Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

Gold standard

Read more on - Polity | Economy | Schemes | S&T | Environment

- The news: An International Bullion Exchange is being established in Gujarat International Finance Tec-City (GIFT). Why was a need for establishing this exchange felt?

- The need: Due to the absence of spot market for gold in India, domestic stakeholders were forced to use prices traded on international exchanges for computing local prices. An MOU was signed between the leading stock and commodity exchanges and depository participants, paving the way for establishing the market infrastructure for the bullion exchange.

- India gold price determination: Today, there is no transparency in determining the local price of gold. It is decided by the Indian bullion and jewellers association based on buy and sell quotes from ten of its biggest dealers. These dealers then convert the international gold price to rupee, add taxes and their commission to quote the price. This method of price fixing is vulnerable to manipulation as witnessed in countries such as the UK.

- Now what: With the establishment of this exchange, transparency will get imparted in determining the local price of gold. Also a strong bullion exchange in the IFSC will help jewellers and retailers to buy gold directly from foreign traders instead of using banks as intermediaries.

- Benefits: In the international bullion market, India will soon become a price setter from being a price taker. The exchange will help in better price discovery of bullions, and will facilitate in trading the bullion spot delivery contract and spot depository receipt. It has Bullion vaulting services which facilitates in storing the gold traded at the offshore exchange. This can also become a future hub of gold trading if international traders are incentivised enough to shift part of their trading here.

- Regulation: In India, most of the spot commodity markets features in the State list and are beyond the purview of SEBI. So the International Financial Services Centres Authority has been given the responsibility of supervising the implementation and operations of the exchange. This is done according to the IFSCA (Bullion Exchange) Regulations, 2020.

- Issues: It is not easy to attract foreign companies who trade gold in other offshore centres to the domestic exchange. The IFSCA has to provide enough incentives -lower transaction cost and other benefits -to make them shift to the GIFT IFSC. There is no clarity whether retail clients can sell their gold at this exchange. If their participation is enabled, then gold assaying centres needs to be up at IFSC along with regulatory changes.

- Knowledge centre:

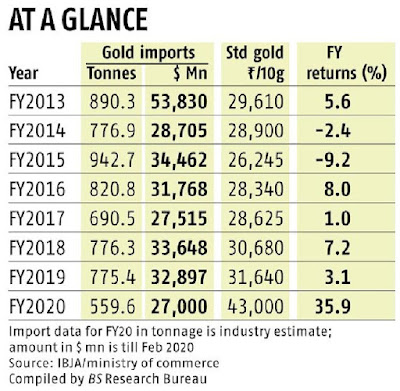

- Indian gold market - India is the second largest consumer of gold globally with annual gold demand of approximately 800-900 tonnes, and it holds an important position in the global markets. However, the domestic market is currently plagued by challenges such as lack of quality assurance, weak price transparency and high market fragmentation. A gold spot exchange can address these challenges and eliminate resulting market inefficiencies.

- World gold trading - The landscape for wholesale gold trading is quite complex and constantly evolving. The three most important gold trading centres are the London OTC market, the US futures market and the Shanghai Gold Exchange (SGE). These markets comprise more than 90% of global trading volumes and are complemented by smaller secondary market centres around the world (both OTC and exchange-traded). Other important markets include Dubai, India, Japan, Singapore and Hong Kong. There are exchanges in all these markets offering a range of spot trading facilities or listed contracts but these have not attracted the liquidity seen on the market’s primary venues. Nonetheless, these markets play an important role to varying degrees in serving local demand or acting as regional trading hubs. For example, Hong Kong has long acted as a gateway to the Chinese market and Singapore is establishing itself as an important focal point for trading in the ASEAN region.

- Drivers of gold price - Gold is often used as a safe-haven asset since Gold price performance often rallies during periods of uncertainty. Gold is both pro-cyclical and counter-cyclical. Investment drivers tend to influence heavily short- and medium-term gold price performance. But long-term price dynamics respond to consumer demand, long-term savings, central bank demand, and supply dynamics. The factors that influence gold can be grouped into four big themes: - (i) Currencies – strength and weakness of the US dollar and various currencies; (ii) Economic growth and market uncertainty – inflation, interest rates, income growth, consumer confidence, tail risks; (iii) Tactical flows – price momentum, derivatives positioning; (iv) Additional gold demand and supply dynamics – mine production, idiosyncratic demand-side shocks.