To help the Indian economy recover from a recession and muted growth, some demand shots can be created.

Reviving India's Covid-hit economy - A roadmap

- The story: Indian economy was already growing slowly, when the pandemic hit in 2020. It shrank substantially in 2020-21, and then was recovering when the second wave hit. A clear roadmap ahead is the need of the hour now. Here are some views from various experts, as they appeared in the mainstream media.

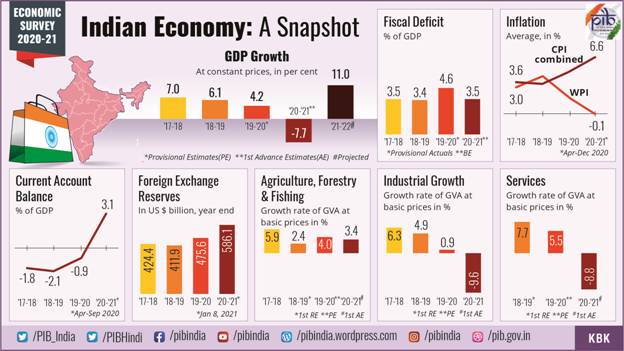

- Facts of the economy: Some key truths should be understood first -

- The steady decline in growth started since the first quarter of 2018-’19 (April 2018 onwards). The GDP growth declined from 7.1% during the first quarter of 2018-’19 to 1.6 % during the fourth quarter of 2020-’21, with negative growth of the first (-24.4%) and the second (-7.4%) quarters of 2020-’21. India's per capita income slumped to the level of just Rs 99,694 in 2020-’21 from Rs 1,00,268 in 2017-’18. India's per capita in 2021 is now what it used to be in 2016-17.

- Covid-19 impacted many macro aggregates that caused a huge demand deficiency. Lockdowns led to huge job losses due to the closure of various commercial and industrial as also all contact service establishments including Micro, Small and Medium Enterprises (MSMEs). As per the Centre for Monitoring Indian Economy (CMIE), job loss were estimated at 50 lakh by March 2020. Recent estimates on June 17, 2021 put job loss at 2.53 crore since January 2021. The labour participation rate has fallen to 39.7 % in June 2021 from 42.9% in June 2018.

- The "State of Working India 2021" report showd that 23 crore individuals have fallen below the national minimum wage of Rs 375, as recommended by the Anoop Satpathy Committee. So the income poverty rate rose by 15% in rural areas and nearly 20% in urban areas. Many families have now fallen into Covid indebtedness, making distress sale of assets (gold). Many are reducing food intake too, leading to nutritional distress.

- The Indian economy is highly unequal, and as per the World Inequality Database, the share of the top 10% in India’s national income was 56%, higher than that in comparable countries like Indonesia (41%), Vietnam (42%) and even China (41%). A study found that in April and May 2020 the poorest 20% of the households lost their entire incomes while the richer households lost less than a quarter of their pre-pandemic incomes. So household consumption has plunged. The recovery among poorer households would be slower as they were forced to sell productive assets and/or to borrow to survive the crisis.

- Pew Research Centre reported that the first wave of Covid-19 has witnessed a shrinkage of India’s middle class which has the capacity to consume and save to 6.6 crore from 9.9 crore. The private consumption as a proportion of GDP at constant prices has plummeted to 55.4 in the fourth quarter of 2020-’21 from 56.2 during the first quarter of 2018-’19. Private consumption has been the major driver of India’s GDP.

- Demand problem: All this shows that the economy is suffering from a huge demand deficiency. Solution is a major demand push.

- Atmanirbhar Bharat package - The government, on May 13, 2020, May 17, 2020, October 12, 2020, and November 12, 2020, proposed many schemes providing for Rs 29.87-lakh crore, equivalent to about 16% of India’s GDP. But actual fiscal outlay was just about Rs 3-lakh crore or 1.5% of GDP. A large part of the stimulus measures was quasi-fiscal in nature with partial or zero outgo. The fiscal outgo was directed towards helping the poor and vulnerable sections including migrant workers, farmers, rural population, agriculture and allied services, MSMEs and senior citizens of the society.

- Supply side push - The Budget 2020-’21 also provided for a huge allocation of Rs 5.54-lakh crore for infrastructural projects with the objective to create jobs which in turn would promote consumption that could drive growth.

- Corporate tax cut - Starting from a drastic cut in corporation tax prior to budget to 2020-’21, the majority of the stimulus schemes under the Atmanirbhar Bharat were intended to stimulate private investment. In the face of falling demand, the response is sluggish except for the health and pharmaceutical-related sectors. But the four quarters following the stimulus package have not witnessed significant growth.

- Clearly the economy needs a big demand push for growth recovery.

- Solution: The Centre should use its huge gain from heavy petroleum taxes, massive RBI transfers and an increased income tax revenue to support the following -

- Households stuck in indebtedness due to Covid-19 hospitalisation must be given full relief

- Households having lost the earning member must be given a basic income of Rs 7,000 per month.

- Release of the three instalments of dearness allowance to the central government employees amounting to around Rs 37,500 crore in the form of expenditure voucher could be considered (so they are spent not saved)

- A total of 1,737 Central sector projects (including delayed projects) costing Rs 150 crore and above with about Rs-26.71 lakh core anticipated completion cost (425th Flash Report by Ministry of Statistics and Programme Implementation) and those proposed in Budget 2020-’21 should be executed on a fast-track basis

- Migrant labours with no jobs should be given a basic income of Rs 7,000 per month for six months

- Urban micro-entrepreneurs and daily wage earners who have lost their livelihood should be given a basic income of Rs 7,000 per month for four to six months

- Summary: Focus on demand regeneration will lead to a much quicker recovery, than focusing on supply side measures. The time to act is now.

COMMENTS