Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

BILLIONAIRES RISING IN COVID MESS

Read more on - Polity | Economy | Schemes | S&T | Environment

- The worldwide pandemic stimulus has made the world’s wealthiest wealthier.

- Since 2000, the global population of billionaires rose steadily, by more than five times. Largest fortunes rocketed past $ 100 bn.

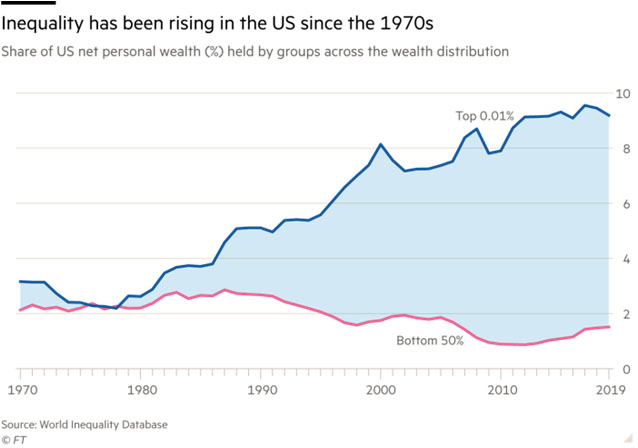

- Rising inequality was becoming ever more of a political issue, threatening to provoke popular backlashes against capitalism itself.

- The pandemic has reinforced this trend. As the virus spread, central banks injected $ 9 trillion into economies worldwide, aiming to keep the world economy afloat.

- Much of that has gone into financial markets, and from there into the net worth of the ultra-rich. The total wealth of billionaires worldwide rose by $ 5 tn to $ 13 tn in 12 months, the most dramatic surge ever registered!

- The billionaire population boomed in 2020 – on the 2021 Forbes list, nearly 700 were added to a record total of more than 2,700.

- The biggest surge came in China, which added 238 billionaires — one every 36 hours — for a total of 626.

- Next came the US, which added 110 for a total of 724.

- The top 10 gainers in the US and China each saw already vast fortunes grow in just one year by sums that not long ago would have seemed impossible in a lifetime: from $25bn to more than $150bn for Tesla founder Elon Musk.

- Naturally, the backlash is strong, and demand to tax these super rich have commenced.

- President Joe Biden has not joined these calls but has begun to cite the billionaire class windfall during the pandemic as reason to tax the very rich more heavily and redistribute wealth.

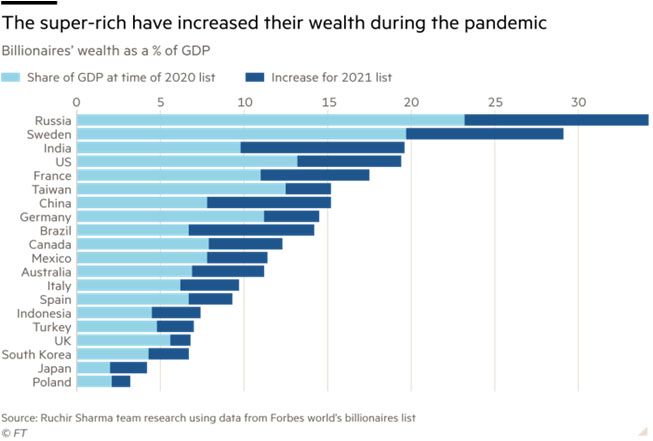

- Although India is relatively poor, billionaire wealth had soared to the equivalent of more than 17 per cent of GDP, one of the highest shares in the world, with most gains accruing to a narrow set.

- In contrast to India, America’s billionaire class looked surprisingly well balanced in the early 2010s, given the reputation of the US as the home of trickle-down capitalism.

- Billionaire wealth totalled about 10 per cent of GDP at that time, which was in line with the average for wealthy countries. Relatively few of the leading US tycoons got their start by inheriting fortunes, or built their wealth in “bad” industries.

- The stock market gains of 2020 flowed largely to tech companies and their usually self-made founders. The share of billionaire wealth held by family scions and “bad billionaires” fell even further.

- The most bloated growth is — surprise — in Sweden, which many progressives still think of as a social democratic utopia. In the past five years Sweden’s population of billionaires has risen from 26 to 41, 10 of them popping up just last year, when their wealth leapt up as a share of GDP from 20 per cent to near 30 per cent.

- A similar trend is unfolding in traditionally left-leaning France, where billionaire wealth had risen steadily to 11 per cent of GDP when the pandemic hit, and jumped to 17 per cent in 2020. In the UK, by contrast, billionaire wealth has remained relatively flat as a share of GDP, at 7 per cent.

- Whether a boom of this scale is stabilising or destabilising depends in part on where the wealth is coming from. In China, as in the US, most of the new billionaires are rising in dynamic, highly productive industries, led by technology and manufacturing.

- China seems conflicted about how to square vast fortunes with what’s left of Maoist values.

- Before the 2010s, Beijing seemed to be enforcing an unwritten rule that no fortune should surpass $ 10 bn. Tycoons whose net worth approached that mark tended to find themselves cut down suddenly by government investigators. As big internet companies took off, the net worth of their founders shot up and, perhaps before authorities could react, surpassed $10bn in 2014!

- America’s relationship with its billionaire class is no less complex. The US has rarely been inclined to target those who realise the dream.

- Only in periods of extreme inequality, such as the robber baron age of the early 20th century, were magnates such as John D Rockefeller targeted as public enemies.

- It helped greatly that many were self-made entrepreneurs, philanthropists or — such as Bill Gates and Warren Buffett — both.

- As the world’s richest man, Jeff Bezos’s $177bn may seem mind-boggling. But at 0.8 per cent of GDP, it is far from Rockefeller wealth, which at his peak amounted to 1.6 per cent of GDP.

- The scale of mega-billionaire fortunes, and their growing number, is bringing down political wrath on the entire class, no matter what their accomplishments or contributions.

- Heads and founders of the American tech giants have been hauled before Congress to defend themselves, cast in the role of grasping, all-powerful monopolists.

- It has been boom times for German billionaires too. Their number rose by 29 to 136 last year, but their total wealth edged up only slightly as a share of GDP. Most keep a low profile. The average wealth of the top 10 is $23bn, compared to $105bn for their American peers. Many large German fortunes classify as inherited, but often those tycoons arise from the Mittelstand; family-run, often small to medium-sized companies, which are the backbone of German industry and still a source of national pride. There is no equivalent of the American anti-billionaire movement.

- Many millennials see Elon Musk as a visionary hero, building the battery-powered economy that will save us from global warming, and do not begrudge the fact that his fortune grew six-fold!

- The Russian list is surprisingly long for a not-so-big economy, at nearly 120 names, and in the past studies showed that an overwhelming majority of them live in and around Moscow.

- Russia adopted elements of capitalism only after the fall of Soviet communism, too recently for families to build generations of wealth. So far the Moscow authorities have been able to smother festering discontent, but the same can’t be said in Mexico. Anger over inequality helped bring leftwing President Andrés Manuel López Obrador to office.

- Japan has lots of “good” billionaires, few “bad” ones and relatively little inherited wealth. But the class as a whole is so small, with wealth equal to barely 4 per cent of GDP, it would appear to symbolise long-term stagnation.

- The pandemic accelerated many economic and social trends that were already in motion.

- The billionaire classes grew at a record pace, raising the threat of anti-wealth backlashes.

- In rich countries these stirrings are as yet focused almost entirely on clawing back wealth through taxation, without addressing the fundamental driver of the market and thus the billionaire boom: easy money pouring out of central banks.

- Easy money is as popular as higher taxes among progressives, as another way to pay for social programmes. So wealth inequality is likely to continue widening until the monetary spigots are turned off.

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.