An update on India's latest GST collections, PMI performance and External sector data

Indian economy update - GST, Exports, PMI

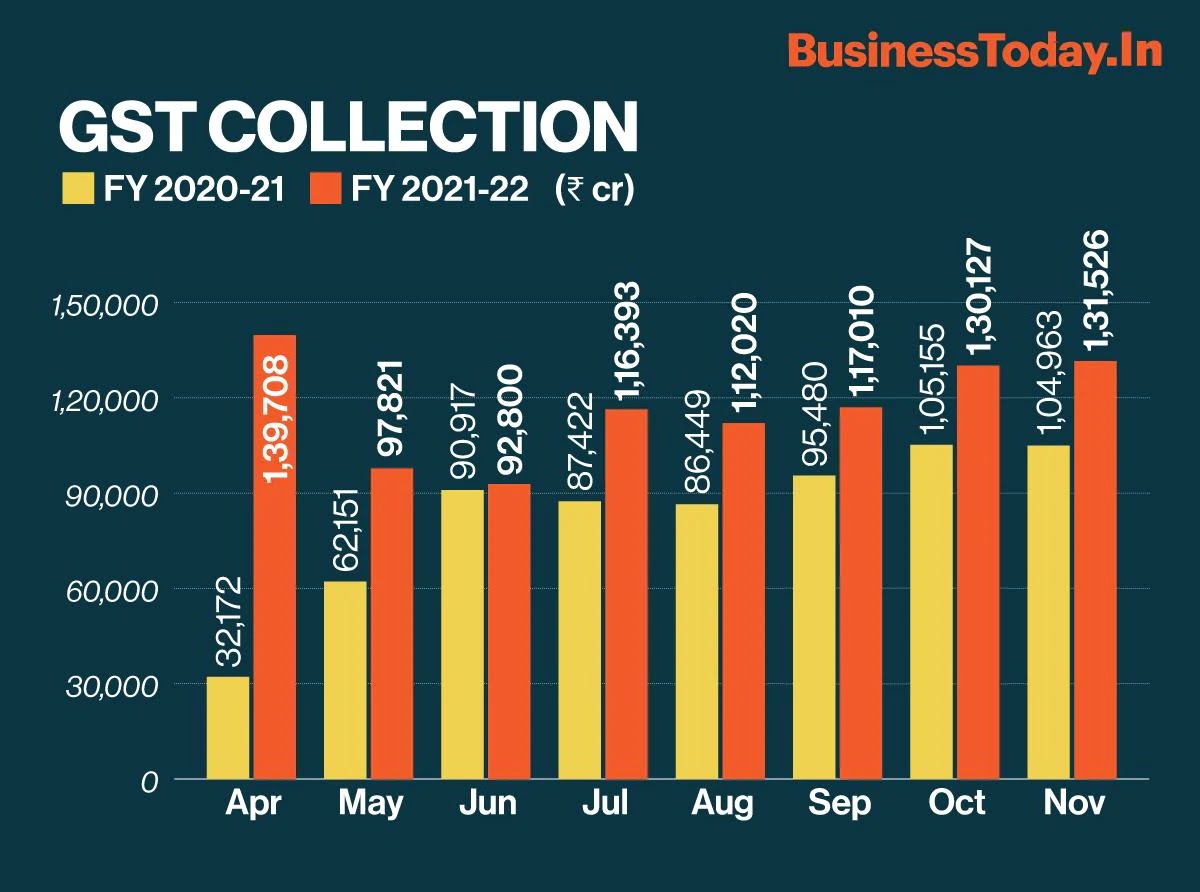

- GST update: The Goods and Services Tax (GST) collection in November grew 25 per cent to Rs 1.31 lakh crore -- second highest since its implementation -- indicating economic recovery with normalisation of business activity and increased compliance. This was the fifth month in a row that the revenues from goods sold and services rendered was over Rs 1 lakh crore. GST, which subsumed a host of indirect taxes like excise duty, service tax, VAT, was rolled out on July 1, 2017.

- The Ministry informed that the gross GST revenue collected in the month of November 2021 was Rs 1,31,526 crore of which CGST was Rs 23,978 crore, SGST was Rs 31,127 crore, IGST was Rs 66,815 crore (including Rs 32,165 crore collected on import of goods) and Cess was Rs 9,606 crore (including Rs 653 crore collected on import of goods) [CGST refers to Central Goods and Services Tax, SGST (State Goods and Services Tax) and IGST (Integrated Goods and Services Tax)]

- The revenues for the month of November 2021, are 25 per cent higher than close to Rs 1.05 lakh crore Goods and Services Tax (GST) revenue in November 2020, and 27 per cent higher over November 2019 revenues. The GST revenues for November 2021 have been the second highest ever since introduction of GST.

- In October 2021, the revenues were at Rs 1,30,127 crore, while in April 2021 it was the highest at Rs 1,39,708 crore.

- The recent trend of high GST revenues has been a result of various policy and administrative measures that have been taken in the past to improve compliance. A large number of initiatives undertaken in the last one year like, enhancement of system capacity, nudging non-filers after last date of filing of returns, auto-population of returns, blocking of e-way bills and passing of input tax credit for non-filers has led to consistent improvement in the filing of returns over the last few months, the ministry added.

- Experts feel that the increase in collections across major states ranging from 18 to 30 percentage plus points to an economic revival across states, accompanied by an increase in collections from import of goods.

- The finance ministry also revised downwards the GST collection figures for April, May and June. Earlier the figure for April was over Rs 1.41 lakh crore, May Rs 1.02 lakh crore and June Rs 92,849 crore, respectively. The revised numbers of current fiscal stands at April Rs 1,39,708 crore, May at Rs 97,821 crore, June (Rs 92,800 crore), July (over Rs 1.16 lakh crore), August (over Rs 1.12 lakh crore), September (over Rs 1.17 lakh crore), October (over Rs 1.30 lakh crore) and November (Rs 1.31 lakh crore).

- External sector performance: The current account balance of India was now expected to turn into a deficit at around one per cent of GDP during 2021-22. The trade deficit touched a record high of $23.27 billion in November 2021, as exports growth slowed faster than imports, following holidays in the festive month.

- This may have an impact on the current account balance, which was in surplus at 0.9 per cent of GDP, in the first quarter of the current fiscal year.

- Exports growth fell to 26.49 per cent in November from 43.05 per cent in the previous month. Imports also grew at a slower pace of 57.18 per cent from 62.51 per cent during this period. In absolute terms too, exports fell drastically to $29.88 billion in November. It is the lowest in nine months. This was largely due to a huge fall in export growth of high-value exchange earners. They include engineering goods, petroleum products and gems and jewellery.

- Export of non-oil, non-gems and jewellery products fell to 22 per cent in November against 28 per cent in the previous month.

- As festivals ended around the first week of November, growth in import of gold fell to eight per cent in November from 104 per cent in the previous month. Similarly, the highest imported item — petroleum — saw imports expanding by a less pace of 27.6 per cent in November from 140 per cent in the previous month.

- Imports of non-oil, non-gems and jewellery products rose by 41.5 per cent in November, which was a bit higher than 40.14 per cent in October. This means that demand in the economy is strong despite taking hits in the overseas market.

- Exports grew 50.7 per cent at $262.46 billion in the first eight months of the current fiscal year. Imports, on the other hand, rose 75.39 per cent to $384.44 billion. This widened the trade deficit to $121.98 billion, a whopping 171 per cent rise over the previous year’s figure.

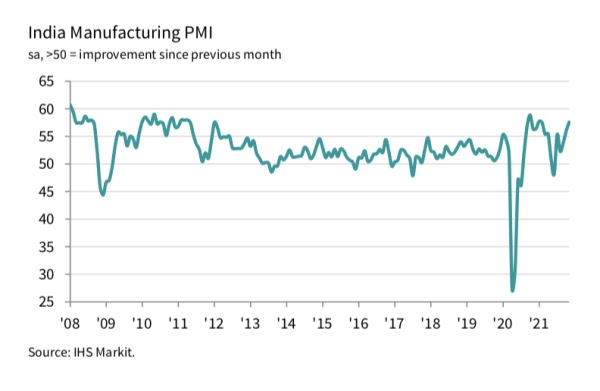

- PMI manufacturing update: A day after the release of Gross Domestic [Product (GDP) data, the IHS Markit Purchasing Managers' Index (PMI) survey painted an optimistic picture of manufacturing as the index zoomed up to a ten-month high in November due to high domestic demand.

- The PMI rose to 57.6 in November from 55.9 in October, the highest since January 2021. The headline figure was well above its long-run average of 53.6. In the PMI lexicon, a figure above 50 points to growth, while the one below this mark denotes contraction.

- The eight-industry core sector growth indicated a bright outlook after GDP data though the numbers were for October. After slipping to 4.5 per cent in September due to late rains, the core sector output grew by 7.5 per cent in October. Manufacturing grew by 5.5 per cent during Q2FY22 year-on-year, according to GDP data. It also rose almost 4 per cent compared to the corresponding pre-covid period of 2019-20.

- The pace of job generation was still moderate. Although fractional overall, the latest expansion was only the second over the past 20 months.

- Cost push inflation remained high due to demand-supply mismatches and rising transport costs. Input prices increased at a rate that was broadly similar to October's 92-month high. Companies transferred to their clients part of the additional cost burden by lifting output charges. That said, the rate of inflation was only moderate.

- Although manufacturers remained upbeat about growth prospects, the overall level of positive sentiment slipped to a 17-month low. Companies were concerned that inflationary pressures could dampen demand and restrict output in the year ahead. Raw material scarcity and shipping issues continue to feed through to purchasing prices, substantial increases in output charges could be seen and demand resilience would be tested.

- The domestic market was the main source of sales growth, as new export orders rose at a slight pace that was weaker than in October '21. Buoyed by the pick-up in demand, companies stepped up production volumes during November. Output rose sharply and at the fastest rate in nine months.

- The post-production inventories decreased in November as manufacturers fulfilled orders directly from stocks. The pace of contraction eased from October, but remained sharp.

- EXAM QUESTIONS: (1) Explain the link between higher GST collections and the underlying performance of Indian economy. (2) What are the ways in which India's external sector performance impacts the rupee value in India? Analyse. (3) What are the ways the PMI data can provide insights about how industrial firms are performing? Present an analysis.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.