The world is soon to have a minimum tax for digital corporates, hoping tax evasion may finally end.

World all set to tax Big Tech - no escape route now

- The story: Since early 2000s, the digital economy prospered at an unprecedented rate worldwide. Firms that entered the market early on, prospered quickly, and many turned into what's called "Big Tech". The GAFAM acronym symbolises the giant MNCs that dominate electronic commerce and internet businesses now. (GAFAM - Google, Apple, Facebook, Amazon, Microsoft)

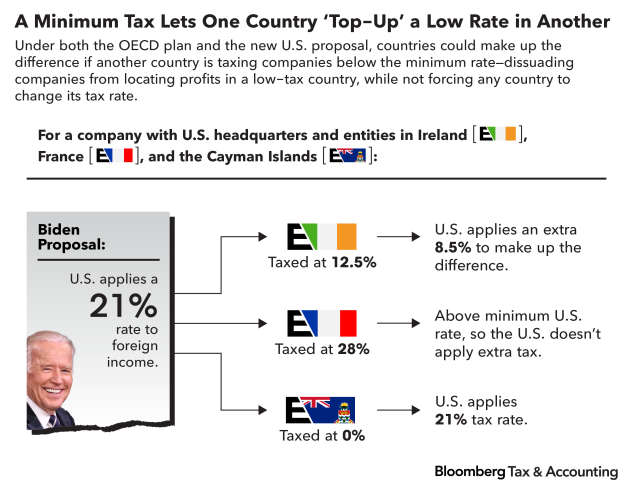

- GAFAM and Big Tech cheat on taxes: Countries realised soon that big multinational companies were funnelling their profits through low-tax jurisdictions. Having tried various thing, finally, 136 countries including India signed a pact to enforce a minimum corporate tax. This could force multinational companies to pay their fair share of tax in markets where they operate and earn profits. The US loses nearly $50 billion a year to tax cheats, according to the Tax Justice Network report, with Germany and France also among the top losers. India’s annual loss due to corporate tax abuse is estimated at over $10 billion.

- These countries will enforce a minimum corporate tax rate of 15%, and an equitable system of taxing profits of big companies in markets where they are earned. Kenya, Nigeria, Pakistan and Sri Lanka have not yet joined the deal.

- The Organisation for Economic Cooperation and Development (OECD), comprising mostly developed economies, has led talks on a minimum corporate tax rate for a decade. A multilateral convention is to be signed 2021.

- Two pillars: The decisions effectively ratify the OECD’s two-pillar package that aims to ensure that large multinational enterprises (MNEs) “pay tax where they operate and earn profits”.

- Pillar One aims to ensure a fairer distribution of profits and taxing rights among countries with respect to the largest MNEs, including digital companies. This would entail reallocation of some taxing rights over MNEs from their home countries to markets where they have business and earn profits, regardless of whether firms have a physical presence there.

- Pillar Two seeks to put a floor on competition over corporate income tax, through a global minimum corporate tax rate that countries can use to protect their tax bases.

- Effecfive 2023: The 15% floor under the corporate tax will come in from 2023, provided all countries move such legislation. This will cover firms with global sales above 20 billion Euros ($23 billion) and profit margins above 10%. A quarter of any profits above 10% is proposed to be reallocated to the countries where they were earned, and taxed there.

- The move follows an earlier agreement among the G7 economies in London in June. The two-pillar solution will be delivered to the G20 Finance Ministers meeting in Washington DC on October 13, and then to the subsequent G20 Leaders Summit in Rome.

- The two-pillar solution will result in “a redistribution of $125 billion taxable profits annually”, and ensure MNEs pay minimum 15% tax once this is implemented. A consensus on global minimum tax “will practically make tax competition amongst nations rather unfeasible by narrowing down any such opportunities to rarest circumstances…

- In the end, two-pillar solutions ought to be reckoned as enduring overhaul of a century old international tax regime, that’s here to change the rule of the global profit allocation amongst taxing jurisdictions completely.

- Why a minimum rate: The proposal is aimed at squeezing the opportunities for big tech firms to indulge in profit shifting, ensuring they pay at least some of their taxes where they do business. Once again, the world will be global, at least in following the principles of taxation rather than following territorial laws. In April 2021, US Treasury Secretary Janet Yellen had urged the world’s 20 advanced nations to move in the direction of adopting a minimum global corporate income tax. A global pact works well for the US government at this time. The same holds true for most other countries in western Europe, even as some low-tax European jurisdictions such as the Netherlands, Ireland and Luxembourg and some in the Caribbean rely largely on tax rate arbitrage to attract MNCs. They are unhappy.

- While China is not likely to have a serious objection with the US call, a concern for Beijing would be the impact on Hong Kong, the seventh largest tax haven in the world

- China’s frayed relationship with the US could be a deterrent in negotiations

- Who are the targets: Apart from low-tax jurisdictions, the proposals are tailored to address the low effective rates of tax shelled out by some of the world’s biggest corporations, including Big Tech majors such as Apple, Alphabet and Facebook, as well as those such as Nike and Starbucks.These companies typically rely on complex webs of subsidiaries to hoover profits out of major markets into low-tax countries such as Ireland, the British Virgin Islands, the Bahamas, or Panama.

- Indian situation: India has had reservations about this new deal, but ultimately backed it in Paris. India is likely to try and balance its interests, while asserting that taxation is ultimately a “sovereign function”. India may have to withdraw its digital tax or equalisation levy if the global tax deal comes through. OECD said the Multilateral Convention (MLC) will “require all parties to commit not to introduce digital tax measures in the future.”

- To tax firms that do business in India digitally, Indian government launched the ‘Equalisation Levy’, in 2016. The IT Act was amended to bring in the concept of “Significant Economic Presence” for establishing “business connection” in the case of non-residents in India.

- There are some fears on the impact of this deal on investment activity. India, China, Estonia and Poland have said the minimum tax could harm their ability to attract investment with special lures like research and development credits and special economic zones that offer tax breaks to investors.

- India had (on September 21, 2019) announced a massive cut in corporate taxes for domestic companies to 22% and for new domestic manufacturing companies to 15%. The Taxation Laws (Amendment) Act, 2019 amended the Income-Tax Act, 1961 to provide for the concessional tax rate for existing domestic companies subject to certain conditions. Existing domestic companies opting for the concessional taxation regime will not be required to pay Minimum Alternate Tax.

- This costs the exchequer Rs 1.45 lakh crore annually. The effective tax rate, inclusive of surcharge and cess, for Indian domestic companies is around 25.17%.

- Problems with the 15% plan: First, all big nations must agree. Second, it impinges directly on the right of the sovereign to decide a nation’s tax policy. Third, a global minimum rate would take away a tool countries use to push policies that suit them. Fourth, bringing in laws by 2022 so that it can take effect from 2023 is tough. Fifth, the deal has been criticised for lacking teeth, because tax havens will continue to exist.

- EXAM QUESTIONS: (1) Explain the debate around base erosion and profit shifting (BEPS). (2) What will the new global minimum corporate tax at 15% achieve finally? Explain. (3) The Indian situation in this new deal is slightly precarious. Explain why.

#OECD #globalminimumtax #GAFAM #taxhavens

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.