Useful compilation of Civil Services oriented - Daily Current Affairs - Civil Services - 01-04-2021

- Indian Economy - Core industries' output contracts in Feb 2021 - The output of eight infrastructure sectors contracted by 4.6% in February 2021, as compared to a revised growth of 0.9% in January, according to data released by the Ministry of Commerce & Industry. This is the highest contraction in six months. All the core segments, including coal, crude oil, natural gas, refinery products and fertilisers witnessed a decline in February. The "core sectors" are eight in number and include Coal, Crude oil, Natural Gas, Petroleum refinery products, Fertilizer, Cement, Steel, and Electricity generation. These eight industries comprise 40.27% of the weight of the items included in the Index of Industrial Production. The IIP is an index that measures the volume growth or decline in industrial production (not value). Contraction of core sector shows that the main engines of economy are not growing.

- Constitution and Law - New York lawmakers legalize marijuana - The New York lawmakers have passed a bill to legalize the use of marijuana by adults. This will make New York the 15th state in the United States to allow recreational use of the drug. New York Governor Andrew Cuomo said on March 30, 2021 that the city has a storied history of being the progressive capital of the nation and the important legislation will once again carry on that legacy. The decision was also welcomed by pro-marijuana groups, as thousands of New Yorkers are arrested every year over petty marijuana offenses, of whom most are young, poor and people of colour. India has an equally interesting history with the cannabis plant. Commonly used in the subcontinent for millennia, it was only outlawed in 1985 by the Narcotic Drugs and Psychotropic Substances Act, following from the 1961 UN Single Convention.

- World Politics - Indo-Korean Friendship Park - India’s First Indo-Korean Friendship Park was jointly inaugurated by Republic of Korea and India at Delhi Cantonment. The park is significant for it being a symbol of strong India-South Korea friendly relations. It is also a monument to India’s contributions as part of 21 countries which participated in Korean war 1950-53, under the aegis of the UN. One of the pillars in the park encompasses Nobel Laureate Gurudev Rabindranath Tagore’s narration of Korea as “The Lamp of the East” which was published in Korean daily “Dong-A-llbo” in 1929. Formal establishment of diplomatic ties between the two countries occurred in 1973, and since then, many trade agreements have been reached: (i) Agreement on Trade Promotion and Economic and Technological Co-operation in 1974; (ii) Agreement on Co-operation in Science & Technology in 1976; (iii) Convention on Double Taxation Avoidance in 1985; and (iv) Bilateral Investment Promotion/ Protection Agreement in 1996.

- World Politics - COVID-19 third-leading cause of US deaths - The COVID-19 disease was the third-leading cause of death in the US in 2020, the Centers for Disease Control and Prevention (CDCP) said. COVID-19 was the underlying or contributing cause of 3,77,883 deaths in US in 2020. American Indians, Hispanics and Blacks had the highest COVID-19 death rates by ethnicity, while most deaths were reported in people aged 65 or above. Provisional estimates from the CDC, published last month, showed that life expectancy in the U.S. fell by a year in the first half of 2020 - the biggest decline since World War 2 - and stood at the lowest levels since 2006. The CDC's current analysis is based on provisional death estimates, but they provide an early indication of shifts in mortality trends, the agency said.

- Science and Technology - Asteroid Apophis - The National Aeronautics and Space Administration (NASA) has ruled out the possibility of the dreaded asteroid Apophis causing any damage to the Earth for the next 100 years. Apophis is a near-Earth asteroid with a relatively large size (about 335 meters wide). Named after the ancient Egyptian god of chaos and darkness, it was discovered in 2004, after which NASA had said that it was one of the asteroids that posed the greatest threat to Earth. Apophis was predicted to come threateningly close to us in the years 2029 and 2036, but NASA later ruled these events out. However, there were still fears about a possible collision in 2068. Recently, the asteroid flew past Earth on 5th March 2021, coming within 17 million km of our planet. During this approach, scientists used radar observations to study in detail the asteroid’s orbit around the sun. Asteroids come in various shapes and sizes. They tend to be rockier than comets. In contrast to asteroids, most comets come from beyond the orbit of Pluto, in a region of the solar system called the Oort Cloud. ... It's when comets sweep in close to the sun that they produce their characteristic gas and dust tails.

- World Politics - France imposes third national lockdown - French President Emmanuel Macron announced on 31-03-2021 that a 'limited lockdown' will be imposed across the nation and schools would be closed for three weeks. From Saturday night and for the next four weeks, travel restrictions will be imposed across the country and non-essential shops will close in line with measures already implemented in COVID-19 hotspots such as Paris. According to Santé Publique France’s latest data, France reports +303 more deaths in 24 hours. This Wednesday 31 March 2021, the death toll includes +303 hospital deaths and 0 in nursing homes. +59,038 new cases have been reported in 24 hours.

- Agriculture - Revival of Millet Cultivation - An International Fund for Agricultural Development (IFAD) supported initiative to revive Kodo and Kutki Millets cultivation, started in the year 2013-14 in Dindori district of Madhya Pradesh, has given new life to the forgotten crops. IFAD is a specialized agency of the United Nations and was one of the major outcomes of the 1974 World Food Conference. Founded in 1977, IFAD focuses on rural poverty reduction, working with poor rural populations in developing countries to eliminate poverty, hunger, and malnutrition. The project was started with 1,497 women-farmers from 40 villages – mostly from the Gonda and Baiga tribes – growing these two minor millets (Kodo and Kutki) on 749 acres. The identified farmers were supplied good-quality seeds and trained by scientists from the Jawaharlal Nehru Agricultural University in Jabalpur and the local Krishi Vigyan Kendra – on field preparation, line-sowing (as opposed to conventional broadcasting by hand) and application of compost, zinc, bavistin fungicide and other specific plant protection chemicals.

- Defence and Military - Exercise Vajra Prahar - The Special Forces of India and the USA conducted the joint military exercise ‘VAJRA PRAHAR 2021’ in Himachal Pradesh. Earlier, India and the USA navy had carried out a two-day Passage Exercise (PASSEX) in the eastern Indian Ocean Region. The joint exercise by the Special Forces of both the countries is conducted alternatively between India and the United States. Special Forces are the units of a country's armed forces that undertake covert, counterterrorist, and other specialized operations. This is the 11th edition of the exercise conducted at Special Forces Training School located at Bakloh, Himachal Pradesh. The 10th edition of VAJRA PRAHAR was held in 2019 at Seattle, USA. Aim is to share the best practices and experiences in areas such as joint mission planning and operational tactics as also to improve interoperability between the Special Forces of both nations.

- Indian Economy - GST collections record high in March 2021 - The Finance Ministry said that the GST revenue collection for March 2021 stood at a record ₹1,23,902 crore. This is the highest since the introduction of GST, it added. Of the GST revenue collected in March, CGST is ₹22,973 crore, SGST is ₹29,329 crore and IGST is ₹62,842 crore. GST revenue crossed ₹1 lakh crore for the sixth consecutive month. Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue over last few months, the government said. The stability in GST numbers comes at a time when the Centre is mulling the merger of 12% and 18% slabs.

- World Politics - China threatens NASA over Taiwan - China asked US space agency NASA to "correct its mistake as soon as possible" after it referred to Taiwan as a country on its website. Calling the incident "unforgivable", China said NASA has hurt the feelings of the country's 1.4 billion people. Taiwan appears as an option on a "country" drop-down box on NASA's website, "Send Your Names to Mars". Zhu Fengilan, the spokeswoman for the Beijing office was quoted by the US media as saying "We hold the clear and firm attitude that the island of Taiwan is part of China. NASA's step to list Taiwan as a country has severely violated the One-China principle and the provisions of the three China-US joint communique. It is not only against the international consensus on the principle but also hurts the feelings of Chinese people," Zhu claimed. Recently, the US Secretary of state, Antony Blinken also referred to Taiwan as a "country", the term that is by far avoided by the US since 2018 when China mounted pressure on the US airlines to stop referring to Taiwan as a country.

- [message]

- SECTION 2 - DAILY CURRENT AFFAIRS

- [message]

- 1. ECONOMY (Prelims, GS Paper 3, Essay paper)

Indian government's April Fool shocker for small savings schemes

- A shock announcement: For the second time in one year, the govt. announced it was cutting interest rates on Senior Citizen Savings Scheme and National Savings Certificate by 90 basis points to 6.5% and 5.9%, respectively. For the Public Provident Fund (PPF), a popular investment and tax-saving avenue, the rate was cut by 70 basis points to 6.4%. (lowest rate since July 1974, at 5.8%)

- Reversal of decision: In a tweet on 01-April, 2021, the finance minister Nirmala Sitharaman reversed this decision and said: “Interest rates of small savings schemes… shall continue to be at the rates which existed in the last quarter of 2020-2021." She attributed it to an 'oversight'. But it's clear that the fact that assembly elections were currently on in several states, forced her to cancel the rate revision.

- General trend: In February 2021, the weighted average interest rates on domestic term deposits of banks was just 5.39%, having dropped by 1.13 % since the beginning of 2020. In parallel, the weighted-average lending rate of banks has gone down by 85 basis points to 9.29% during the same period.

- Lower interest rates are supposed to help both individuals and corporate borrowers, leaving more cash in hand for other economic activities than just repaying a loan.

- At lower interest rates, individuals may borrow and spend more, and corporates borrow and expand, helping the economy grow in the process.

- This is the standard logic given by experts, always.

- But by February 2021, the overall lending to corporates had contracted by 0.24%, showing that borrowing isn’t just about lower interest rates. When it comes to retail lending, the growth was rather subdued in the single digits at 9.55%. (retail lending and personal loans are the most attractive segment for Indian banks now)

- Government's self-interest: The other beneficiary of lower interest rates is the government. In 2020-21, the government had plans to borrow a total of ₹12.8 trillion. In 2021-22, it plans to borrow a further ₹12.06 trillion. It would love lower interest rates. But are borrowers the only part of this story? No, there are savers on the other side as well, and lower interest rates hit them hard.

- Savers: The interest rates on offer now are very close to the inflation rate, which was at 5.03% in January. Core inflation (excludes food, fuel and light items) was around 6% in January 2021.

- The real rate of interest (interest rate minus core inflation) on deposits is now in negative territory. And this is without even taking into account the income tax that needs to be paid on interest on deposits.

- A significant section of Indians, e.g. senior citizens, are dependent on interest income to meet their regular expenditure. They have already been hurt by low interest rates, and a cut in interest rates on small savings schemes would have further hurt them.

- When interest rates fall as much as they have since the beginning of 2020, and inflation doesn’t, the senior citizens end up in trouble. The only way out being to cut down on their expenditure. This impacts consumption and, in turn, economic growth.

- Indians don't prefer stocks: Most Indians save by investing in fixed deposits, small savings schemes, provident and pension funds and life insurance. In 2019-20, 84.24% of the household financial savings were made in these. Investment in shares and debentures (which includes mutual funds), despite all the hype, formed a minuscule 3.39% of the overall savings. A fall in interest rates negatively impacts a bulk of India’s savers, with the return on their investments coming down. This obviously has an impact on consumption.

- Desperate for returns: Due to low interest rates, some savers have moved their money into the stock market in search of higher returns. They have been successful over 2020, but current valuations are high, and if the bubble bursts, they may lose a lot. A fresh cut in interest rates on small savings schemes would have pushed more investors into stocks, increasing the overall riskiness.

- So what is an ideal level: The Indian banking system is facing a serious problem. Between March 27, 2020, and March 12, 2021, the banks have raised deposits worth ₹13.55 trillion, and given out loans worth just ₹4.27 trillion (less than a third of the deposits). So banks are unable to lend out a bulk of the deposits raised, so it is natural for the interest rates to fall. The RBI has printed and pumped money into the financial system, driving down interest rates further in order to help the government borrow money at lower rates. So anyone who claims that "lower interest rates are good for the economy", clearly is focused on the borrowers, and not the savers (who are many times more numerous than the borrowers).

- [message]

- 2. ENVIRONMENT AND ECOLOGY (Prelims, GS Paper 3, Essay paper

New Red Algal Seaweed species

- The story: Two new red algal seaweed species have been discovered along India’s coastline, in 2021. India has a coastline of over 7,500 kms.

- Points to note: These species grow in the intertidal regions of the coast, namely the area that is submerged during the high tide and exposed during low tides. The genus Hypnea consists of calcareous, erect, branched red seaweeds. There are 61 species of which 10 were reported in India. With two new species, the total number of species now would be 63.

- Hypnea indica was discovered in Kanyakumari in Tamil Nadu, and Somnath Pathan and Sivrajpur in Gujarat.

- Hypnea bullata was discovered from Kanyakumari and Diu island of Daman and Diu.

- Importance: Hypnea variants of seaweeds can fetch good monetary value if commercial-scale cultivation is taken up. Hypnea contains Carrageenan, a biomolecule commonly used in the food industry.

- Seaweeds: These are the primitive, marine non-flowering marine algae without root, stem and leaves, play a major role in marine ecosystems. Large seaweeds form dense underwater forests known as kelp forests, which act as underwater nurseries for fish, snails and sea urchins. Some species of seaweeds viz. Gelidiella acerosa, Gracilaria edulis, Gracilaria crassa, Gracilaria verrucosa, Sargassum spp. and Turbinaria spp. Seaweeds are found mostly in the intertidal region, in shallow and deep waters of the sea and also in estuaries and backwaters. The southern Gulf of Mannar’s rocky intertidal and lower intertidal regions have rich populations of several seaweed species.

- Ecological importance:

- Bioindicator - When waste from agriculture, industries, aquaculture and households are let into the ocean, it causes nutrient imbalance leading to algal blooming, the sign of marine chemical damage. Seaweeds absorb the excess nutrients and balance out the ecosystem.

- Iron sequestrator - These aquatic organisms heavily rely on iron for photosynthesis. When the quantity of this mineral exceeds healthy levels and becomes dangerous to marine life, seaweeds trap it and prevent damage. Similarly, most heavy metals found in marine ecosystems are trapped and removed by seaweeds.

- Oxygen and Nutrient Supplier - On their part, the seaweeds derive nutrition through photosynthesis of sunlight and nutrients present in seawater. They release oxygen through every part of their bodies. They also supply organic nutrients to other marine life forms.

- Role in Climate Mitigation - Seaweed has a significant role in mitigating climate change. By afforesting 9% of the ocean with seaweed, it is possible to sequester 53 billion tons of carbon dioxide annually. Hence, there is a proposal termed as ‘ocean afforestation’ for farming seaweed to remove carbon.

- Other Utilities - They can be used as fertilizers and to increase aquaculture production. When livestock is fed with seaweed, methane emission from cattle may be reduced substantially. They can be buried in beach dunes to combat beach erosion. It is used as an ingredient in preparing toothpaste, cosmetics and paints.

- Related Initiative - The Technology Information, Forecasting and Assessment Council (TIFAC) has launched a Seaweed Mission.

- [message]

- 3. FOREIGN AFFAIRS (Prelims, GS Paper 3, Essay paper)

- 3. FOREIGN AFFAIRS (Prelims, GS Paper 3, Essay paper)

President Biden repealing Trump-Era ICC sanctions

- A strike for human rights: The Biden administration in US is about to revoke a Trump-era executive order levying sanctions on the prosecutor of the International Criminal Court (ICC) and a top deputy, removing another source of friction in U.S. relations with key allies, including many of America’s European counterparts, according to two sources familiar with the decision.

- US not anti-human rights: The expected move is likely to ease a state of open hostility by the U.S. government toward the Hague-based international tribunal, which clashed bitterly with the Trump administration over its efforts to investigate possible war crimes by American personnel in Afghanistan and Israeli security forces in the Palestinian territories. But it is unlikely to end tension between the court and the Biden administration, which, like prior administrations, contends that the tribunal lacks standing to prosecute Israeli and U.S. nationals. Neither country has ratified the 1998 treaty creating the international court.

- Once Trump left: This move comes after months of pressure on the Biden administration from human rights groups and European governments after former President Donald Trump left office. In February 2021, more than 80 groups signed an open letter urging the Biden administration to repeal the Trump-era sanctions, calling them a “betrayal of the U.S. legacy in establishing institutions of international justice.”

- It comes after the ICC judges this week upheld the conviction and 30-year prison sentence of a Congolese warlord, Bosco Ntaganda, for atrocities committed during an ethnic conflict in the Democratic Republic of the Congo in 2002 to 2003.

- The United States played a key role in Ntaganda’s apprehension and transfer to the ICC, an example that experts point to as showing how U.S. cooperation with the ICC can advance global human rights and accountability measures.

- The Trump administration took a hostile approach to the Hague-based court, viewing its efforts to scrutinize alleged war crimes by Israeli forces in the Palestinian territories and American personnel in Afghanistan as an affront to those countries’ sovereignty.

- Trump issued a sweeping executive order in June 2020, authorizing the imposition of economic sanctions against any ICC officials participating in the investigation of “allied personnel without that ally’s consent.”

- Trump's actions: Executive Order 13928 was issued months after the court’s judges authorized an investigation into alleged war crimes by U.S. service members and intelligence officers. It followed an April 2019 decision to revoke a U.S. travel visa for Fatou Bensouda, a Gambian lawyer who serves as the ICC chief prosecutor. In September 2020, then-Secretary of State Mike Pompeo announced the imposition of a series of travel restrictions and financial sanctions on Bensouda and a senior aide, Phakiso Mochochoko, for engaging in “illegitimate attempts to subject Americans to its jurisdiction.” Trump’s executive order, issued under a specious national emergency, was due to expire in June 2021.

- Trump versus Biden: The Trump executive order, an assault on the premier institution of international justice, is at odds with the Biden administration’s professed aim of reasserting America’s support for human rights in the world.

- ICC: The criminal court was established by treaty at a 1998 conference in Rome to prosecute perpetrators of the most serious crimes and came into force in 2002. The Clinton administration signed the treaty in December 2000, but the George W. Bush administration “unsigned” it in May 2002, voicing fears that the prosecutor might carry out frivolous investigations into Americans and their allies.

- Bush and his successor Barack Obama never fully embraced the court, but they found ways to support or at least not impede its investigations that suited American interests.

- In March 2005, the Bush administration abstained on a United Nations Security Council vote authorizing an investigation into mass atrocities in Darfur, Sudan, and the Obama administration voted in favor of a 2011 decision by the Security Council to open an ICC investigation into crimes committed in Libya. But the United States has never ratified the treaty.

- Even with the massive shift in foreign policy from Trump to President Joe Biden, the Biden administration is still hewing to past criticisms of the ICC, particularly over its investigations on Israeli-Palestinian issues.

- Human rights experts have praised some of the Biden administration’s early moves, including ending the so-called Muslim travel ban and reengaging the United Nations. But some say they’ve been disappointed by the slow pace of Biden’s efforts to roll back Trump-era policies, including waiting months before making a decision on the ICC sanctions. Some say that even if Biden lifts the sanctions, the fact that the United States imposed sanctions in the first place could still cause lasting damage to Washington’s reputation on global human rights.

- [message]

- 4. GOVERNMENT SCHEMES (Prelims, GS Paper 2, Essay paper)

- 4. GOVERNMENT SCHEMES (Prelims, GS Paper 2, Essay paper)

Suez Canal blockade and implications

- Choke point choked: The Suez Canal, one of the world’s most critical transit routes, got blocked in March 2021 due to a large container vessel, the MV Ever Given. This has caused enormous disruption to global shipping. The temporary closure proved expensive for global trade, as it is estimated that the loss per hour is almost $400 million. The negative impact on the intricate and delicately balanced global supply-chain and oil prices will impose additional costs on the customer globally.

- The importance of it: Suez canal closure automatically lead to a cascading downstream disruption of trade and economic consequences. This aspect points to the fragility of global trade and needs to strengthen them.

- Suez Canal background: The origins of the Suez Canal go back to the ancient period and the first waterway was dug during the reign of Senusret III Pharaoh of Egypt (1874 BC). But this rudimentary canal was abandoned due to silting and reopened several times in the intervening centuries. The modern Suez was built in the mid-19th century through efforts by the French and opened for navigation on November 17, 1869. In 1858, the Universal Suez Ship Canal Company was tasked to construct and operate the canal for 99 years, after which rights would be handed to the Egyptian government. Located in Egypt, the artificial sea-level waterway was built between 1859 and 1869 linking the Mediterranean Sea and the Red Sea. The Suez Canal is pivotal in connecting Europe and Asia, as it negates the need to navigate around the Cape of Good Hope in Africa and thus cutting distances by up to 7,000 km. The Suez Canal put Egypt at a strategic junction between Asia and Europe. In the wave of assertion by colonies and quasi-colonies, Gamal Abdel Nasser nationalized the canal in 1956. In order to protect the corporate interests that hinged on the Canal, Britain, France, and Israel invaded Egypt. This war was termed the Suez Crisis 1956.

- Significance:

- Helped the colonisers - The construction of the Suez Canal was a tectonic development for global maritime connectivity and impacted colonial history in a definitive manner. The rise of the British Empire was enabled considerably by this canal.

- Global trade's lifeline - The canal continues to be the lifeline for all trade between the West and East as 10% of the global trade passes through it every year. The value of goods shipped through the canal is estimated to be $9.5 billion daily and the canal generates a major share of the revenue for the Egyptian government.

- Global choke point - The Suez along, with the Panama canal (that links the Pacific and Atlantic oceans), are the two most critical canals in the global maritime domain along with the Volga-Don and the Grand Canal (China).

- Impact of closure: The Suez situation could compound issues for a supply chain already under pressure from the pandemic and a surge in buying. The closure could affect shipments of oil and natural gas from the Mideast to Europe.

- Summary: The world is a different place now but between then and now, global trade's vulnerabilities have only grown.

- [message]

- 5. POLITY AND CONSTITUTION (Prelims, GS Paper 2, GS Paper 3)

Establishment of the RBI

- British Raj feels the need: After amalgamating the three Presidency Banks (Bombay, Bengal and Madras), a larger bank 'The Imperial Bank of India' was constituted, but it was functioning like a quasi-central bank. The prevailing economic conditions particularly regulating issue of notes, money supply, money maintenance, economic policy, monetary and payments system and regulating and controlling the banking system in India needed a centralized institution which could function as a central bank of India.

- Nascent efforts: Due to economic crises during 1913-17 and later in 1922 a number of banks had failed because of their unregulated activities. These circumstances created a need to seriously consider establishment of Central Bank for India. The efforts of creating a banking institution with central banking character had been considered from time to time. In late 18th century in 1773 a bank with character of a central bank was established in Bengal on the recommendations of Governor of Bengal but it could not sustain. Another effort for establishment of a Central Bank was made by a member of Bombay Government. He had in 1807-08 prepared a scheme for a General Bank. The Governor General in Council of Bengal, to whom the scheme was submitted for consideration expressed – “The idea of Mr. Richard appeared to us to resolve themselves into mere speculation, without embracing objects capable of being realized while the machinery proposed by the gentleman for the performance of a very simple operation, was extremely cumbersome and complicated.” The scheme was rejected by the East India Company.

- Hilton Commission: In 1926 the Royal Commission of Currency & Finance (Hilton Young Commission), after carrying out a widespread survey on currency, economy and banking conditions, recommended a Central Bank to take over the entire control of banks to end the dichotomy of functions and divisions of responsibilities for control of currency and credit. Its recommendations envisaged that the central bank should have its separate existence for augmenting banking functions throughout the country.

- Sir Hilton Young had vast experience on financial matters and had been working as financial journalist writing for the ECONOMIST. He was the London correspondent of the Financial Supplement of the New York Times. Later in 1915 he was elected to the House of Commons. Before recommending the central bank for India he had in 1925 prepared a scheme for the Government of Iraq for enabling them to issue their own currency through a Board located in London.

- Before having their currency the Indian Rupee was introduced in Iraq by the British expeditionary forces. Firstly Iraq did not accept the proposal but later in 1930 Iraq agreed to the proposal as London based currency board model was already in use by Britain in numbers of its colonies. Mr. Hilton Young also played a vital role in establishing the framework in which the Iraq Currency Board was to operate.

- Hilton Young had also headed a mission to Poland from 1923-25 to help establish a stable economy which introduced the Zloty. In 1925-26 he was Chairman of a Royal Commission on Indian finance, which inter-alia drew up the constitution of the Reserve Bank of India) He also served as a Director of British Bank of Middle East.

- Recommendations: Hilton Young Commissions recommendations for creating a Central Bank for India was backed by Mr. Hilton’s rich experience in financial, economic and banking matters. But it was not so easy that the recommendations were accepted solo motto. The bill to establish a central bank for India was first introduced in January 1927 in the Legislative Assembly. A long drawn discussion among members took place with large number of differences in views regarding ownership, constitution and composition of its Board of Directors that made the whole atmosphere so clouded that the proposal was dropped.

- What should be the Name of Central Bank - First of all what is a Central Bank and on what principles it should be based. If the purpose is to centralizes the control of all banks it should be known as central bank and not the Reserve Bank. As regards the meaning of a Central Bank, it can be and has been defined in many ways. But in simple words a Central Bank may be described as “The people’s agency to govern their supply of currency and credit, free from any undue influence of political or profits.” The purpose of Hilton Young Commission 1926 in suggesting the name as Reserve Bank was to avoid ambiguity. In India a number of banks existed having concept or nomenclature suggesting the name of Central Bank! The Central Bank of Africa was also founded in 1920 with the similar name i.e., Reserve Bank of South Africa. In view of this consideration the name of the Reserve Bank seemed quite suitable and people had also become familiar with it since it had been used not only in the report of the Hilton Young Commission, but also in number of reports of the provincial and Indian Banking Enquiry Committees (1929-31).

- What should be the functions and mechanisms - According to the Indian Central Banking Enquiry Committee (1929-31), the two principal tasks of the Reserve Bank will be to maintain the international value of the rupee and to control the credit situation in India, which would include the rate of interest at which credit would be available to trade and industry’. It should have the sole right of note issue; it should be the channel, and the sole channel, for the output and intake of legal tender currency. It should be the holder of all the Government balances; the holder of all the reserves of the other banks and branches of banks in the country. It should be the agent, so to speak, through which the financial operations at home and abroad of the Government would be performed. It would further be the duty of a central bank to effect, so far as it could, suitable contraction and suitable expansion, in addition to aiming generally at stability, and to maintain that stability within as well as without. When necessary it would be the ultimate source from which emergency credit might be obtained in the form of rediscounting of approved bills, or advances on approved short securities, or Government paper.

- Summary: The conclusion was that a central Bank must have four functions or rights - 1) The right of note issue, 2) The right to hold the reserves of the commercial banks, 3) The right to buy and sell securities, and 4) The right to discount. The above four were strongly recommended by the Committee on Finance and Industry in its report of 1931. The committee was of the view that the main objective of a central Bank is to maintain stability in the value of money or, which is the same thing, steady prices.

- Mechanism: It should be obvious that the twin rights of note issue and holding the reserves of the commercial banks place the Central Bank in the best position to control the existing supply of currency and credit. As the only bank of issue it has the power, broadly speaking, to expand and contract currency, as it may deem fit; while in its capacity as the custodian of the reserves of commercial banks, it occupies the position of a sovereign bank, bankers’ bank or a Central Bank a bank which is the central supervisory body to co-ordinate the activities of all banks in the country.

- Safeguards and Restrictions: A Central Bank has very wide powers in the realm of finance for it is charged with the supreme duty of maintaining stability in the value of money or a steady price-level and, therefore, equipped with the sole right of note issue coupled with the custody of the nation’s ultimate cash reserves both governmental and banking. A Central Bank is thus both a Bankers’ Bank and a State Bank in the sense that it serves both the banks as well as the State. But it is more. It is the Nation’s Bank which exists for the larger service of the nation, sectional interests having no place in it. It must adequately also be safeguarded from all undue influence of politics or profits, from sectional influences whether of institutions or individuals, and particularly from all extraneous and foreign influences. The ultimate responsibility for the stability of national currency must, of course, rest with the national government. But in the interests of such stability itself, it is best that the regulation of currency and credit is in the hands of a bank free from governmental control.

- Position of Credit: India was not altogether lacking in the elements which go to make up a sound banking system. There did exist the indigenous bankers, co-operative societies, commercial banks, exchange banks, savings banks, investment securities, even some bills of exchange and stock exchanges, but they are all ill-developed and lack co-ordination. The banking reserves of the country were scattered among various agencies with no mechanism for their mobilisation, while credit, was also divorced from currency. This was perhaps the greatest weakness of the banking system in India, and was responsible for the evils of fluctuating and high rates of interest. An annual range of three per cent, in interest rates was unheard of in other countries, but was quite ordinary in India and exercises a detrimental influence on the economic life of the country. variation in the bank rate.’

- Role of Dr. Ambedkar: He was an economist, politician, and social reformer who was known for his campaigns against social discrimination against Dalits, women and labour. He was the first untouchable to pass matriculation and become first Indian to pursue an Economic doctorate degree abroad. The Reserve Bank of India was conceptualised in accordance with the guidelines presented by Dr Ambedkar to the Hilton Young Commission (also known as Royal Commission on Indian Currency and Finance) based on his book, 'The Problem of the Rupee – Its Origin and Its Solution'.

- [message]

- 6. SCIENCE AND TECHNOLOGY (Prelims, Various GS Papers)

LIDAR

- What it is: Light detection and ranging (LiDAR) is a remote sensing method that uses light in the form of a pulsed laser to measure ranges to the Earth.

- Details: LiDAR uses a pulsed laser to calculate an object’s variable distances from the earth surface. LiDAR follows a simple principle — throw laser light at an object on the earth surface and calculate the time it takes to return to the LiDAR source. Given the speed at which the light travels (approximately 186,000 miles per second), the process of measuring the exact distance through LiDAR appears to be incredibly fast. These light pulses — put together with the information collected by the airborne system — generate accurate 3D information about the earth surface and the target object. There are three primary components of a LiDAR instrument — the scanner, laser and GPS receiver. Other elements that play a vital role in the data collection and analysis are the photodetector and optics. Two Types: Airborne LiDAR installed on a helicopter or drone for collecting data and Terrestrial LiDAR systems installed on moving vehicles or tripods on the earth surface for collecting accurate data points.

- Applications:

- Oceanography: LiDAR technology is used to map the land and is used to measure seafloor and riverbed elevations. LiDAR is also used for calculating phytoplankton fluorescence and biomass in the ocean surface, which otherwise is very challenging.

- Digital Elevation or Terrain Model: Terrain elevations play a crucial role during the construction of roads, large buildings and bridges. LiDAR technology has x, y and z coordinates, which makes it incredibly easy to produce the 3D representation of elevations to ensure that concerned parties can draw necessary conclusions more easily.

- Agriculture: Typical applications of LiDAR technology in the agriculture sector include analysis of yield rates, crop scouting and seed dispersions. Besides this, it is also used for campaign planning, mapping under the forest canopy, and more.

- Security: LiDAR is used by military for carrying out various security operations near the national borders.

- Rescue Missions: When the authorities want to know the exact depth of the ocean’s surface to locate any object in the case of a maritime accident or for research purposes, they use LiDAR technology to accomplish their mission

- Advantages: Data can be collected quickly and with high accuracy. LiDAR is an airborne sensing technology which makes data collection fast and comes with extremely high accuracy as a result of the positional advantage.

- Surface Data has a higher sample density - LiDAR gives a much higher surface density compared to other methods of data collection such as photogrammetry. This improves results for some kinds of applications such as flood plain delineation.

- Capable of collecting elevation data in a dense forest - LiDAR technology is capable of collecting elevation data from a densely populated forest thanks to the high penetrative abilities. This means it can map even the densely forested areas.

- Can be used day and night - LiDAR technology can be used day and night thanks to the active illumination sensor. It is not affected by light variations such as darkness and light. This improves its efficiency.

- Not affected by extreme weather - LiDAR technology is independent of extreme weather conditions such as extreme sunlight and other weather scenarios. This means that data can still be collected under these conditions and sent for analysis.

- Disadvantages: High operating costs in some applications; Ineffective during heavy rain or low hanging clouds because of the effects of refraction, but the data collected can still be used for analysis; Degraded at high sun angles and reflections; Unreliable for turbulent breaking waves as it will affect the reflection of pulses; No International protocols; Very large data sets which are difficult to interpret; The laser beams may affect human eye in cases where the beam is powerful; Requires skilled data analysis techniques; Low operating altitude of between 500-2000m.

- [message]

- 7. SOCIAL ISSUES (Prelims, GS Paper 2)

Global Gender Gap Index Report 2021

- What it is: The Global Gender Gap Index benchmarks the evolution of gender-based gaps among four key dimensions (Economic Participation and Opportunity, Educational Attainment, Health and Survival, and Political Empowerment) and tracks progress towards closing these gaps over time. This year, the Global Gender Gap index benchmarks 156 countries, providing a tool for cross-country comparison and to prioritize the most effective policies needed to close gender gaps.

- Global lessons: Globally, the average distance completed to parity is at 68%, a step back compared to 2020 (-0.6 percentage points). These figures are mainly driven by a decline in the performance of large countries. On its current trajectory, it will now take 135.6 years to close the gender gap worldwide.

- The gender gap in Political Empowerment remains the largest of the four gaps tracked, with only 22% closed to date, having further widened since the 2020 edition of the report by 2.4 percentage points. Across the 156 countries covered by the index, women represent only 26.1% of some 35,500 parliament seats and just 22.6% of over 3,400 ministers worldwide. At the current rate of progress, the World Economic Forum estimates that it will take 145.5 years to attain gender parity in politics.

- The gender gap in Economic Participation and Opportunity remains the second-largest of the four key gaps tracked by the index. According to this year’s index results 58% of this gap has been closed so far. The gap has seen marginal improvement since the 2020 edition of the report and as a result we estimate that it will take another 267.6 years to close.

- Gender gaps in Educational Attainment and Health and Survival are nearly closed. In Educational Attainment, 95% of this gender gap has been closed globally, with 37 countries already at parity. However, the ‘last mile’ of progress is proceeding slowly. The index estimates that on its current trajectory, it will take another 14.2 years to completely close this gap. In Health and Survival, 96% of this gender gap has been closed, registering a marginal decline since last year (not due to COVID-19), and the time to close this gap remains undefined.

- The toppers: Geographically, the global top 10 continues to be dominated by Nordic countries, with —Iceland, Norway, Finland and Sweden—in the top five. The top 10 is completed by one country from Asia Pacific (New Zealand 4th), two Sub-Saharan countries (Namibia, 6th and Rwanda, 7th, one country from Eastern Europe (the new entrant to the top 10, Lithuania, 8th) and another two Western European countries (Ireland, 9th, and Switzerland, 10th, another country in the top-10 for the first time).

- South Asian situation: Following the Middle East and North Africa, South Asia is the second-lowest performer on the index, with 62.3% of its overall gender gap closed. In addition, progress has been too slow in the recent past, and this year has actually reversed. A decline of approximately 3 percentage points has resulted in a significant delay in the projected time needed for this region to close gender gaps, now estimated at 195.4 years.

- Within the region, a wide gulf separates the best-performing country, Bangladesh, which has closed 71.9% of its gender gap so far, from Afghanistan, which has only closed 44.4% of its gap.

- India is the third-worst performer in the region, having closed 62.5% of its gap. Because of its large population, India’s performance has a substantial

- impact on the region’s overall performance. Home to 0.65 billion women, India has widened its gender gap from almost 66.8% closed one year ago to 62.5% this year.

- Lack of progress on women’s labour force participation hinders economic opportunities for women not only in these countries, but also throughout the region. Only 22.3% of women in India, 22.6% in Pakistan, and 38.4% in Bangladesh are active in the labour market. On average in the region, the women’s labour force participation rate is 51% of the male labour force participation rate. In Nepal, however, over 85% of women participate in the labour force.

- Summarised points:

- Most of the decline occurred on the political empowerment sub-index, where India regressed 13.5 percentage points, with a significant decline in the number of women ministers (from 23.1 per cent in 2019 to 9.1 per cent in 2021).

- Among the drivers of this decline is a decrease in women’s labour force participation rate, which fell from 24.8 per cent to 22.3 per cent.

- The share of women in professional and technical roles declined further to 29.2 per cent. The share of women in senior and managerial positions also remains low: only 14.6 per cent of these positions are held by women and there are only 8.9 per cent firms with female top managers.

- The estimated earned income of women in India is only one-fifth of men’s, which puts the country among the bottom 10 globally on this indicator.

- Discrimination against women is also reflected in the health and survival sub-index statistics. With 93.7 per cent of this gap closed to date, India ranks among the bottom five countries in this sub-index.

- Wide gaps in sex ratio at birth are due to the high incidence of gender-based sex-selective practices. In addition, more than one in four women has faced intimate violence in her lifetime.

- Conversely, 96.2 per cent of the educational attainment sub-index gender gap has been closed, with parity achieved in primary, secondary and tertiary education. Yet, gender gaps persist in terms of literacy: one third of women are illiterate (34.2 per cent) compared to 17.6 per cent of men.

- Among India’s neighbours, Bangladesh ranked 65, Nepal 106, Pakistan 153, Afghanistan 156, Bhutan 130 and Sri Lanka 116.

- Among regions, South Asia is the second-lowest performer on the index, with 62.3 per cent of its overall gender gap closed.

- [message]

- 8. MISCELLANEOUS (Prelims, GS Paper 1, GS Paper 2)

- 8. MISCELLANEOUS (Prelims, GS Paper 1, GS Paper 2)

Tata - Mistry Judgement

- The story: In March 2021, the Supreme Court overturned the National Company Law Appellate Tribunal (NCLAT) decision and upheld Tata Group’s decision to remove Cyrus Pallonji Mistry as the Executive Chairman and Director of Tata Sons.

- Points to note: The Supreme Court observed that minority shareholders or their representatives are not automatically entitled to a seat on the private company’s board like a small shareholder’s representative. The provisions contained in the Companies Act 2013 only protects the rights of small shareholders of listed companies by asking such companies to have on their board at least one director elected by such small shareholders. Since the Mistry family and the Shapoorji Pallonji (SP) Group are not small shareholders, but minority shareholders, there is no statutory provision which gives them the “right to claim proportionate representation,” on the board of Tata Sons. Private companies, which have minority shareholders, are free to make an enabling provision but are under no statutory obligation to give minority shareholder seats on the board.

- Pending issue: The SP Group now would want to sell its shareholding, and exit the Tata group. The valuation of that remains controversial.

RBI's inflation targeting system to continue as it is

- GoI thinks: The government asked the Reserve Bank to maintain status quo on retail inflation targeting at 4 per cent with a margin of 2 per cent on either side for another five-year period ending March 2026.

- What it means: The continuation of the MPC’s inflation targeting band at 2-6 per cent is welcome as an upward revision could have contributed to an unanchoring of inflation expectations. To keep inflation under a specified level, the government in 2016 decided to set up the Monetary Policy Committee (MPC) headed by RBI governor and entrusted the panel with the task of fixing the benchmark policy rate.

- MPC's role: The six-member MPC, which had its first meeting in October 2016, was given the mandate to maintain annual inflation at 4 per cent until March 31, 2021 with an upper tolerance of 6 per cent and a lower tolerance of 2 per cent. The 400 basis points within which the central bank has sanction to operate is the widest in Asia, matched only by Turkey and surpassed by Argentina. The RBI had previously faced criticism for largely overstating inflation with its forecasts used to underpin a hawkish policy stance. The recent stubborn inflation has forced the central bank to pause interest-rate cuts despite the economy needing more stimulus after entering an unprecedented recession, analysts said.

- Trends in CPI-inflation: An RBI paper found that there was a steady decline in trend inflation to 4.1-4.3 per cent since 2014. Setting an inflation target below the trend may impart a deflationary bias to monetary policy because it will go into overkill relative to what the economy can intrinsically bear in order to achieve the target, says the paper titled Measuring trend inflation in India. Analogously, a target that is fixed above trend renders monetary policy too expansionary and prone to inflationary shocks and unanchored expectations. Hence, maintaining the inflation target at 4 per cent is appropriate for India.

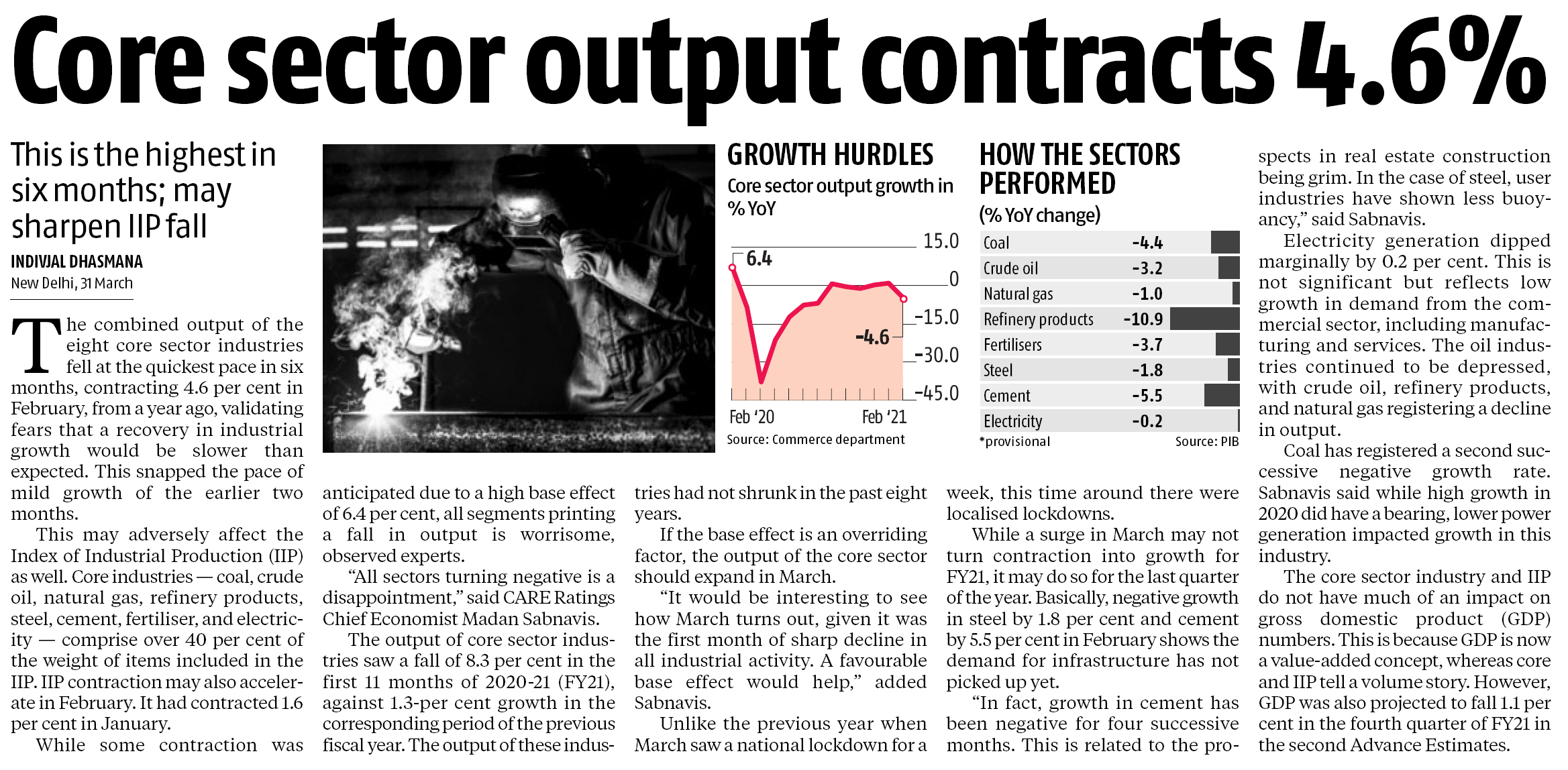

Core sector contracts sharply

- All eight down: India’s eight infrastructure sectors contracted at the sharpest pace in six months in February 2021, reversing two months of positive growth. Data by the industry department showed core sector shrank 4.6%, underlining the uncertain path to recovery.

- Shrinkage: During the month, output contracted in all eight sectors, including steel (-1.8%) and electricity (-0.2%), after recording growth in the last five months. Refinery products (-10.9%) recorded the sharpest decline in output followed by cement (-5.5%). Among other sectors, coal (-4.4%), crude oil (-3.2%), natural gas (-1%), and fertilizers (-3.7%) also recorded sharp contraction during the month.

- Projections: Fitch Ratings had only recently upgraded India’s growth projection for FY22 to 12.8% from 11% estimated earlier on a stronger carryover effect, a looser fiscal stance, and better virus containment. The Organisation for Economic Co-operation and Development (OECD) had earlier this month projected that the economy will bounce back to grow at 12.6% in FY22, the highest among G20 countries, aided by additional fiscal support after the covid-19 pandemic pushed the economy into recession. The Economic Survey has estimated FY22 growth at 11%, while the Reserve Bank of India has projected gross domestic product growth at 10.5% for the same year.

ECB's digital currency

- The story: The European Central Bank President Christine Lagarde said her institution could launch a digital currency around the middle of this decade if her fellow policy makers give the project the green light in 2021.

- Details: The ECB is about to release an analysis of the 8,000 responses it received as part of a public consultation process on the potential launch of a central bank digital currency. That will be sent to the European Parliament and then the ECB’s decision-making Governing Council will decide in the middle of this year whether to move forward with its practical experimentation. The second decision -- whether to roll out a digital currency -- will be made six months to a year after that, she said.

- Not easy: “It’s a technical endeavor as well as a fundamental change,” Lagarde said. “We need to make sure that we’re not going to break any system, but to enhance the system.” Central banks are at varying stages of developing digital currencies. Cash will also continue to be available, she added. Lagarde also said she will be closely watching the recent roll out of a digital currency by the Bahamas, called the Sand Dollar.

9.1 Today's best editorials to read

- We offer you 7 excellent editorials from across 10 newspapers we have scanned.

- [message]

- SECTION 3 - MCQs (Multiple Choice Questions)