Without again getting the consumption engine running, Indian GDP won't rise and shine.

India's consumer demand growth - An analysis

- The story: A large part of India's GDP is driven by the biggest engine - PFCE - private final consumption expenditure. If that slows down, the entire GDP slows down. It also impacts corporate investments, as slow consumer demand is not motivating enough to put new plants!

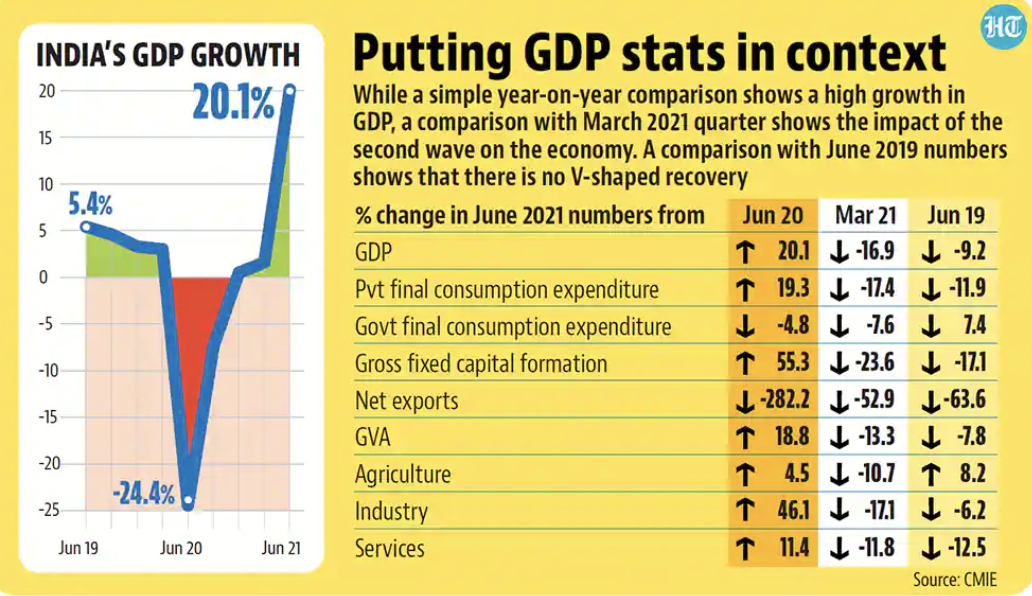

- Nature of slowdown: India's GDP went into a sharp slowdown (growth recession) and the debate around the nature of the economic slowdown is raging. Correctly diagnosing the root cause for India’s low growth rate is the right way to finding the right policy solutions.

- A wrong approach: Some experts may want to ignore the demand side, and consider that supply side constraints are responsible. To support, they may cite the carmakers struggling to meet demand owing to a global chip shortage. Some may counter it referring to the box office sales, and argue that consumer demand is still weak.

- But instead of picking and choosing sectors and industries, a stronger way would be to look at the official data for Gross Domestic Product, which is the monetary measure of the country’s total output.

- The key variable to track within the GDP table is the Private Final Consumption Expenditure (PFCE).

- PFCE and significance: The GDP is calculated by capturing the total expenditures of different components of the economy. So it adds up the expenditure by private individuals (PFCE), by the businesses investing money (Gross Fixed Capital Formation or GFCF), and all the spending by the government (Government Final Consumption Expenditure or GFCE). In India, the PFCE accounts for 55%-56% of all national GDP in a year and is the biggest driver of economic growth.

- But apart from its direct influence of 55%, it also indirectly influences the next biggest driver of India’s GDP — the Gross Fixed Capital Formation (GFCF).

- The GFCF is a measure of the money spent by businesses when they make investments, and it accounts for 33% of all GDP.

- It is crucial to understand the economic logic that links these two biggest drivers of economic growth which together account for 88% to 89% of all GDP in India.

- The crucial link: If consumer demand slows down, it kills the business incentive to boost productive capacities by making fresh investments. Just boosting investments — without regard for demand — will not make sense. The tremendously strong role of private consumer demand in boosting India’s GDP makes it the most important factor determining India’s economic fortunes.

- Government role: The third driver of GDP is government spending (GFCE), and it accounts for 10%-11% of all GDP. It should typically be counter-cyclical: when the rest of the economy is doing well — consumers are demanding lots of goods and businesses are investing in new capacities to furnish such demand — the government should try to limit its spending without hurting (or “crowding out”) private sector firms from accessing credit and markets. But when consumer demand is weak, and firms are holding back from making fresh investments, the government should raise its spending to push the economy and, hopefully, “crowd in” the private sector in the growth process.

- Exports: The fourth engine — net exports or the net effect of India’s demand for imports and the Rest of the World’s demand for our products (exports) — is quite small in India’s case. That is true despite a sharp rise in exports in 2021.

- Consumer demand over the years: Private consumption expenditure grew at an annual rate of 8.2% between 2004-05 (Financial Year 2005 or FY05) and 2011-12.

- Between FY12 and FY20 (just before Covid), its annual growth slowed down to 6.8%. In the years since FY17 (after which India’s GDP growth rate started decelerating sharply) and FY20, the PFCE annual growth rate had slowed to 6.4%.

- Then came Covid-induced lockdowns in FY21 and they destroyed the already weakening demand. If we include FY21 as well, then the PFCE growth rate since FY12 falls to below 5% per annum.

- In FY22, the current financial year, the Indian economy is expected to register a recovery. Even if we assume that at the end of the current financial year, PFCE would grow at the same rate — 6.8% — that it had in the eight years before Covid, the FY12 to FY22 annual growth rate would barely rise above 5%.

- The growth rate between FY17 and FY22 shows an annual growth rate of just 3.2%.

- It was 8.2% annual growth rate during FY05 and FY11! Clearly, consumer demand has lost its growth momentum.

- Lessons: The implication of this is that investments by corporations won't pick up and actually remain subdued for the coming year or two as indeed they were in the years preceding the pandemic despite historic cuts in corporate tax rates in 2019. The GFCF grew by just 3.9% every year between FY12 and FY20. (It grew by 10.9% per annum between FY05 and FY11)

- Does India have a supply problem: Just find the rate of capacity utilisation. RBI’s OBICUS (Order Books, Inventories and Capacity Utilisation Survey) shows capacity utilisation has struggled to cross the 75% mark. So firms have been working far below their full capacity for several years now. Covid disruptions have created several bottlenecks or broken supply chains, in addition, leading to delays and price inflation.

- Summary: There is just one core problem with Indian economy - the weak growth in consumer demand. To improve that is the golden key to sustained progress.

- EXAM QUESTIONS: (1) Explain the key challenge for Indian policymakers, as far as kickstarting economic growth is concerned. (2) Analyse India's GDP from the multiple engines of growth perspective. (3) What three things can kickstart the demand engine of India? Explain.

#Demand #Consumption #investment #recession #growthslowdown #GDP

* Content sourced from free internet sources (publications, PIB site, international sites, etc.). Take your own subscriptions. Copyrights acknowledged.

COMMENTS