What are ARCs, Bad Banks and the new NARCL? An update.

ARCs, Bad Banks and Regulatory Regimes

- ARCs: An Asset Reconstruction Company (ARC) is a special type of financial institution that buys the debtors of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself. The ARCs are registered under the RBI and regulated under the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI Act, 2002). The ARCs take over a portion of the debts of the bank that qualify to be recognised as Non-Performing Assets (NPAs) thus engaging in the business of asset reconstruction or securitisation or both.

- Details on ARC: They charge management fees for the securities they manage on behalf of a bank, and are also permitted to sell these securities in the secondary market to qualified buyers. The performance of ARCs has been dull as banks and other investors were only able to recover about 14.29% of the amount owed by borrowers during the period from 2003-04 to 2012-13. There is an ongoing probe against certain ARCs that allegedly are a front for promoters trying to settle debt cheaply.

- Bad Banks: A bad bank is an ARC or an asset management company that takes over the bad loans of commercial banks, manages them and finally recovers the money over a period of time. The bad bank is not involved in lending and taking deposits.

- It just helps commercial banks clean up their balance sheets and resolve bad loans. The takeover of bad loans is normally below the book value of the loan and the bad bank tries to recover as much as possible subsequently.

- The National Asset Reconstruction Company Limited (NARCL) is India’s first-ever bad bank. It will pay 15% of the agreed price in cash and the remaining 85% will be in the form of Security Receipts. A government guarantee will back the Security Receipts for a maximum amount of Rs.30,600 crore, and the guarantee will be valid for a resolution period of 5 years.

- NARCL versus ARCs: There are many differences.

- Government backup - ARCs are private companies but the bad bank, NARCL, will have a public sector character since the idea is mooted by the government and majority ownership is likely to rest with state-owned banks. (This is interesting because Modi govt. has publicly claimed that 'business is not the business of government')

- Valuation - Individual banks have to sell their stressed assets to ARCs and this process gets stuck because ARCs typically seek a steep discount on loans and valuation comes as a hurdle. With the NARCL being set up, the valuation issue is unlikely to come up since this is a government initiative.

- Big accounts - Smaller ARCs do not have the ability to do cash deals with respect to big accounts but the government backed NARCL will have deep pockets to buy out big accounts and thus free up banks from carrying these accounts on their books.

- Negotiation of deals - Once the industry bad loans are aggregated in one entity (NARCL), the existing ARCs can negotiate deals with that bad bank rather than waiting for approval from multiple lenders before a deal is concluded. Being a government initiative, the RBI might extend certain rule relaxations to NARCL related to the provisioning norms for banks on assets sold to an ARC.

- Improving the ARCs: Many recommendations were made by a panel set up by the RBI to ensure that ARCs truly become vehicles of business revival.

- Setting up AIFs - ARCs should be allowed to set up alternate investment funds for the purpose of bringing in capital and competencies for reconstruction. If RBI permits, an ARC industry can be expected that can participate in the process of price discovery in competition with the national bad bank which can reduce the burden on taxpayers.

- Level playing field between private ARCs and NARCL - Since the NARCL can buy NPAs with a 15-85 split between cash and securities, with the value of the securities guaranteed by the government, but private ARCs will be allowed to place counter-bids on an all-cash basis, the NARCL will be able to bid high amounts while private ARCs will be constrained to bid conservatively despite having the same ability to raise capital after the proposed creation of the Indian Debt Resolution Company (IDRC), linked with the NARCL. That is why the NARCL should be treated as just another ARC and the Centre can infuse capital into it, but it should not have backing of a government guarantee.

- Sale of NPAs - The NPAs acquired from banks by the NARCL without the application of market discipline are likely to be mispriced which raises the possibility of losses in the sales. The sale of NPAs should be subjected to competitive forces at the time they move off a bank’s books, not when the NARCL is ready to sell them.

- Cash proportion - The RBI said cash proportions of 35% and 51% for fully written-off NPAs and for other NPAs respectively which is higher than the 15% cash proportion currently suggested for the NARCL. This cash proportion is high enough to avoid sales at higher than fair value. To prevent market rigging, the actual cash proportion should be determined through a two-dimensional bid comprising deal value and cash proportion.

- Optimal recovery and revival - Setting reserve prices conservatively and adopting a multi-round auction format will result in NPAs moving off the books of banks at fair prices. Market-determined prices will ensure that sales happen faster leading to optimal recovery and revival. The experience of national bad banks in jurisdictions like China are cautionary tales that warn against ignoring market processes.

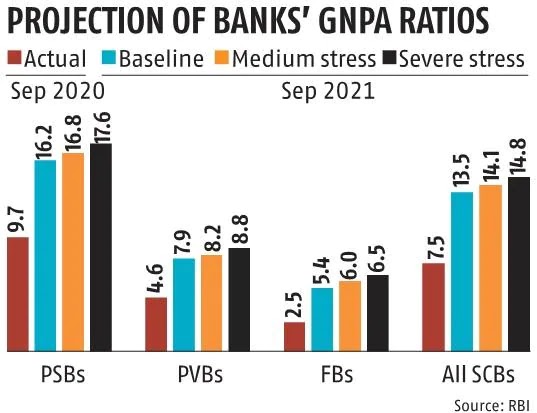

- Summary: In most countries, the national bad banks set up to clean the balance sheets of banks make losses but India has a long-standing industry of privately-held asset reconstruction companies set up in 2002 under the SARFAESI Act. The RBI’s Financial Stability Report claims that the gross non-performing assets (GNPA) ratio of banks may rise to 9.8% by March 2022 from the 7.48% in March 2021. Within the bank groups, public sector banks' (PSBs') GNPA ratio is 9.54% in March 2021. It is time for decisive action.

- EXAM QUESTIONS: (1) Explain the role and significance of a Bad Bank in India. (2) What are Asset Reconstructionc Companies (ARCs)? How do they work? Explain.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.