The world is witnessing the unprecedented scene of unlocking of strategic petro reserves, to cool prices. An update.

Oil market in turbulence - emergency reserves unlocked

- The story: Oil as a key driver of modern world economy has retained centre-stage despite all other developments to eventually replace it. Nations that are net exporters have enriched themselves beyond their wildest dreams, and net importers always struggle to manage their foreign exchange outflows. The biggest cartel of oil producers - the OPEC - has controlled prices via a system of rigging production volumes.

- The 2021 situation: Suddendly, oil consuming countries like the United States, India and others, announced concerted action to release a part of the strategic oil reserves. India’s move to release 5 million barrels of oil from its strategic reserves as part of a coordinated challenge led by the US against the OPEC+ producers’ cartel’s move to curb output, is the first time that India dipped into its reserves to leverage it as a geopolitical tool.

- The oil will be released “in parallel and in consultation with” the US, China, Japan and South Korea

- The UK announced that it will release 1.5 million barrels of crude; the US is set to release 50 million barrels

- Why release oil from strategic reserves: It is part of a concerted effort to negate upward pressure on crude prices from OPEC+ — a 13-country grouping of oil exporters that has been joined since 2016 by 10 others led by Russia to decide production quotas — keeping supply below demand, even though the action is largely symbolic in nature.

- India has always called for an increase in the supply by OPEC+ at multiple international forums and in bilateral talks with oil producing countries. India argues that high crude oil prices are impacting the post-Covid economic recovery, especially in the developing countries.

- Now, the White House has said that American consumers and businesses were feeling the impact of high prices “because oil supply has not kept up with demand as the global economy emerges from the pandemic”.

- Will prices be affected at all: Talk of a coordinated release of reserves by large oil consuming countries had already played a role in bringing down prices from a high of $86.4 in late October '21 to under $80 per barrel by November 23. But Brent prices recovered to $82.3 per barrel as the US had released less oil from its reserves than was expected. The coordinated release led by the US may add about 70-80 million barrels of crude supply, less than the more-than-100 million barrels the market has been pricing in.

- Saudi Arabia and Russia are the largest oil producers in the OPEC+ group, which has indicated it may revisit its plans to gradually increase production in the light of releases from strategic reserves.

- OPEC+, which controls about half the world’s oil output, had cut production by 10 million barrels a day in April 2020 when prices fell below $20 per barrel as global demand collapsed due to lockdowns. The cartel has been accused of being slow to restore production levels despite a sharp increase in crude prices in 2021.

- Even after a scheduled increase in production of 4,00,000 barrels per day in December '21, the output of OPEC+ will still be lower than the reference levels of member countries by nearly 5.4 million barrels per day.

- Oil prices and India: High global prices have contributed to consumers paying record high prices for petrol and diesel across the country. In Delhi, petrol is retailing at Rs 104.0 per litre, and diesel at Rs 86.7 per litre, up 27 per cent and 21 per cent respectively from a year ago. Consumers are facing prices that are significantly higher than those prior to 2021, despite a recent move by the Centre to cut excise duty on petrol by Rs 5 per litre, and on diesel by Rs 10 per litre. The Centre had in 2020 increased central excise duties on petrol and diesel by Rs 13 and Rs 16 per litre respectively in an effort to shore up revenues as economic activity crashed due to the pandemic. Some states have also hiked VAT on fuels.

- India’s strategic petroleum reserves: India’s reserves are part of a plan to build an emergency stockpile with millions of barrels of crude oil, on the lines of the reserves that the US and its Western allies set up after the first oil crisis of 1973-74. Under the first stage of the Strategic Petroleum Reserve project, underground rock caverns with total storage of 5.33 MMT, or about 38 million barrels of crude oil, were commissioned at three locations — Visakhapatnam (1.33 MMT), Mangalore (1.5 MMT), and Padur in Karnataka (2.5 MMT).

- These can provide for about 9.5 days of India’s crude oil requirements based on 2019-20 consumption levels. The combined storage facilities of Oil Marketing Companies (OMCs) in the country can hold enough crude oil to meet 64.5 days of requirement, bringing the total national capacity for storage of crude oil and petroleum products to 74 days, according to the Centre.

- India is in the process of expanding its strategic petroleum reserve storage by 6.5 MMT at two locations — Chandikhol in Odisha (4 MMT) and Padur (2.5 MMT).

- The International Energy Agency (IEA) recommends that all countries hold crude oil stocks worth 90 days of imports. India imports about 85 per cent of its crude oil requirements. Crude oil from the reserves are to be released by an empowered committee constituted by the government, in the event of any supply disruptions from abroad. These include any natural calamity or unforeseen global event leading to an abnormal increase in prices.

- China's game: China is the world’s largest crude importer, and remained non-committal on releasing oil from its reserves on a request from the United States. China has indeed said it was working on its own reserves release. Fuel demand had dropped early in the COVID-19 pandemic but came roaring back this year, and oil prices have surged.

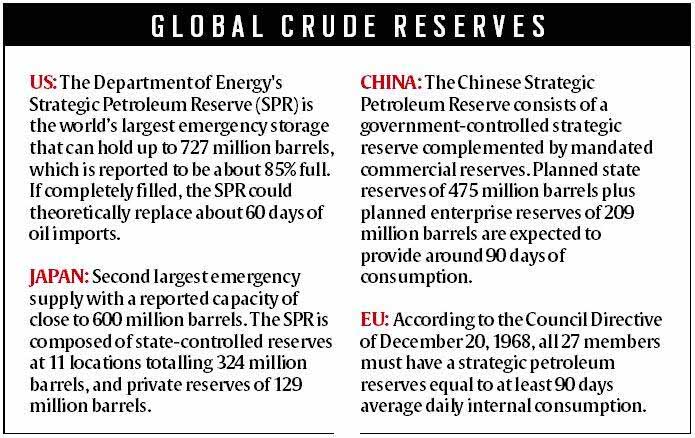

- Summary: This is the first instance of India using strategic reserves to influence international prices, adding that India had also drawn down its reserves somewhat earlier this year to supply refineries as crude oil prices were rising. A release of 5 million barrels from strategic reserves would equate to about 13 per cent of India’s strategic petroleum reserves. A release of 50 million barrels of crude oil from the US strategic petroleum reserves would equate to about 8.3 per cent of the 604.5 million barrels of crude oil stored in US strategic petroleum reserves.

- EXAM QUESTIONS: (1) What are strategic petroleum reserves? Explain the need to unlock a part of these. (2) What are the geopolitical compulsions working behind the scene, as far as OPEC is concerned? (3) The US itself is a huge producer and exporter of crude oil. Then why is it insisting other importing nations too unlock their strategic petro reserves to cool high prices? Explain.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.