Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

INDIAN PENSION SYSTEM, PFRDA, NPS

Read more on - Polity | Economy | Schemes | S&T | Environment

- Why pension: A pension provides people with a monthly income when they are no longer earning.

- Unorgnised sector: While government employees are entitled to pension, many private sector workers are not. Of these, the unorganized are the worst off. These constitute nearly 90% of the total labour force of 47.29 crore as per the 66th Round of NSSO Survey of 2011-12, but did not earlier have any formal pension provision.

- Indian case: In India, in the absence of a country-wide social security system (formal pension coverage being just 12% of working population), and ageing and social change happening in parallel, made the govt. work towards overhaul of pension systems. It launched project OASIS (Old age social and income security).

- UPA government’s effort: GoI passed the 'Unorganized Workers' Social Security Act, 2008 which worked on formulating welfare schemes to meet the three major social security needs – (a) Life and Disability Cover, (b) Health and Maternity Support and (c) Old Age Protection.

- Various government pension schemes

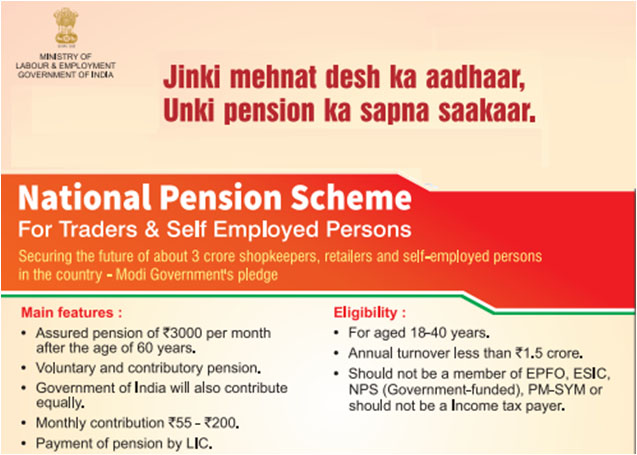

- National Pension Scheme (NPS) - The NPS scheme was launched in the year 2004 by Pension Fund Regulatory and Development Authority of India (PFRDA). This government pension scheme is designed to specifically provide financial security to senior citizens, post-retirement. This scheme allows the subscribers to make a regular contribution to their account while they are working and can avail the benefits of the regular annuity after their retirement. The subscribers can also make a partial withdrawal from the national pension system account in case of an emergency. The national pension scheme is available for all employees including the public sector, private sector, and even the unorganized sector except those who work in the Armed Forces. The NPS scheme allows its subscribers to make a minimum contribution of Rs. 6000 in a financial year. The amount can be paid as a lump-sum or as a monthly instalment of Rs 500, whatever is more convenient for the subscriber.

- Atal Pension Yojana (APY) - One of the many pension schemes by the government is the Atal Pension Yojana. This government pension scheme aims to provide pension benefits with a minimum contribution per month. The Atal pension scheme is mainly targeted to the unorganised sector and addresses the longevity risks amongst the workers of this sector. The APY scheme encourages the workers to voluntarily save for their retirement by giving minimum contribution on a monthly basis.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY) - The Pradhan Mantri Vaya Vandana Yojana provides social security and financial independence after retirement by offering an assured rate of return on the investments. This pension scheme is only offered by the Life Insurance Corporation of India (LIC) and provides assured returns for 10 years. According to the 2018-19 budget, the government increased the maximum purchase price to Rs. 15 lakhs.

- Indira Gandhi National Old Age Pension Scheme (IGNOAPS) - The government pension schemes for senior citizens play a vital role in providing financial security amongst the elderly while also initiating economic development in certain crucial areas of society. Indira Gandhi National Old Age Pension Scheme is one such pension plans in India. The scheme was introduced by the Ministry of Rural Development of India in 2007 and is popularly known as the National Social Assistance Programme (NSAP). The main aim of this scheme is to provide social protection to its beneficiaries by providing senior citizen pension, widow pension and pensions for disabled people.

- Employee Pension Scheme (EPS) - The EPF pension scheme was introduced by the government in 1995 and is also called as the Employees Pension Scheme 1995. The EPS scheme was launched by the Employee’s Provident Fund Organization (EPFO) and its main aim is to provide social security to the employees. The old pension scheme provides pension to the employees working in the organized sectors during their retirement i.e., after the age of 58 years. The benefits of which can only be availed by employees who have served for a minimum period of 10 years (continuous or non-continuous).

- Widow pension – Also known as Vridha pension where the widow of the deceased EPFO member is eligible for the pension

- Child pension – In case the EPF member is deceased, their surviving children become applicable to receive the monthly pension until the child turns 25 years old

- Orphan pension – In case the EPF member dies and does not have a surviving widow, the children of the member receive a pension under the orphan EPF pension scheme

- Reduced pension – The member of the EPF pension scheme can withdraw an early pension if he/she has attained the age of 50 but are less than 58 years old, only if they have made an active contribution for 10 years or more. In this case, the pension value is reduced to 4% rate per year

- Varishtha Pension Bima Yojana (VPBY) - It is a government pension scheme that offers income security as well as a guaranteed rate of return. It provides annuity pay-outs to senior citizens in the form of an Immediate Annuity Plan. This scheme is also known as LIC Varishtha Pension Bima Yojana since it is implemented through Life Insurance Corporation of India. In the scheme, the member needs to pay the premium of their choice at the beginning of the policy. Once this premium is paid, they are eligible for a regular pension. The Varishtha Pension Bima Yojana offers an assured pension based on a guaranteed rate of return of 8% per annum, for a period of 10 years. Here, the member can opt for the pension on a monthly, quarterly, half-yearly or annual basis.

- Swavlamban and Atal Pension Yojana: The govt. launched Swavalamabn Scheme in 2010 based on defined contribution pension system. To provide fixed pension, the NDA Government launch a Guaranteed monthly Pension Scheme “Atal Pension Yojana” in 2015.

- PFRDA: To regulate the Indian pension sector, in 2003, the govt. set up the Interim Pension Fund Regulatory and Development Authority (PFRDA), to promote, develop & regulate the pension sector.

- The Pension Fund Regulatory and Development Authority Act was passed in 2013.

- PFRDA is the regulator established by GoI to promote old age income security in India.

- PFRDA establishes, develop and regulate pension funds, to protect the interests of subscribers to schemes of various pension funds (government and corporate).

- PFRDA has created the framework for administering the ‘National Pension System’ (NPS) for government employees and all citizens of India.

- National Pension System (NPS): The NPS is being administered by the PFRDA.

- The Govt. introduced the NPS from 1st January, 2004 for new entrants to Central Government service, except to Armed Forces. An interim regulator (IPFRDA) was setup first. (PFRDA Act was passed in 2013)

- Design features of the NPS are self-sustainability, scalability, individual choice, maximizing outreach, low-cost yet efficient, and pension system based on sound regulation.

- NPS is a market linked, defined contribution product. A unique Permanent Retirement Account Number (PRAN) is maintained by the Central Recordkeeping Agency (CRA) for individual subscribers.

- The National Securities Depository Limited (NSDL) was selected as the Central Recordkeeping and Accounting Agency (CRA) by PFRDA.

- NPS offers two types of accounts – Tier-I and Tier-II. Tier-I account is the default pension account having restricted withdrawals. Tier-II offers liquidity of investments and withdrawals and is allowed only when there is an active Tier-I account in the name of the subscriber.

- On exit/retirement/superannuation, a minimum of 40% of the corpus is mandatorily utilized to procure a pension for life by purchasing an annuity from a life insurance company and the balance corpus is paid as lumpsum.

- NPS platform offers different models for different users. The investment of pension fund corpus are done differently for different funds. These models include :

- The Government model for the Central and State Government Employees – NPS is mandatory for Central Government employees (except Armed Forces) recruited on or after 01.01.2004. All State Governments also adopted NPS. Govt. employees make a monthly contribution at the rate of 10% of their salary and a matching contribution is paid by the Govt. Employer’s contribution rate was enhanced to 14% w.e.f. 01.04.2019.

- The Corporate Model – Companies can adopt NPS for their employees with contribution rates as per the employment conditions.

- The All Citizens Model – It allows all citizens of India 18 - 65 years to join NPS voluntarily.

- NPS is administered through an unbundled architecture involving intermediaries appointed by the PFRDA viz. Pension Funds, Custodian, Central Recordkeeping Agency (CRA), National Pension System Trust, Trustee Bank, Points of Presence (PoP) and Annuity Service Providers.

- Access and Portability is ensured through online access of the pension account to the NPS subscribers through web and mobile, across all locations and portability of employments.

- Tax Benefits are available under NPS. So, it is a pension cum investment scheme.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.