An update on India's Q2 GDP and GVA data for 2021-22

India's GDP growth - Quarter 2 data arrives

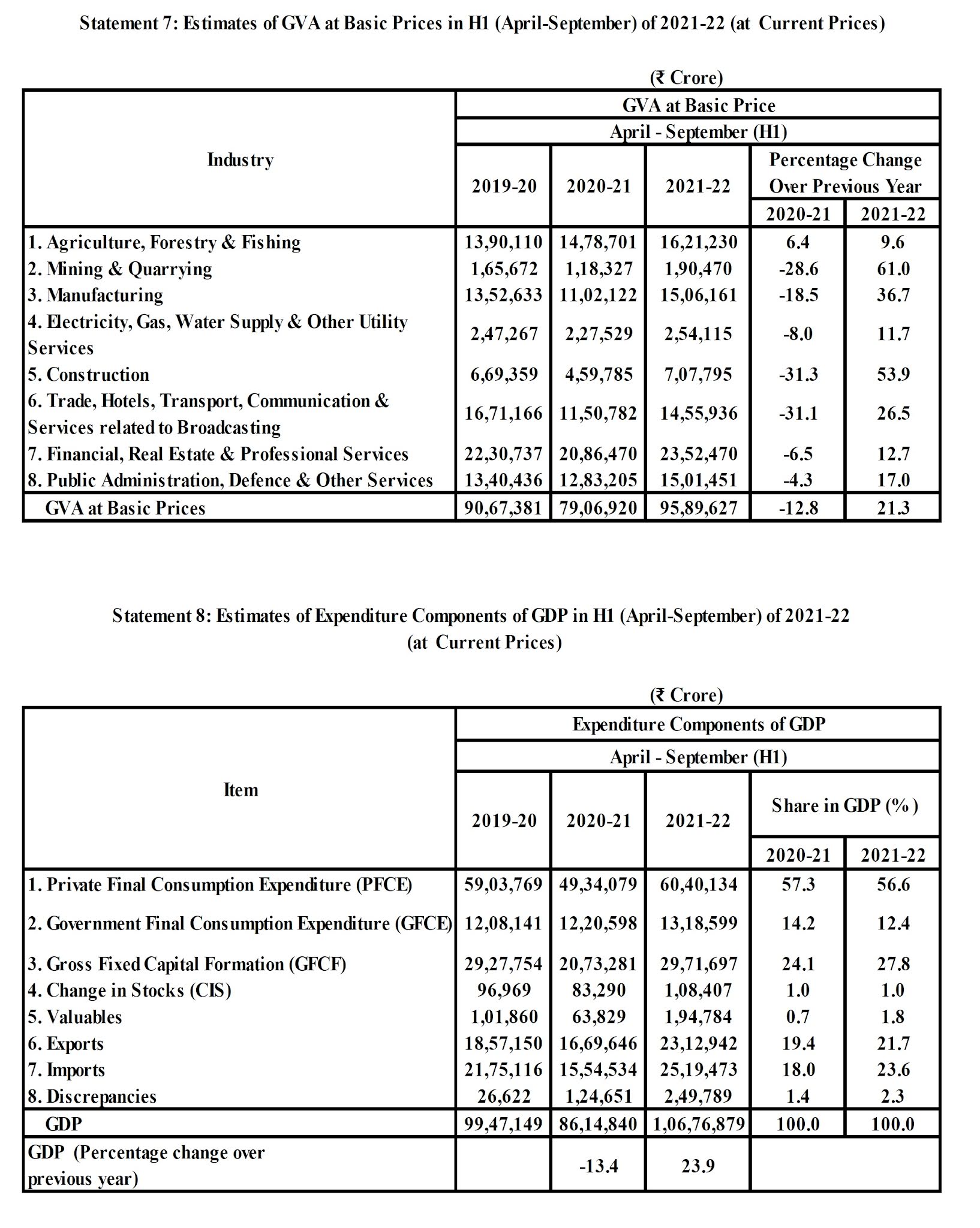

- The story: The MoSPI released the economic growth data for the second quarter — July, August and September 2021 — and India’s Gross Domestic Product (GDP) was 8.4% more than it was in the same quarter in 2020-21. Here, GDP is measured as economic activity from the demand side, by looking at the expenditures by various sectors. The Gross Value Added (GVA) was 8.5% more than it was in the same quarter 2020-21 (GVA measures economic activity from the supply side by looking at the value added by different sectors of the economy).

- An abnormal year: The Indian economy, like others, had suffered a huge contraction in the financial year 2020-21. So, it is better to avoid looking at growth rates and instead look at absolute levels of economic activity. That helps see the economic situation better when compared with 2019-20, the pre-pandemic year (a "normal" one).

- First message: The Indian economy is now recovering from the recession it went into in the second quarter of 2020. No V-shape recovery is visible yet.

- Technically speaking: The GDP is the sum total of - (i) All the money that Indians spend as private individuals spend [C], (ii) All the money that the government spends [G], (iii) All the money that businesses spend (or invest) [I], and (iv) The net effect of exports (what foreigners spend on our goods) and imports (what Indians spend on foreign goods) [NX].

- This year, private consumption (which accounts for 55% of all GDP and is the biggest engine of growth) grew by 8.6% over Q2 of last year. In Q2 last year, private consumption expenditure had contracted by more than 11%. So, private consumption in Q2 this year was much lower than it was in the same quarter two years ago. So, Indians spent less this year than they did in the same quarter two years ago (2019-20).

- The investments made by businesses (the second biggest engine of GDP growth) accounting for 33% of all GDP in Q2, grew handsomely by 11%, easily overhauling the contraction of 8.6% in 2020-21. Firms made more investments in this Q2 than in any Q2 over the last five years. So firms were optimistic about India’s economic recovery.

- Government’s expenditurs data shows that barring last year which was an exceptional year, the government’s expenditure is the lowest in five years. This shows that at a time when private demand is struggling to recover, the government has not been able to plug the gap.

- GVA data: While GDP is preferred for measuring growth, it is “derived” by taking the GVA data and adding the taxes earned by the government on different products and then subtracting all the subsidies given by the government on products. Thus, GDP = (GVA) + (Taxes earned by the government) — (Subsidies provided by the government).

- While analysing quarterly growth data, it makes sense to look at GVA as apart from telling us about the overall health of the economy, it also tells us which sectors are struggling and which are leading the recovery.

- Absolute data is the better way to assess growth for 2021-22. While the GVA in all sectors is better than it was in Q2 of last year, four key sectors that play a great part in creating fresh jobs are still below the levels achieved in 2019 or before - Mining & Quarrying; Construction and Services such as trade, hotels; and all the financial services.

- Lower GVA levels would imply lower incomes for those employed in these sectors as well as lower employment opportunities in them.

- Message for the government: It is a relief to Indians that the economy is recovering from the severe recession it saw in Q2 of 2020. But this recovery is still fledgling. A V-shaped recovery would have required the Q2 GDP and GVA to be much higher. It may take another two years to cross those levels, and some GDP may be permanently lost in this process.

- Seeing the first two quarters (or the first half) of the current financial year, both GVA and GDP are around 3.5% and 4.5%, respectively, lower than the first half-year of 2019.

- The key policy concern is the threat to future business investments if private consumption remains weak or constrained. Inventories of unsold goods will build up. When that happens, it is expected that governments will spend aggressively and boost overall demand. That doesn’t seem to be happening at present.

- What the GVA data shows is that several contact-intensive services are struggling to recover levels set in the pre-Covid years. With the threat of another variant — Omicron — it is important to give sustained policy relief to such sectors.

- Summary: It's still a long way ahead to normalcy, for the economy. The government has avoided giving demand-side push to the economy, and is hoping that supply side reforms would create enough momentum to do the trick. Time will tell.

- EXAM QUESTIONS: (1) Explain the share of various segments in India's GDP calculations. What is the present growth trend like? (2) If we remove the PFCE and GFCF components from the GDP, little is left. Do you agree? Explain why.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.