Excellent study material for all civil services aspirants - begin learning - Kar ke dikhayenge!

Fire in fuel prices singes Indians

Read more on - Polity | Economy | Schemes | S&T | Environment

- Pay more for fuel: Indians are paying

historically the highest fuel prices at retail pumps now. In the middle of a

raging and polarised debate, retail prices of automobile fuels touched record

highs across India. These fuels are taxed heavily in India, and oil price

decontrol is a one-way street — the consumer never benefits. The

"decontrol" promise looks laughable.

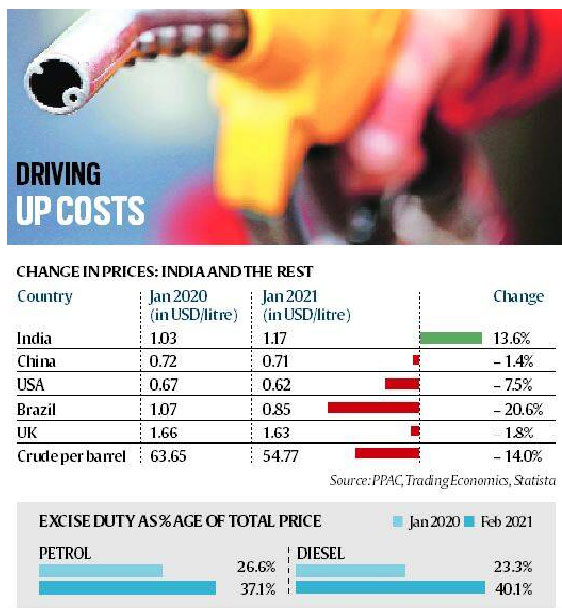

- Wrong claims: Petrol touched Rs 89 per litre in Delhi on 15-02-2021, and diesel a new high of Rs 86.30 per litre in Mumbai. The government reasons that global crude oil prices have risen by more than 50 per cent to over $63.3 per barrel since October 2020, forcing oil retailers to increase pump prices. That is only half true. Indians are paying much higher than what they were paying in January 2020, even though crude prices are yet to reach those levels! Pump prices of both fuels in other countries are just reaching pre-pandemic levels, while Indian consumers are shelling out a lot more.

- Why are Indians made to pay more: Retail petrol and diesel prices are in theory decontrolled — or linked to global crude oil prices. So if crude prices fall, as seen since February 2021, retails prices should come down too, and vice versa. But this does not happen in practice, largely because oil price decontrol is a one-way street in India. So, when global prices go up, the resultant increase is passed on to the consumer, who has to cough up more for every litre of fuel consumed — but when the reverse happens and prices slide, the government puts fresh taxes and levies to ensure that it rakes in extra revenues! The consumer loses always.

- Who earns: The main beneficiary in this price decontrol is the government. The consumer is a clear loser, as are the fuel retailing companies. Early into the novel coronavirus pandemic in 2020, when crude prices crashed, the state-owned oil retailers stopped price revisions for a record 82 days. The consumer was hit by a double whammy of sorts — not benefitting from the fall in crude prices in the first half of fiscal 2021, and then facing record high prices in the second half even as crude prices partially recovered, with the government using the opportunity to raise taxes on petrol and diesel.

- Brent crude: Prices collapsed in April 2020 after the pandemic spread around the world, and demand fell away. But as economies have reduced travel restrictions and factory output has picked up, global demand has improved, and prices have been recovering. Brent crude, which was trading at about $40 per barrel between June and October, started rising in November, and has gone past the $60 per barrel mark as the global rollout of Covid-19 vaccines gathers pace. The controlled production of crude amid rising demand has been another key factor in boosting oil prices, with Saudi Arabia voluntarily cutting its daily output by 1 million barrels per day to 8.125 million barrels per day through February and March.

- Impact of taxes: The central government hiked the central excise duty on petrol to Rs 32.98 per litre during the course of last year from Rs 19.98 per litre at the beginning of 2020, and increased the excise duty on diesel to Rs 31.83 per litre from Rs 15.83 over the same period to boost revenues as economic activity fell due to the pandemic. A number of states have also hiked sales tax on petrol and diesel to shore up their revenues. The government of Delhi raised the Value Added Tax on petrol from 27 per cent to 30 per cent. Today, state and central taxes amount to around 180 per cent of the base price of petrol and 141 per cent of the base price of diesel in Delhi. (Taxes on fuels as a % of pump prices was 65 per cent of the retail price in Germany and Italy, 62 per cent in the United Kingdom, 45 per cent in Japan, and around 20 per cent in the US).

- OMCs: The price of India’s crude basket fell from $64.3 per barrel in January 2020 to $19 in April 2020, but price of auto fuels fell only marginally from Rs 75.14 to Rs 69.59 in the case of petrol and Rs 68 to Rs 62.3 in the case of diesel, with the government holding on to most of the gains from lower crude oil prices rather than passing them to consumers. The oil marketing companies had halted daily revisions of petrol and diesel prices for 82 days starting March 16, 2020 when international price was at its lowest.

- Basket of Hope: The average price of India’s crude basket has increased to $54.8 per barrel in January 2021 from about $40 per barrel in June 2020, and the government has kept central levies high, leading to prices rising. While the oil marketing companies are notionally free to set prices for petrol and diesel based on international prices, hikes in central levies nullify any gains.

- Other countries: The price of petrol is hitting pre-pandemic levels in other countries, but India has been seeing record high prices since January due to high state and central taxes. The average price of petrol in India (Delhi) in January was up 13.6 per cent compared to the year-ago period, while average price of Brent crude was down about 14 per cent. And consumers in the US, China, and Brazil paid average prices in January that were 7.5 per cent, 5.5 per cent, and 20.6 per cent lower than the year-ago period.

- Impact on inflation: The impact of rising fuel inflation has been counterbalanced by declining food inflation, but consumers with greater expenditure on travel are feeling the pinch. The urban population would be more impacted by rising fuel prices than the rural population. A weak monsoon may lead to rural India being hit as farmers are forced to rely more on diesel-powered irrigation.