The prompt corrective action framework takes a new shape, with NBFCs coming under its ambit. An update.

NBFCs get a Prompt Corrective Action framework

- The story: The Reserve Bank of India (RBI) has now released a prompt corrective action (PCA) framework for non banking finance companies (NBFCs) also, detailing punitive action (punishments) against these, in case their capital adequacy ratio falls or non performing assets (NPAs) rise above a certain threshold. The first of its kind PCA for NBFCs will come into effect from October 1, 2022.

- Why this PCA: The RBI said that NBFCs' growing size and substantial inter-connectedness with other segments of the financial system poses risks. Hence, a PCA Framework for NBFCs will be put in place to further strengthen the supervisory tools applicable to NBFCs.

- RBI's action comes after multiple jolts to the financial system in the last three years starting with the collapse of IL&FS in September 2018.

- The collapse of IL&FS has been followed by the bankruptcy of Dewan Housing Finance Ltd (DHFL) in 2019 and the Kolkata based Srei Group and Anil Ambani controlled Reliance Capital in 2021.

- The Capital adequacy ratio and asset quality will be the key moniterables for deposit and non deposit taking NBFCs while the central bank will also look at leverage along with capital and asset quality for core investment companies (CICs).

- A NBFC will be placed under PCA based on the audited annual financial results and/or supervisory assessment made by RBI, but RBI may impose restrictions on NBFCs even during the course of the year.

- How to judge problems: The NBFCs will be judged according to three risk threshold parameters.

- For example - if the capital adequacy for deposit or non deposit taking NBFCs fall more than 300 basis points below the minimum required 15% or Tier 1 capital ratio drops 200 basis points below the minimum required 8% or net NPA ratio increases above 6%, the RBI may restrict dividend distribution or remittance of profits.

- Promoters and shareholders will also be called to infuse equity and reduce leverage.

- If capital adequacy falls a further 300 basis points, Tier 1 capital ratio another 200 basis points below the minimum required and net NPA rises above 9% the central bank will restrict branch expansion in addition to the above actions.

- A further deterioration and fall in capital adequacy to less than 9% and Tier 1 capital to less than 6% with net NPA rising to more than 12% will lead to restrictions on capital expenditure, other than for technological upgradation and a reduction in variable operating costs.

- Other steps: The RBI can also take discretionary action like calling for special monitoring meetings or inspections, special audits through external auditors or even file a insolvency application against an NBFC or issue a show cause notice for winding up of the NBFC. It may recommend a change in management, remove directors or supersede the board of the NBFC under the PCA framework. It can also restrict borrowings from the debt market, ban accepting new deposits or prevent the NBFC from making new investments.

- Other companies: For core investment companies the RBI will look at leverage ratios besides the capital adequacy and net NPAs. If the leverage ratio for such companies increased above 2.5 times the central bank will restrict such companies from issuing guarantees or taking on other contingent liabilities on behalf of group companies. CICs hold shares or debentures in other group companies. These companies mostly control the subsidiaries through holding majority shareholding.

- Relief: The PCA restrictions will be withdrawn from an NBFC if no breaches in risk thresholds in any of the parameters are observed as per four continuous quarterly financial statements, one of which should be annual audited financial statement (subject to assessment by RBI) after a RBI led supervision.

- Summary: Clearly, the RBI is pushing ahead with financial consolidation in the industry, in light of delinquent players getting weeded out. Over time, this should help the system rejuvenate substantially, and aid economic recovery.

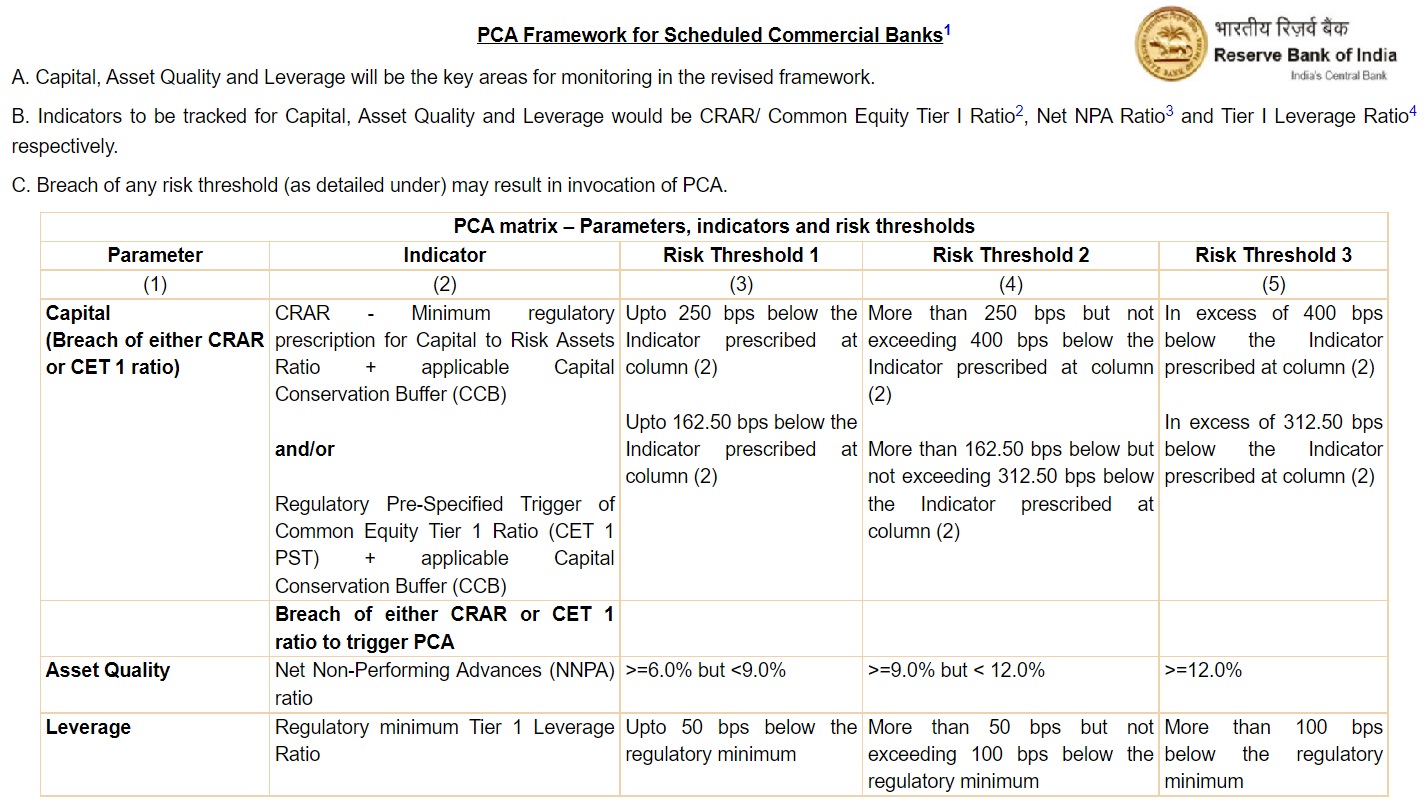

- Knowledge centre: From the start, PCA was a framework under which banks with weak financial metrics are put under watch by the RBI. The RBI introduced it in 2002 as a structured early-intervention mechanism for banks that become undercapitalised due to poor asset quality, or vulnerable due to loss of profitability. It aimed to check the problem of Non-Performing Assets (NPAs) in the Indian banking sector. The framework was reviewed in 2017 based on the recommendations of the working group of the Financial Stability and Development Council on Resolution Regimes for Financial Institutions in India and the Financial Sector Legislative Reforms Commission. The PCA is intended to help alert the regulator as well as investors and depositors if a bank is heading for trouble. It helps RBI monitor key performance indicators of banks, and taking corrective measures, to restore the financial health of a bank. The PCA framework deems banks as risky if they slip some trigger points - capital to risk weighted assets ratio (CRAR), net NPA, Return on Assets (RoA) and Tier 1 Leverage ratio. Certain structured and discretionary actions are initiated in respect of banks hitting such trigger points. The PCA framework is applicable only to commercial banks and not to co-operative banks and non-banking financial companies (NBFCs). It may be noted that of the 21 state-run banks, 11 are under the PCA framework.

- NPA - A non performing asset (NPA) is a loan or advance for which the principal or interest payment remained overdue for a period of 90 days. Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Capital Adequacy Ratio (CAR) - The CAR is a measure of a bank's available capital expressed as a percentage of a bank's risk-weighted credit exposures. The Capital Adequacy Ratio, also known as capital-to-risk weighted assets ratio (CRAR), is used to protect depositors and promote the stability and efficiency of financial systems around the world.

- Reforms - The Narasimham Committee (1998) on structural reforms recommended the merger of Indian banks; consolidated banking industry will be able to better deal with NPA crisis. A formal agency such as Public Sector Asset Rehabilitation Agency (PARA), can be instituted to resolve the large bad debt cases; this step was taken by East Asian countries after they were hit by severe TBS problems in the 1990s. The Insolvency and Bankruptcy Code (IBC) mechanism needs to be strengthened to meet global standards with active involvement of the government, regulators, lenders, borrowers and the judiciary.

- EXAM QUESTIONS: (1) Explain the idea behind PCA, NPA and CAR in RBI's language. (2) What are the worries of RBI pertaining to India's NBFCs? Explain.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.