Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

US Bonds impact the Indian economy

Read more on - Polity | Economy | Schemes | S&T | Environment

- Indian markets hit by bonds: Indian stock markets saw a sharp spike in the yields that one earns from United States government bonds. When govts. sell bonds (to raise money to meet their expenditure), the bonds have a selling price and a fixed coupon rate. If a 10-year government bond (Treasuries in the US, Gilts in Britain and G-Secs in India) is priced at Rs.1000 and the coupon rate is Rs.50 then it means if you buy such a bond from the government for Rs.1000 today, it will pay you Rs.50 each year and return you Rs.1000 at the end of the 10 years.

- The yield on bond: Here, the “yield” or the annual rate of return from the bond was 5%. But it can change if the selling price of the bond changes. If at the start of the second year, investors turn unhappy about the prospects of the broader economy or the private firms, and some of them decide to invest in government bonds now (safest investment), then the demand for such bonds will rise (and so will their prices). Suppose the price of the same 10-year bond rises to Rs.1010.

- Since the coupon rate is still Rs.50, the effective return on an investment of Rs.1010 that bondholders will now get at the end of the second year will be only Rs.40 (50 - 10). That implies a yield of 40 / 1010 = 3.96%, a fall from the 5% bondholders earned in the first year.

- Since government bonds are the safest investments, their yields tend to be the benchmark for interest rates in the economy as well as investor confidence.

- If investors find it more lucrative to lend money to businesses, they move away from government bonds, which results in a fall in bond prices and an increase in yields. If they are concerned about the state of the economy, they rush to buy bonds and thus yields fall.

- Since Covid-19 vaccines are being rolled out in the US and economic activity (helped generously by government spending) gathers pace, investors are moving away from government bonds — thus spiking the bond yields.

- A fall in interest rates makes bond prices rise, and bond yields fall — and rising interest rates cause bond prices to fall, and bond yields to rise. In short, a rise in bond yields means interest rates in the monetary system have fallen, and the returns for investors (those who invested in bonds and govt securities) have declined.

- Global impact: Apart from being the benchmark domestically, the US bond yields are very influential globally as well. That's because they attract funds from investors across the world. Investing in US treasuries is safest, and if such bond yields are rising then they become an even more attractive proposition. Higher yields in the US also signal the US central bank — the Fed — might raise interest rates to contain inflation, which will rise as economic growth takes off. So many global investors pull out money from emerging economies such as India, where economic recovery is still slow, and either invest in US bonds or the broader economy. This reverse flow explains why India's domestic stock markets suffered in February last week.

- Indian bonds: Yields of Indian G-secs rose in line with US bond yields. So investors find lending to the Indian government a better alternative than lending to the Indian firms via the stock markets. Recall the release of the Second Revised Estimates (SAE) of national income for FY 21 by the Ministry of Statistics and Programme Implementation (MoSPI).

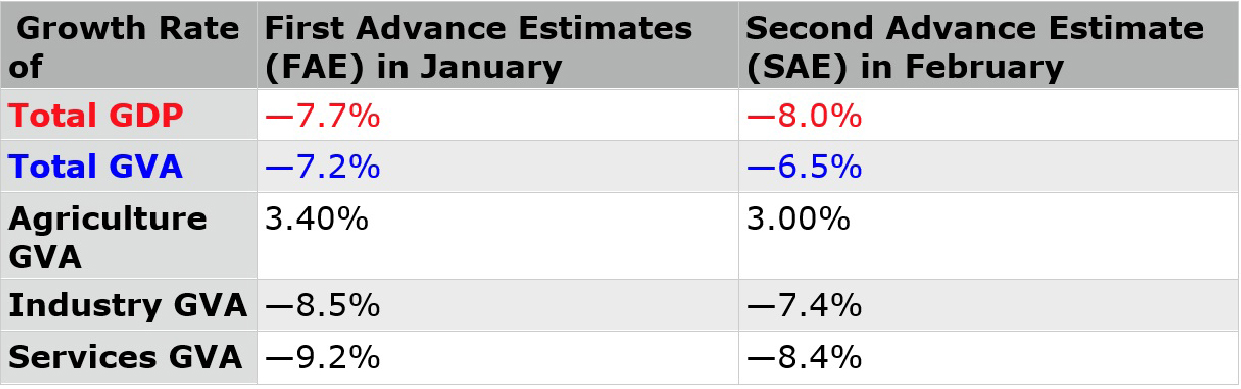

- In the First Advance Estimates, released on January 7, the government expected India’s GDP to contract by 7.7% in the current financial year. The SAE released on February 26 peg this contraction at 8%. This cannot be great news for the economy.

- A contraction by 7.7% meant that India’s per capita GDP, per capita private consumption and the level of investments in the economy — all were expected to fall to levels last seen in 2016-17 or earlier.

- At minus 8%, most of these key metrics have either worsened or, in case they have improved, they haven't done so substantially enough. For instance, according to the FAE, the per capita GDP in 2020-21 was estimated to be Rs 99,155. According to the SAE, this number has fallen further to Rs 98,928 — that's a fall of Rs 227 per head across each of 1.36 billion Indians.

- Borrowings and FPI flows: When bond yields rise, the RBI has to offer higher cut-off price/yield to investors during auctions. This means borrowing costs will increase at a time when the government plans to raise Rs 12 lakh crore from the market. RBI is expected to stabilise yields through its OMOs (open market operations) and operation twists. As government borrowing costs are used as the benchmark for pricing loans to businesses and consumers, any increase in yields will be transmitted to the real economy. And bond yields play a big role in FPI flows too. When bond yields rise in the US, FPIs move out of Indian equities. Also, it has been seen that when the bond yield in India goes up, it results in capital outflows from equities and into debt.

- GVA and GDP: The silver lining in the national income data was the growth rate of Gross Value Added (GVA). It makes sense to look at the GDP, which maps national income from the point of view of what was the total amount of money spent in an economy, for comparing the full-year performance of an economy. But there is another way to look at the economy’s performance — the Gross Value Added (GVA). It captures the value added (in money terms) by economic agents in each sector of the economy. It is more relevant when one tries to map how the domestic economy is changing from one quarter to another. The GVA data is made available first by govt., not the GDP, which is later arrived at by taking the GVA number, adding all the taxes earned by the government and subtracting all the subsidies provided by the government.

- For the same level of GVA in an economy, the GDP could alter just because the government earned more money from its taxes or spent more on subsidies.

- If one wants to know the true state of India’s economic revival, one should focus on the GVA.

- Even though the GDP growth rate has been revised down, the GVA growth rate has been revised up. While both the industry and the services sectors are expected to contract this year, the pace of contraction is lower than what was expected in January 2021.