banks have preferred to restructure the debt of stressed borrowers through the CDR or JLF mechanisms. While the CDR mechanism was used extensively, the objective seems to have been to provide temporary relief to the borrower rather than make active efforts to revive businesses. CDRs have met with limited success (only 17% exits as of June 2016) in reviving stressed assets due to poor evaluation of business viability and the lack of effective monitoring.

- Strategic Debt Restructuring (SDR) - Until the introduction of the SDR in June 2015, the Reserve Bank of India (RBI) had largely stayed away from devising a mechanism that enabled the banks/lenders to play a direct role in the turnaround of stressed borrowers. SDR is a tool for lenders to acquire majority ownership in a borrower by converting a part of the outstanding loan (including overdue interest) into equity. At a later date, it can transfer the control to a new promoter. The SDR scheme (along with variations introduced in February 2016) provdes bank some relaxation from the RBI income recognition and asset classification norms. Most importantly, SDR aimed to provide the lenders an option to initiate a comprehensive turnaround by taking control, giving them a fair shot at reviving these companies by partnering with a more capable promoter. There has been limited will, though, from banks to take on management of companies through the SDR route. Along with an apprehension that the existing legal system would not allow a change of management to take place smoothly, banks were skeptical of lack of protection from existing and imminent litigations. Lack of willingness of the banks to “right size” the debt and provide the “new” buyer with an appropriate capital structure to turn around the assets has also impacted the success of SDR.

- Scheme for Sustainable Structuring of Stressed Assets (S4A) - The lack of a positive response to SDR from banks have led the RBI to devise other measures such as S4A in June 2016. S4A is a reversal from the “creditor in control” stance taken by the RBI. Under S4A, control may remain with the existing promoter as long as 50% of their debt is sustainable. While the efficacy of the S4A is yet to be evaluated, it has found limited eligibility as it prescribes a short-term cash flow visibility and does not allow any change in repayment terms. Even as these challenges are being addressed, the lack of emphasis on a comprehensive turnaround could possibly result in the problem just being postponed. Corporate stress needs a quick and decisive revival rather than an indefinite deferral.

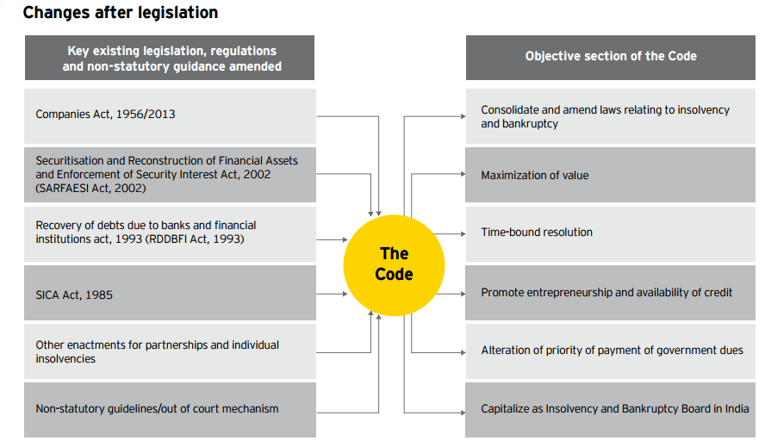

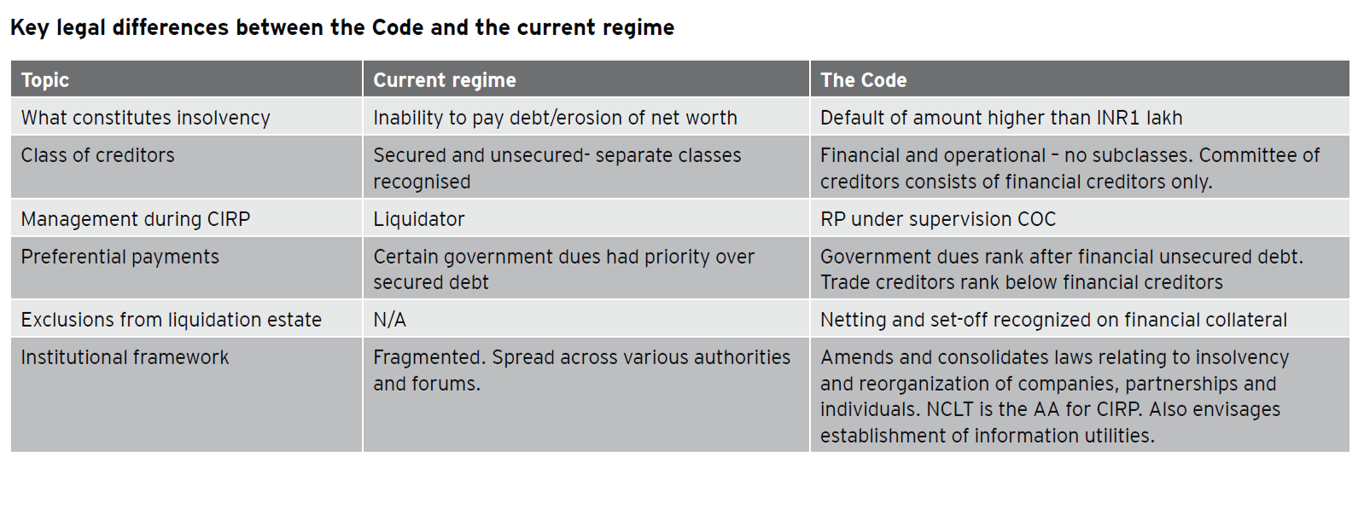

- The current judicial framework : Until the Code, there was no single legislation that governed corporate insolvency and bankruptcy proceedings in India. Lenders had limited muscle when faced with default and promoters stayed in control. Only one element of a bankruptcy framework has been put into place to a limited extent: banks are able to repossess fixed assets pledged with them. According to the Bankruptcy Law Reforms Committee (BLRC), Corporate bankruptcy and insolvency is covered in a complex of multiple laws, some for collective action and some for debt recovery. These are:

- Companies Act, 2013 – Chapter on collective insolvency 1. Companies Act, 2013 – Chapter on collective insolvency resolution by way of restructuring, rehabilitation, or reorganization of entities registered under the Act. Adjudication is by the NCLT. This chapter has not been notified.

- Companies Act, 1956 – Deals with winding up of companies. No separate provisions for restructuring except through Mergers and acquisitions (M&A) and voluntary compromise. Adjudication is under the jurisdiction of the High Court.

- SICA, 1985 – Deals with restructuring of distressed industrial firms. Under this, the Board for Financial Reconstruction (BIFR) assesses the viability of the industrial company, and refers an unviable company to the High Court for liquidation. SICA 1985 stands repealed w.e.f. 25 November 2016.

- Too complex : The large number of laws and complex interplay between them have made the recovery of debts cumbersome for lenders. The lack of clarity on jurisdiction and lack of commercial understanding have allowed stakeholders to manipulate the situation and stall progress. The average life of cases recommended for restructuring in 2002 was 7 years and the average life of cases recommended for winding up to the court was 6.5 years. Even as of 31 October 2015, only about 955 (out of 4,636) and 163 (out of 545) cases of court and voluntary winding up had been resolved within 5 years.

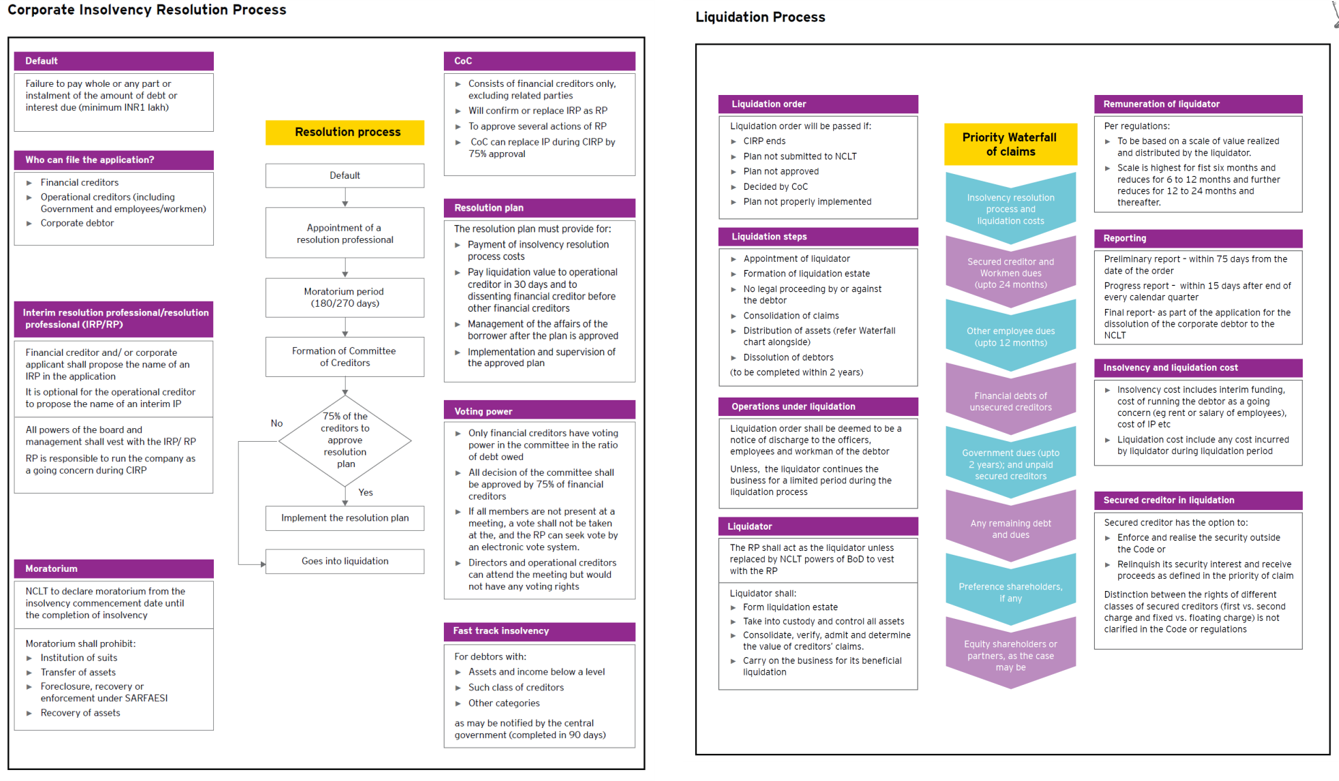

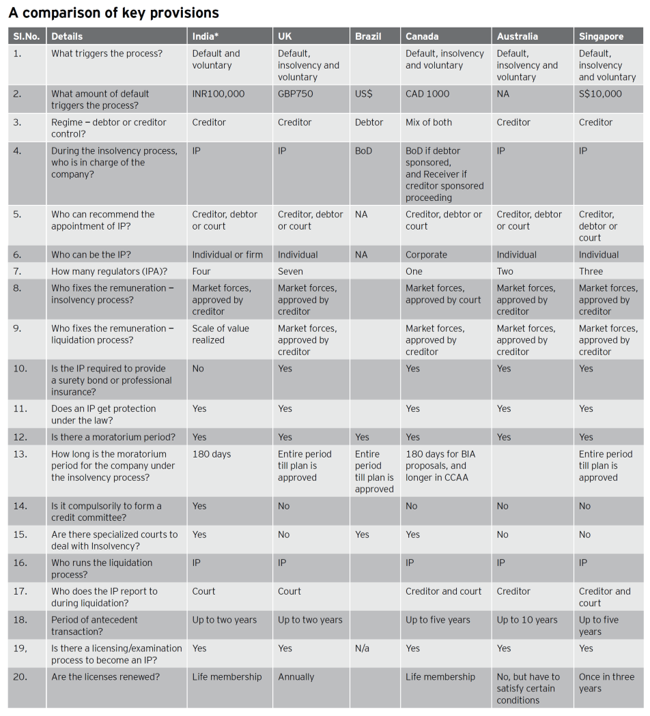

- The IBC : Then came the Insolvency and Bankruptcy Code IBC in 2016. The Code makes a clear distinction between insolvency and bankruptcy — the former is a short-term inability to meet liabilities during the normal course of business, while the latter is a longer term view on the business. As all businesses cannot succeed, it is perfectly normal for some businesses to fail, making it important to emphasize on corrective action.

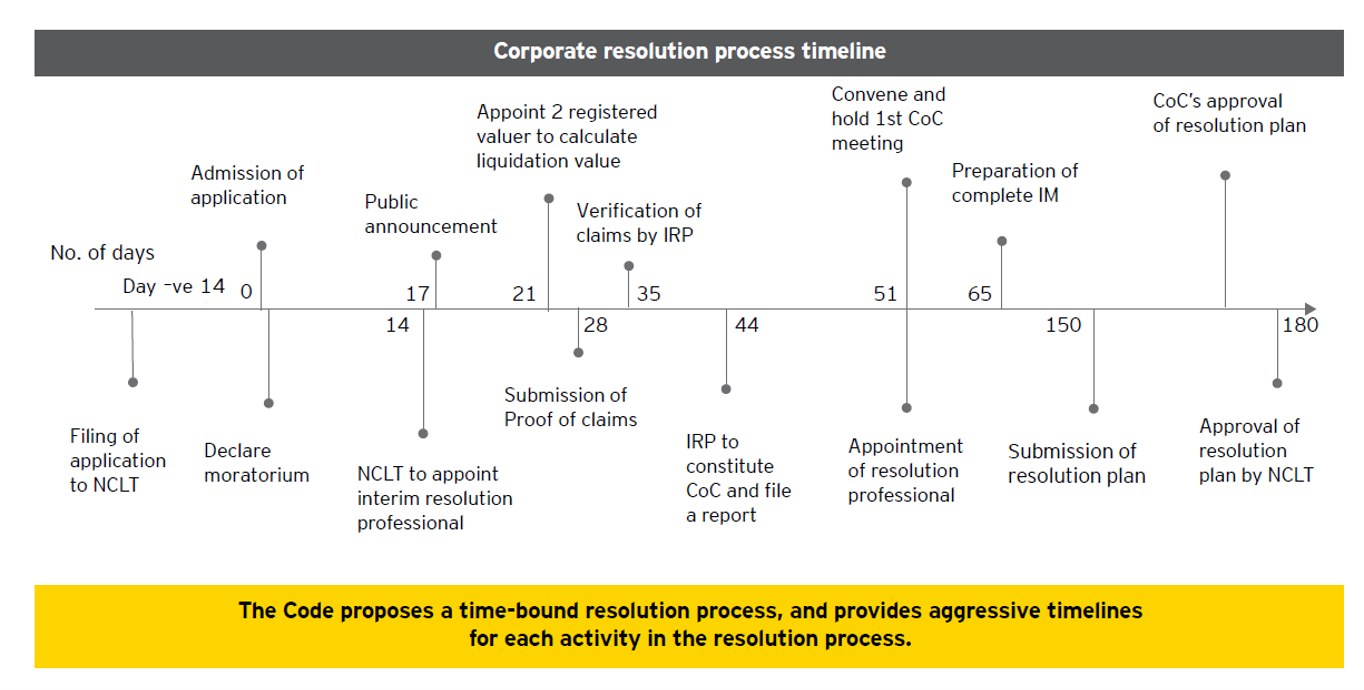

- How it helps : As per the BLRC, the Code set out the following objectives to resolve insolvency and bankruptcy: 1. Low time to resolution, 2. Higher recovery, and 3. Higher level of debt financing across a wide variety of instruments.

- Why was IBC needed :

- Reduce the time taken to resolve insolvency,

- Develop investor confidence,

- Eliminate confusion caused by a complex judicial framework,

- Address the NPA situation decisively, and

- Develop the credit and bond market.

- What is being achieved by IBC :

- Create a single insolvency and bankruptcy framework, and set up a clear and unambiguous process to be followed by all stakeholders in a time-bound manner,

- Provide a commercial solution to a commercial issue,

- Allow genuine business failures a second chance,

- Clear and unambiguous process to be followed by all stakeholders in a time-bound manner, and

- Provide confidence to lenders.

- What does it change for the lenders :

- Right to control the borrower upon default and maximize recovery,

- Option to initiate the process even if the default is in respect of the debt of another lender,

- Need for more robust monitoring systems to enable judicious exercise of powers,

- Lack of lender consensus on resolution plan can push the borrower into liquidation, and

- Clear priority of distribution (waterfall) upon liquidation; government dues subservient to those of secured creditors and unsecured ones.

- What does it change for the borrowers :

- Any creditor can file an insolvency petition on a default of Rs.1 lakh or more,

- Insolvency Professionals (IPs) take over the management of the firm during the CIRP (Corporate Insolvency Resolution Process)

- No fradulent diversion of assets possible, imprisonment a possibility.

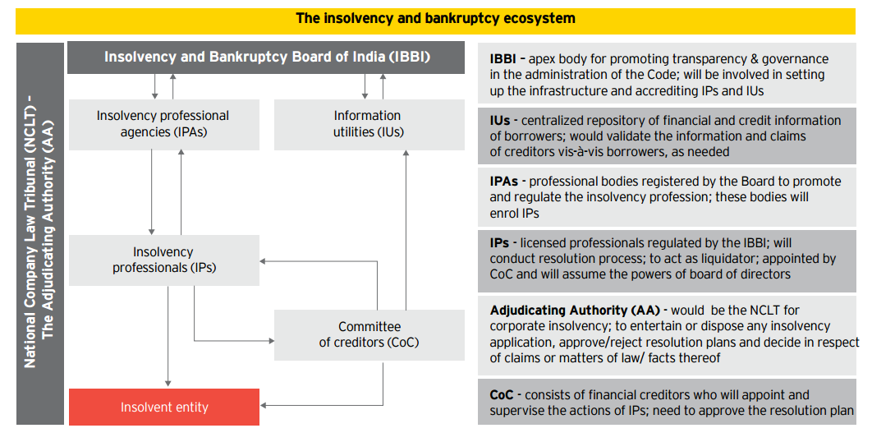

- IBBI : The Insolvency and Bankruptcy Board of India was established on 1st October, 2016 under the Insolvency and Bankruptcy Code, 2016 (Code). It is a key pillar of the ecosystem responsible for implementation of the Code that consolidates and amends the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of the value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all the stakeholders. It is a unique regulator: regulates a profession as well as processes. It has regulatory oversight over the Insolvency Professionals, Insolvency Professional Agencies, Insolvency Professional Entities and Information Utilities. It writes and enforces rules for processes, namely, corporate insolvency resolution, corporate liquidation, individual insolvency resolution and individual bankruptcy under the Code. It has recently been tasked to promote the development of, and regulate, the working and practices of, insolvency professionals, insolvency professional agencies and information utilities and other institutions, in furtherance of the purposes of the Code. It has also been designated as the ‘Authority’ under the Companies (Registered Valuers and Valuation Rules), 2017 for regulation and development of the profession of valuers in the country.

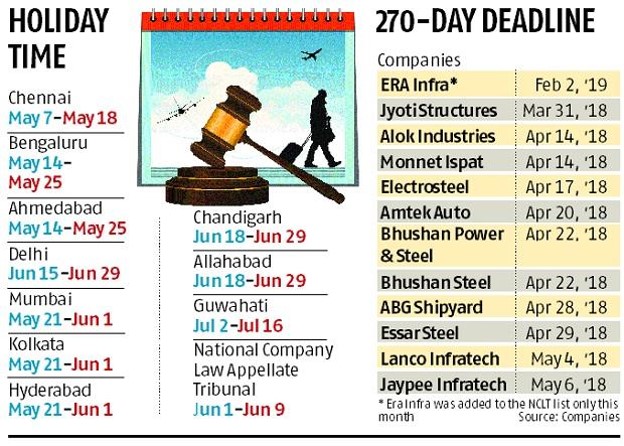

- NCLT : The Central Government has constituted National Company Law Tribunal (NCLT) under section 408 of the Companies Act, 2013 (18 of 2013) w.e.f. 01st June 2016. In the first phase the Ministry of Corporate Affairs have set up eleven Benches, one Principal Bench at New Delhi and ten Benches at New Delhi, Ahmadabad, Allahabad, Bengaluru, Chandigarh, Chennai, Guahati, Hyderabad, Kolkata and Mumbai. These Benches will be headed by the President and 16 Judicial Members and 09 Technical Members at different locations.

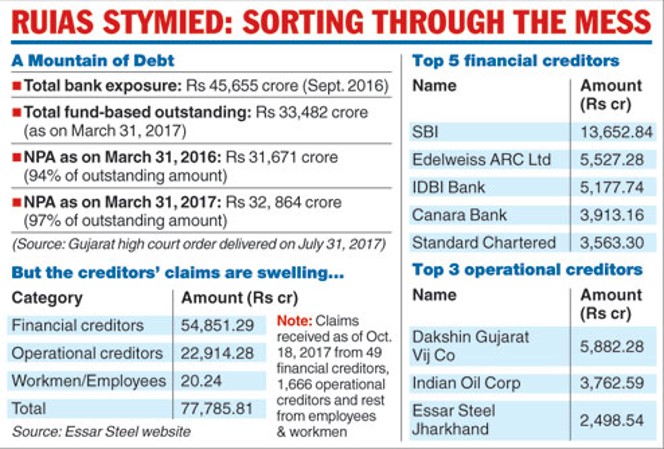

- The Essar Steel timeline :

- 2017

- May - Banking Regulation (Amendment) Ordinance authorises RBI to proceed with bankruptcy proceedings by banks against defaulters.

- June - Reserve Bank of India (RBI) identifies 12 defaulters including Essar Steel India Ltd (ESIL) and asks banks to initiate insolvency proceedings against them under Insolvency and Bankruptcy Code (IBC), 2016. On June 27, Insolvency proceedings initiated against ESIL at the National Company Law Tribunal (NCLT), Ahmedabad.

- July - ESIL moves Gujarat High Court against the insolvency proceedings initiated by its lenders - led by the State Bank of India. HC disposes of ESIL petition.

- August - NCLT Ahmedabad bench admits insolvency petition against ESIL; appoints Satish Kumar Gupta from Alvarez & Marsal India as Interim Resolution Professional (IRP or RP).

- October - RP invites EOIs for Essar Steel.

- 2018

- February - First round of bids submitted by Numetal Limited, ArcelorMittal India Limited.

- March - RP holds Numetal and ArcelorMittal bids ineligible. The companies challenge rejection in NCLT.

- April - RP invites second round of bids. NCLT Asks RP to re-examine first round of bids afresh. As a result, ArcelorMittal, Numetal file fresh bids.

- May - Suspended board of ESIL submits debt restructuring plan, gets rejected.

- September - NCLAT asks ArcelorMittal to clear dues in Uttam Galva and KSS Petron.

- October - ESIL's majority shareholder, Essar Steel Asia Holdings (ESAHL) offers a settlement proposal to repay entire debt of Rs 54,389 crore. Meanwhile, COC approve ArcelorMittal's bid of Rs 42,000 crore with 92 per cent majority vote.

- November - Operational Creditors (OCs) file petitions challenging ArcelorMittal's plan. Standard Chartered files separate petition against ArcelorMittal's plan.

- 2019

- January - NCLT holds ESAHL's Rs 54,389-cr settlement offer 'non-maintainable'.

- March 8 - NCLT approves ArcelorMittal's Rs 42000 crore bid for Essar Steel.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.